BTC price dropped to the $56,700 levels a few hours ago, significantly impacting altcoins. Recent declines have caused the entire crypto market to shrink considerably. What is the current situation on the on-chain front? What are the latest predictions for Bitcoin?

Bitcoin On-Chain Analysis

There is no massive investor cost between $59,901 and $62,095. However, sales above $62,095 caused the BTC price to drop to its current levels. As we have written dozens of times in recent days, billions of dollars of new supply in July had already dampened investor appetite. Those who sold out of fear of further declines were proven right with the recent losses.

Miner Reserves

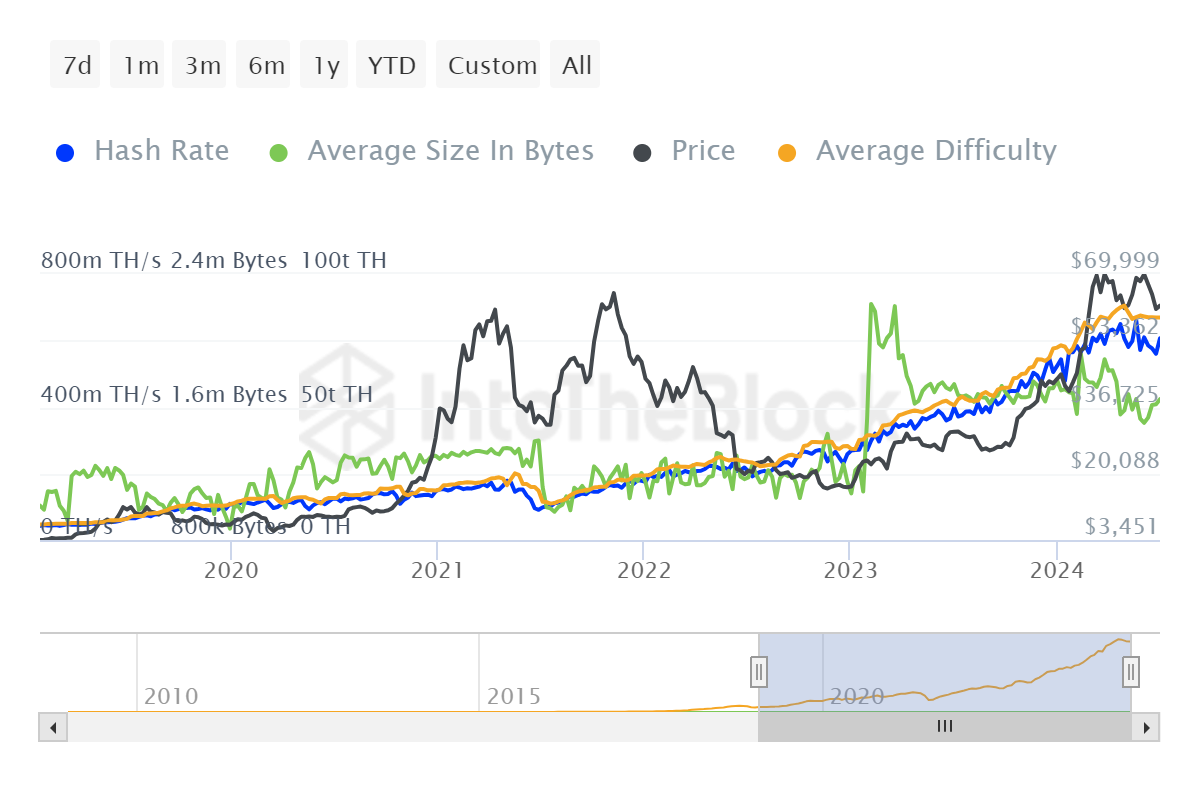

Miner reserves, which have fallen to 1.9 million BTC, are back to 2014 levels. The halving caused some mining devices to become unprofitable, leading some miners to shut down operations and sell. Miner reserves, which have fallen to the lowest levels in 10 years, decreased by 0.28% in the last 7 days. Although it is less than 1%, we should remember that the total reserve is 1.9 million.

Miner power dropped to the dip level of 560 TH/s in February and April. This indicates that the continuously increasing miner power between April 2024 and June 2021 has reversed again. The 2021 decline was due to China bans.

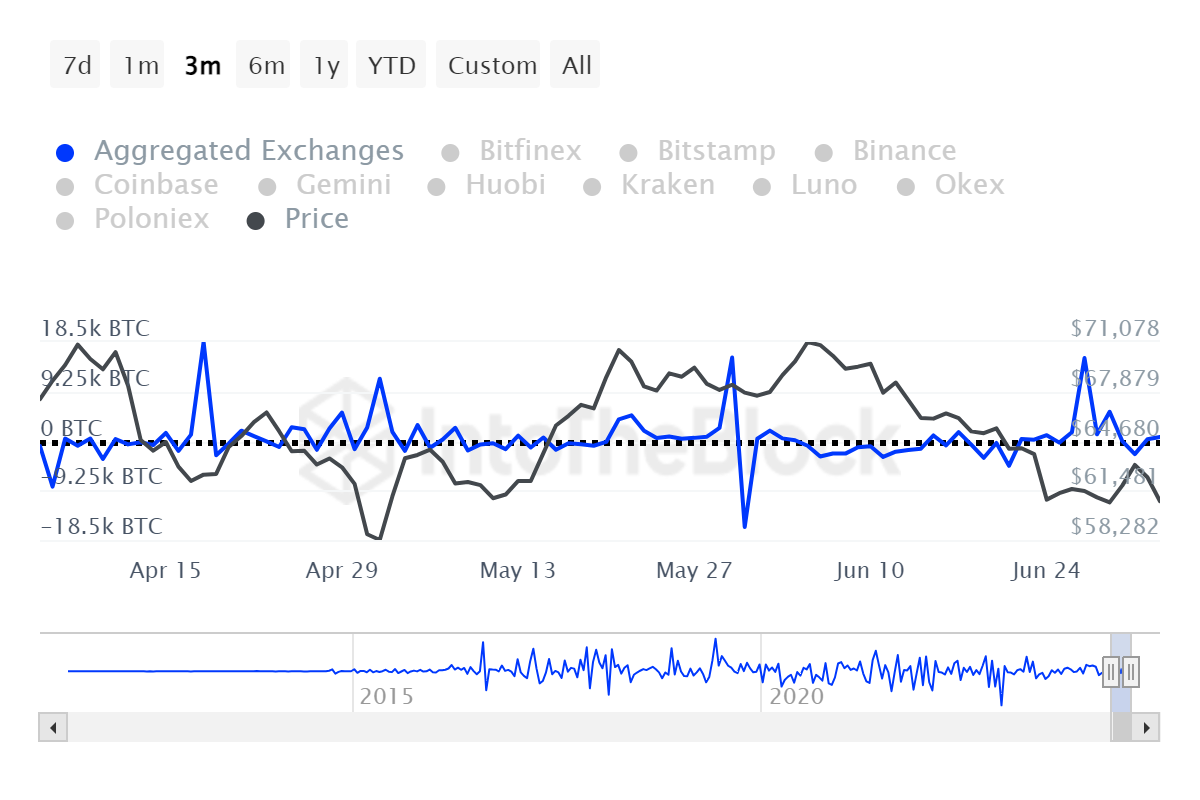

Exchange Inflows

On June 27, there were large net inflows similar to the period of May 30. Subsequently, the decline in BTC price accelerated. While a group of investors turned to accumulation, governments and possibly those receiving MTGOX refunds continuously transferring assets to exchanges for sale accelerated the price drop.

Whale Transactions

Before the July decline, whale transactions remained high. The number of transactions exceeding $100,000 did not fall below 15,000. The ongoing whale sales also supported the BTC decline. At the time of writing, BTC is hovering around $58,000.

Germany BTC Sale

At the time of writing, the German government’s BTC transfers continue. Assets sent to exchanges are still being directed for sale despite the price drop. Germany, which had 50,000 BTC, now has 41,929 BTC left after its recent sales. Its market value at the current exchange rate is $2.44 billion. Moreover, the US and MTGOX transfers are not yet fully felt in the exchanges.

Türkçe

Türkçe Español

Español