Bitcoin (BTC), which started October with a strong rise, renewed investor optimism by reaching up to $28,600 and rejuvenating hopes for the cryptocurrency market. This rise came after weeks of anticipation by many who hoped that the new month would be better for the cryptocurrency market following a period of low volatility in the third quarter.

Bitcoin Whales Accumulate BTC as Buying Power Increases

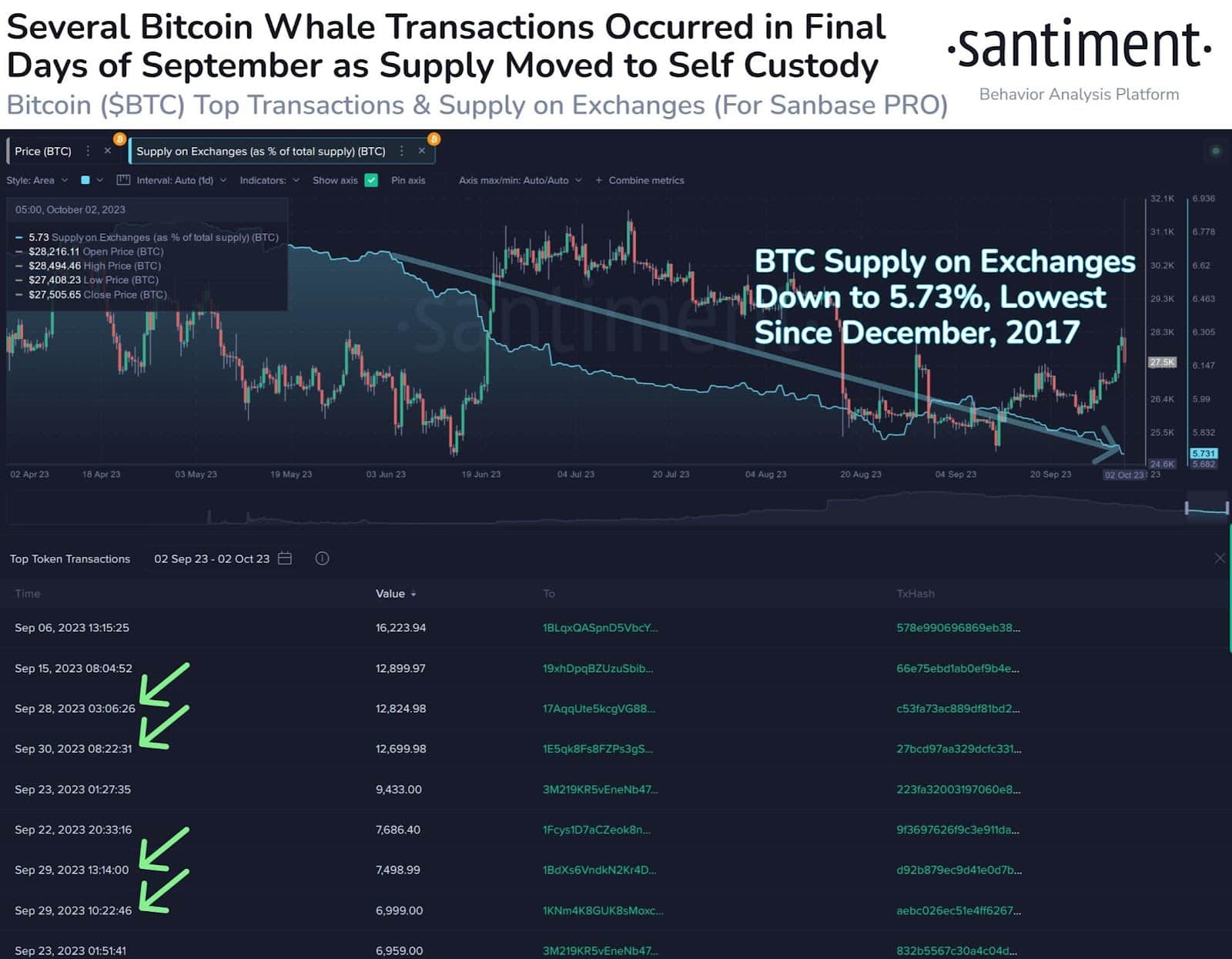

One of the most important factors contributing to the increase in investor optimism were the recoveries seen in the fundamental and technical aspects of Bitcoin. Crypto analysis platform Santiment highlighted the significance of several large transactions just before Bitcoin surpassed the $28,000 level for the first time in six weeks.

According to Santiment, the value of these transactions ranges between $187 million and $346 million. The company also reported that the BTC supply on crypto exchanges decreased from 5.99% to 5.73% of the circulating supply since September 1, which is considered a positive sign for the market.

Furthermore, Santiment reported that Bitcoin whales have been accumulating Bitcoin and Tether (USDT) over the past six weeks. These whales have started holding the highest amount of 13.03 million BTC in wallet addresses as of September 29. Additionally, these wallet addresses, which hold between 100,000 and 10 million USDT, have increased their buying power to the highest level in the past six months with a total of 15.03 billion USDT.

BTC Predictions by Analysts

Crypto analysts have been predominantly making positive predictions for Bitcoin in recent days. Adrian Zdunczyk, the founder of crypto analysis site TheBirbNest, pointed to a target price level of $40,500 in his latest Bitcoin prediction. Zdunczyk’s prediction is based on a high-conviction bull market, rising dominant trends, and the potential for a sharp breakout after a six-month consolidation period. Experienced market analyst Peter Brandt also said that the confirmation of the inverse head and shoulders formation indicates an upward movement in BTC.

Rekt Capital, a closely followed anonymous crypto analyst, stated that Bitcoin encountered resistance around $27,100 in September, but broke through this resistance in October. According to him, a retest of this resistance level as a support level will pave the way for further price increases.

Although analysts have predominantly made positive predictions, there are also calls for caution. Some crypto analysts, such as Stockmoneylizards, are expecting a downturn to begin with the breakout of the triangle formation on the current Bitcoin chart, pointing out the similarities between the current chart and the chart from 2020.

Türkçe

Türkçe Español

Español