Bitcoin, starting the week with a rise in October, aimed for the $28,500 resistance level at the Wall Street opening. Analysts emphasize the importance of caution regarding Bitcoin’s technical indicators and resistance levels as these factors can affect its short-term price movement. The US dollar index (DXY) is currently at 106.7 and has the potential to break to above 108, reaching its highest level in 11 months.

Beware of BTC Monthly Close

Bitcoin’s price movement remained strong at the opening of the US trading session. Data from TradingView for the first session day of October proves this. The monthly closing of the leading cryptocurrency BTC/USD at $26,970 did not satisfy many investors. However, quick gains in the weekly closing compensated for this.

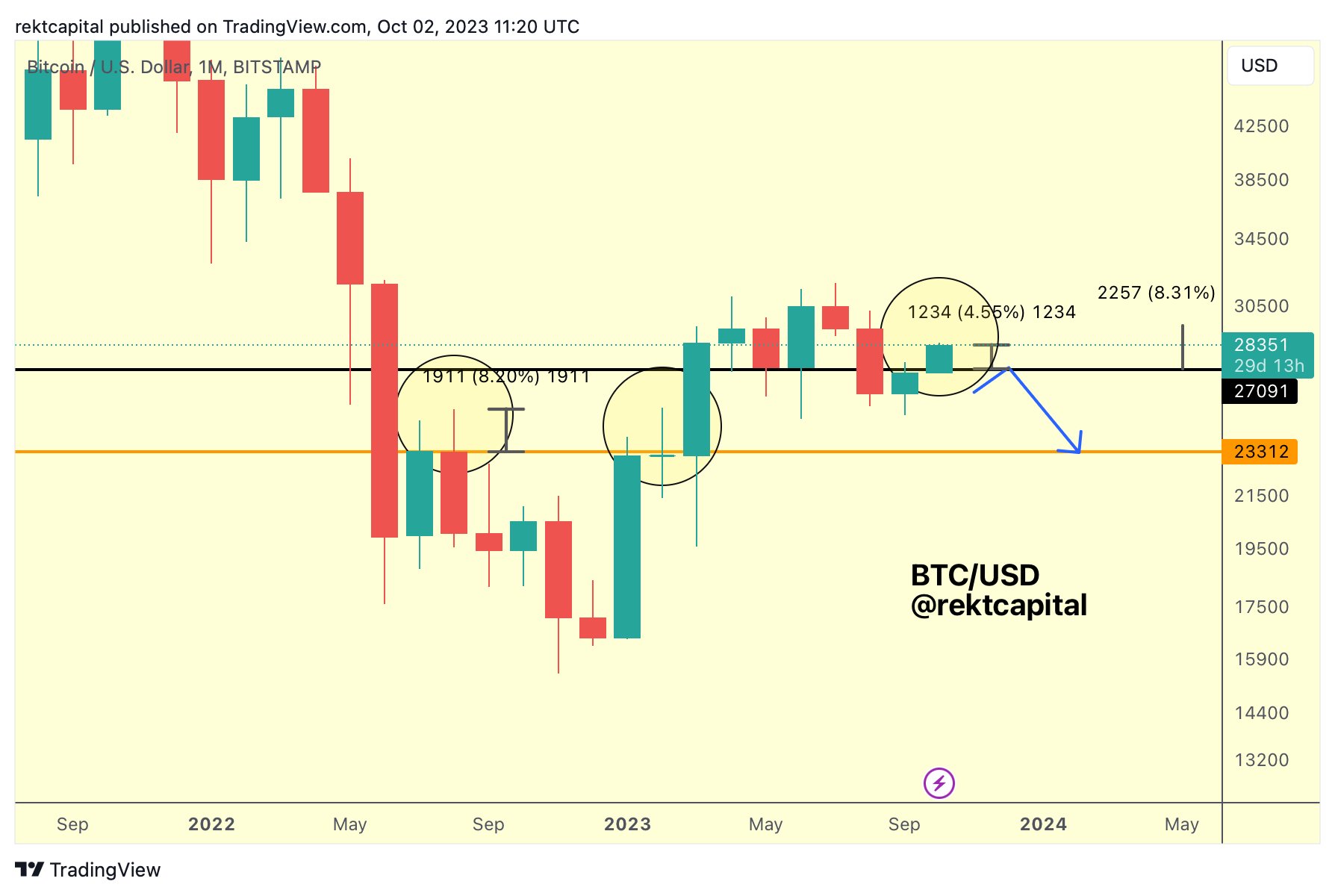

Popular investor and analyst Rekt Capital issued a warning about the monthly close. In his statement, he noted that despite a 5% increase since the closing, the monthly chart shows a close below $27,100 as a strong resistance for the black September. Rekt Capital added that this warning would be invalidated if the breakout continued in October. However, he also stated that if Bitcoin closes below the resistance, the rise in October could result in a spike:

“Bitcoin closed a monthly candle below $27,100 (black). Technically, it solidified as resistance for September.”

Rekt Capital added to his statement that if the breakout in October continued, this warning would be invalidated. However, he also mentioned that if Bitcoin closes below the resistance, the rise in October could result in a spike:

“Bitcoin has previously presented upward spikes of up to 8%. Currently, BTC has shown a 4.5% increase this month. So, theoretically, anything up to $29,400 (8%) could end as an upward spike.”

Concerns About DXY’s Rise

Analysts in the crypto community also announced that promising signals in the order books of exchanges continued. Another famous investor, Skew, pointed out the discrepancy between the spot market and the futures market with the opening of Wall Street.

Today, the US dollar, along with Bitcoin, showed eagerness to reach new highs. After positive news from Congress, the US dollar index (DXY) recovered from the losses seen in previous weeks.

At the time of writing, DXY was at 106.7, just 0.2 points away from the highest level of 2023. According to cryptocurrency analyst Nebraskan Gooner, a possible breakout on the DXY front would open the way to 108 points, and the highest level in 11 months would be reached.

Türkçe

Türkçe Español

Español