Bitcoin price was testing $66,395 at the time of writing, and altcoins were continuing the day with double-digit rises. On the other hand, BTC is now on the verge of reaching its all-time high (ATH) target, while the ETF channel is attracting impressive demand. If this hype remains strong, Bitcoin could reach the $69,000 peak in the coming hours.

Bitcoin Approaches Historic Peak

The king cryptocurrency is now just a stone’s throw away from its ATH level. The price, nearly at the peak, will surpass its historic high seen in November 2021 with an additional increase of $2,800. Moreover, the halving has not yet occurred, the Fed has not started lowering interest rates, and a new investor influx has not yet begun.

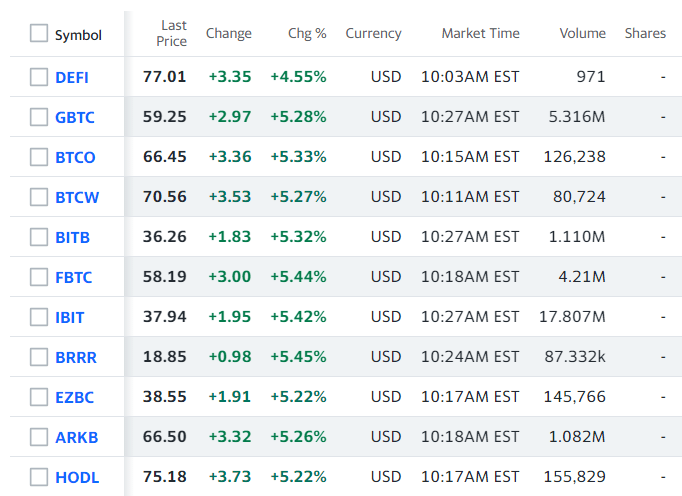

Spot Bitcoin ETFs

Only one hour had passed since the US markets opened at the time of writing. However, BlackRock’s Spot Bitcoin ETF had already reached a trading volume of $675 million. It wasn’t long ago that we were excited about daily volumes of $3 billion. If this interest in the ETF channel continues, we could see a cumulative volume record pushing beyond $8 billion in the coming hours.

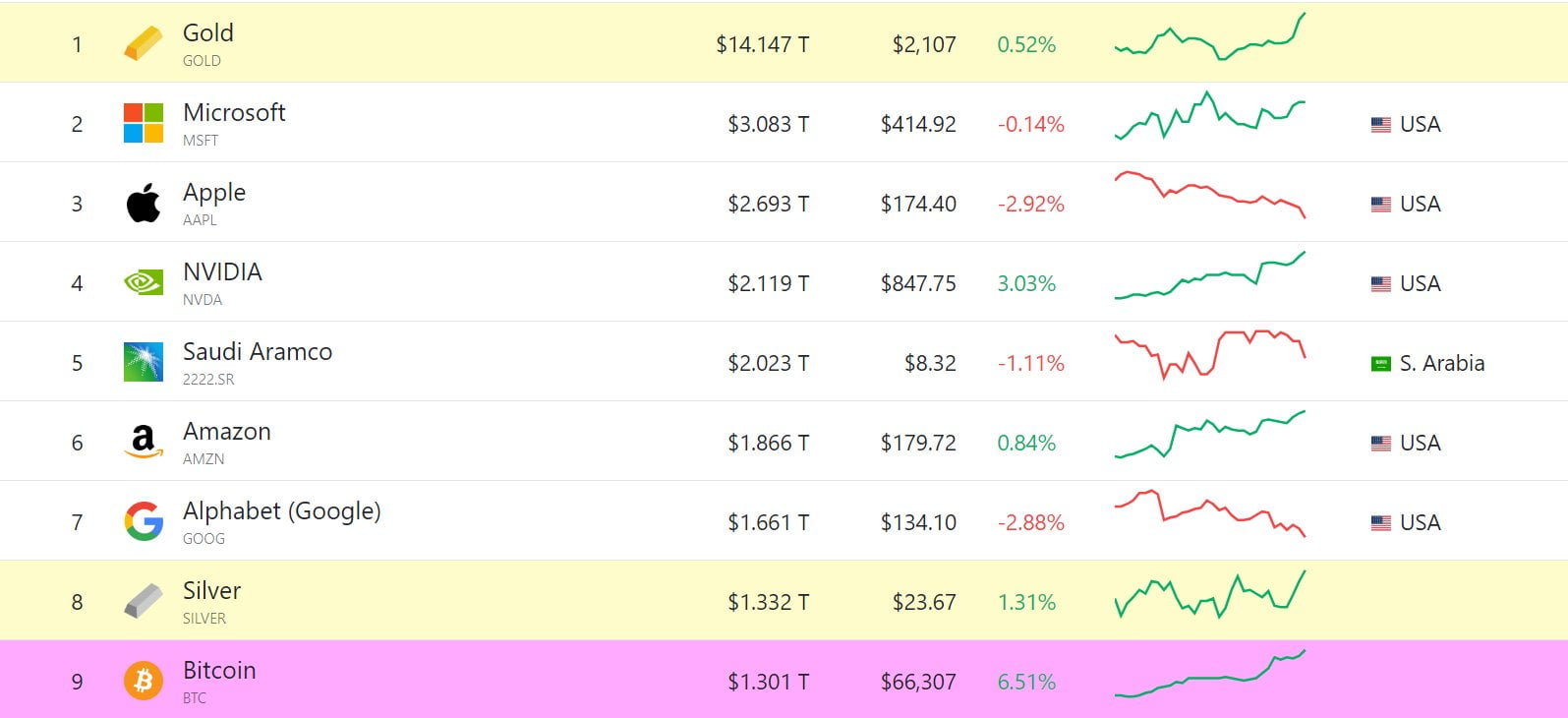

Bitcoin in Ninth Place

With a market value exceeding $1.3 trillion, Bitcoin is now ranked ninth among the world’s most valuable assets. If it increases by another 10%, it will leave Silver behind. Considering the chaotic days of November 2022, March 4, 2024, seems like a dream come true for investors.

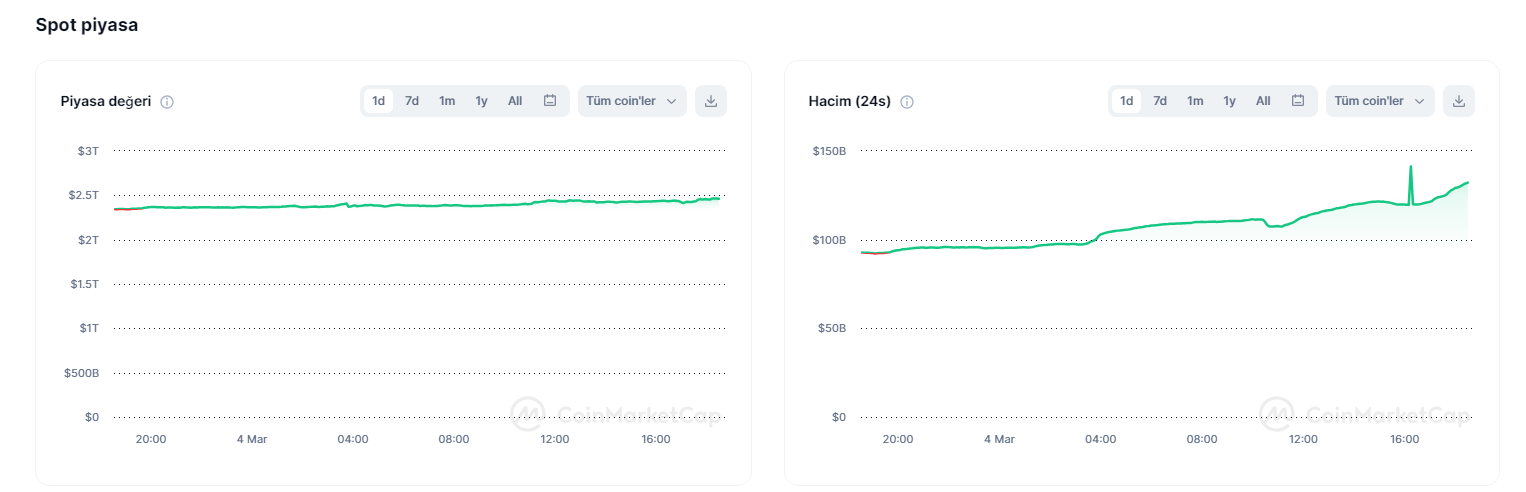

Volumes Are Increasing

Bitcoin’s price has risen above $66,000, signaling a volume record in the ETF channel. However, the excitement is also reflected in the trading volumes on cryptocurrency exchanges. The cumulative value of cryptocurrencies, exceeding $2.46 trillion, is supported by a daily volume of $131 billion. Compared to the previous day, the volume has increased by a full 41.8%. With the Bitcoin Dominance Index (BTCD) at the 53% threshold, and Bitcoin consolidating at the top, there is a lot of room for growth for altcoins.

Lastly, the fear and greed index has risen to a level of 86.4. While Google trend data still does not reflect the investor enthusiasm for BTC, we are experiencing interesting days before the halving. If historical data repeats itself after April 20, this year’s six-figure target for BTC could easily be surpassed.

Türkçe

Türkçe Español

Español