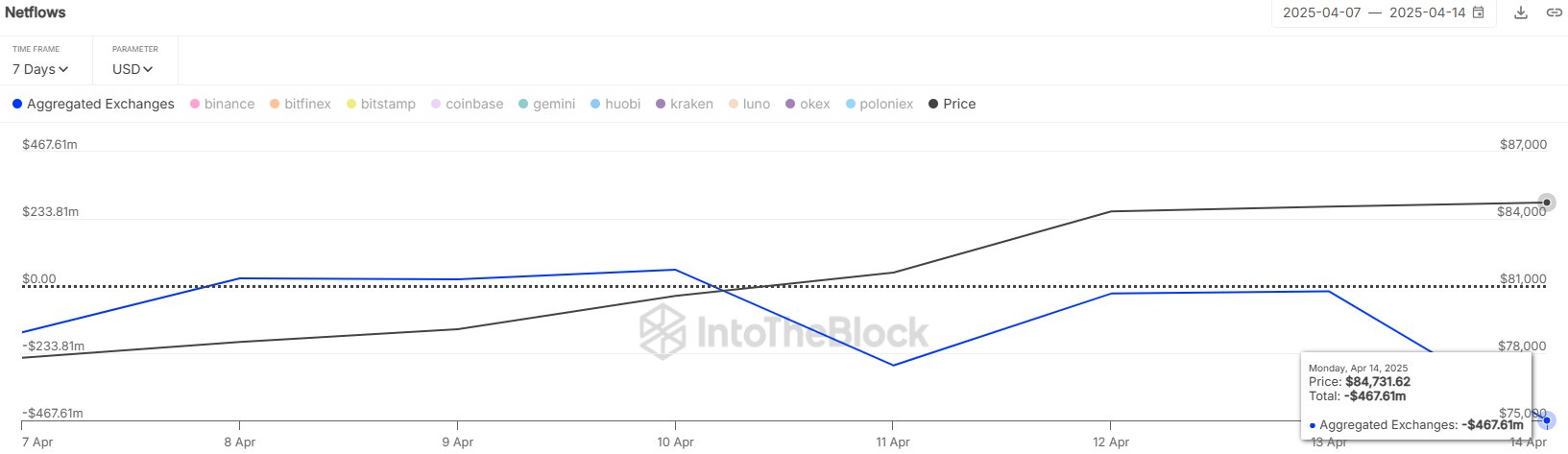

A significant development has occurred in the cryptocurrency market. According to data from on-chain analysis platform IntoTheBlock, as of April 14, 2025, traders withdrew Bitcoin  $109,894 from centralized exchanges totaling over $467 million. This withdrawal amount is considered an important signal indicating a shift towards long-term holding strategies among traders. The increasing accumulation trend in the market may potentially relieve the supply pressure on the largest cryptocurrency.

$109,894 from centralized exchanges totaling over $467 million. This withdrawal amount is considered an important signal indicating a shift towards long-term holding strategies among traders. The increasing accumulation trend in the market may potentially relieve the supply pressure on the largest cryptocurrency.

Bitcoin Withdrawals Indicate Growing Accumulation

On-chain data reveals a transformation in trader behaviors. Particularly, the transfer of significant amounts of Bitcoin from centralized exchanges to cold wallets suggests reduced selling pressure in the market and a tendency among traders to hold BTC for longer periods. This situation is generally interpreted as a precursor to bullish market conditions.

According to the latest report from on-chain data provider IntoTheBlock, the value of BTC withdrawn from exchanges in just one day exceeded $467 million. Withdrawals of this scale suggest potential institutional purchases or whale movements beyond ordinary trader activities. The transfer of large investors’ assets to private wallets indicates that potential sales may be postponed.

Critical Indicators in Market Direction Seeking

The outflow of Bitcoin from exchanges impacts not only supply-demand dynamics but also market psychology. The increased flow of BTC to off-exchange wallets is interpreted as a decrease in the likelihood of sales, leading to a tighter market structure. This situation lays the groundwork for potential upward price movements.

Additionally, while such large transfers may not directly impact prices in the short term, they are critically important as they may support market stability in the long run. Particularly, as the summer season is recognized as a period of low liquidity, the accumulation signals on Bitcoin indicate a strengthening of investor confidence. Whether this trend will become permanent will become clearer with upcoming data flows and price movements.

Türkçe

Türkçe Español

Español