“`html

Bitcoin price continues its volatile trend after testing $67,000, erasing some gains post-US market opening. Despite strong excitement in the ETF channel, some investors believe the ETH ETF listing on Tuesday might lead to a sell-the-news scenario. The pricing of the ETF approval for ETH has not fully materialized due to the strong negative fluctuations in BTC price.

Ethereum (ETH)

Former Wall Street trader and now general manager at an investment firm, Vivek Raman, confidently states that the remainder of the year will be a great period for ETH. This indirectly means a rise for altcoins in general, as the easing of BTCD is expected to strengthen cash inflows into altcoins.

Raman, who believes the Ether ETF launch will eliminate most risks associated with Ether, wrote in his latest assessment:

“Looking back, the second half of 2024 will be the most significant bullish period in recent history for the Ethereum ecosystem. The three headwinds holding ETH back will turn into tailwinds starting this week.”

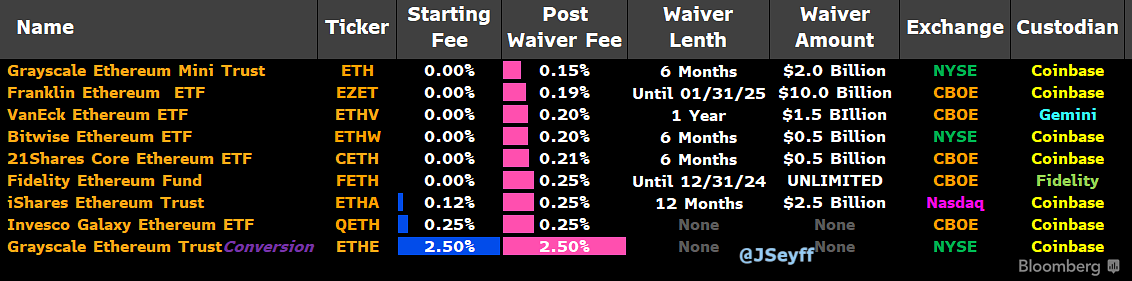

The ETF channel for Bitcoin hosted extremely large inflows. Seventy-five percent of new investments in the leading cryptocurrency came through this channel initially. Moreover, with reserves exceeding $50 billion, ETH issuers are well aware that they are in a highly attractive area.

However, the most important aspect is that regulatory risks have been eliminated with the BTC ETF. Raman believes the same applies to ETH.

“While individual investors only want to invest passively, institutions want to invest only after regulatory clarity is provided. The ETH ETF will unlock new inflows from both in one go.”

Ethereum 2024 Predictions

Raman expects the battle against the Ethereum ecosystem to weaken. He believes the regulatory uncertainty that has turned into a witch hunt will disappear. Charles d’Haussy, CEO of the dYdX Foundation, stated that we could see ETH ETF sizes up to $10 billion, which is quite an ambitious figure.

With interest rate cuts and US elections, crypto investors have many price catalysts for a better second half of the year. This explains why institutional appetite remains strong amid short-term declines. Raman says:

“The political view towards crypto, which has been shamelessly hostile for years, is changing. The world’s largest capital markets are finally embracing crypto, and new institutional and individual capital will flow into ETH and BTC, with ETFs being the safest entry routes.”

“`

Türkçe

Türkçe Español

Español