A leading technical analysis indicator has recently sparked optimism among cryptocurrency enthusiasts, suggesting that the price of Bitcoin (BTC) could double within the next three months. This implies that the price of the largest cryptocurrency could rise to as much as $140,000 in the coming three months.

Analyst Foresees $140,000 Bitcoin Price

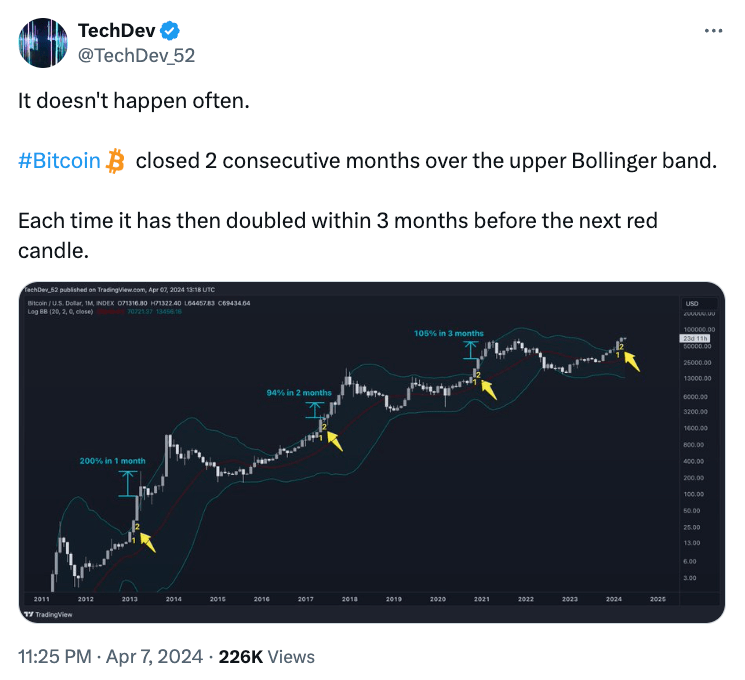

An anonymous crypto analyst known as TechDev, who has a significant following on the popular social media platform X, stated that Bitcoin‘s recent close above the upper Bollinger Band indicates a significant potential for price increase. TechDev noted that historically, when Bitcoin reached this milestone, its price doubled in the following three-month period. This prediction suggests that Bitcoin’s price could approach $140,000 by July.

Bollinger Bands, a technical tool frequently used in technical analysis, measure the momentum and volatility of assets within a certain range. Typically, when the price surpasses the upper band, it can indicate an overbought condition, while touching the lower band may show a potential oversold area. However, it is important to acknowledge that Bollinger Bands are just one of many technical indicators available to analysts, which tend to be reactive rather than predictive, based on past price movements and volatility data. Moreover, their effectiveness can significantly change, especially during periods of increased market volatility.

Experts’ Commentary on Bitcoin

Anthony Scaramucci, CEO of SkyBridge Capital, recently presented a bullish outlook for Bitcoin on a CNBC program. He suggested that Bitcoin could rise to as much as $170,000 in the current cycle and potentially reach half the size of the gold market. While this forecast implies a significant growth trajectory for Bitcoin, Scaramucci emphasized that such milestones will not happen overnight and will likely involve significant fluctuations along the way.

Scaramucci’s view is echoed by the recent proliferation of “selling machines,” known as spot-based Bitcoin exchange-traded funds (ETFs). These ETFs have witnessed significant inflows, with nine out of ten currently having over $12 billion in net inflows. This increase in demand for Bitcoin-related financial products indicates a growing interest in cryptocurrencies among both individual and institutional investors.

Furthermore, Ripple CEO Brad Garlinghouse shares Scaramucci’s bullish view. Garlinghouse predicts that the value of the cryptocurrency market could double by the end of the year. He bases this optimistic forecast on various factors, including the upcoming Bitcoin block reward halving, the evolving regulatory environment, and the increasingly widespread adoption of spot Bitcoin ETFs.

Türkçe

Türkçe Español

Español