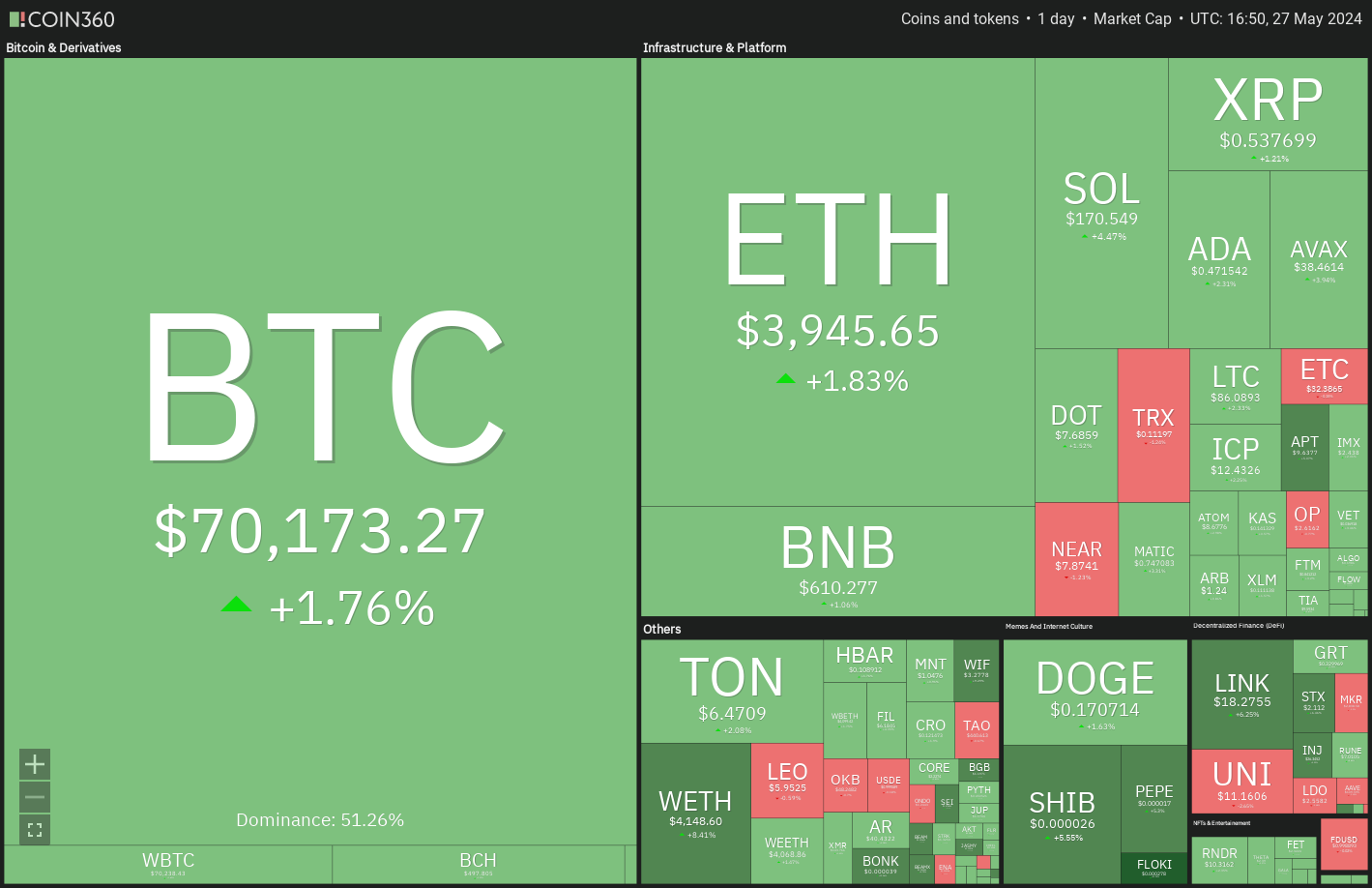

Bitcoin, after a three-day struggle, surpassed the psychological barrier of $70,000 on May 27. This indicates that the bulls are maintaining control. However, some analysts do not believe a breakout is likely in the near term. Analyst Rekt Capital emphasized that the post-halving reaccumulation phase typically lasts 160 days, suggesting Bitcoin may remain flat for a few more weeks.

Bitcoin’s quiet performance and the approval of spot Ethereum exchange-traded funds shifted the focus to Ethereum. Many analysts believe Ethereum will rise and are anticipating its increase. DeFiance Capital founder Arthur Cheong stated in a post on X that Ethereum could rise to $4,500 before the launch of spot ETF funds.

Bitcoin Chart Analysis

Bitcoin rose to its 20-day EMA average of $66,798 on May 24 and surpassed the $70,000 level on May 27, indicating that the bulls are trying to strengthen their hold. The BTC/USDT pair is likely to rise towards the significant general resistance at $73,777.

The bears are expected to defend this level with all their might because if they fail, the pair could rise to $80,000 and then to $84,000. On the other hand, a sharp drop from the general resistance and a break below the moving averages would signal that the pair could remain stuck in the range of $59,600 to $73,777 for some time.

Ethereum Chart Analysis

Ethereum rose from $3,730 on May 26, indicating that the bulls have turned the level into support. The bulls are trying to keep the price above $3,950. If they succeed, the ETH/USDT pair could rise towards the strong general resistance at $4,100. If the bulls overcome this hurdle, the pair could gain momentum and rise towards $4,868.

If the bears want to prevent the rise, they will have to pull the price below the breakout level of $3,730. This could initiate a drop towards the 20-day EMA average of $3,455, which is likely to act as strong support. If the price rises above this level, the bulls will try to push the pair back to $4,100. The launch of ETF funds in the Ethereum sector will reduce the circulating supply of Ethereum and increase its price. During this process, a bullish scenario could emerge for many altcoins, especially Ethereum.

Türkçe

Türkçe Español

Español