At the beginning of 2024, Bitcoin‘s price observed a strong rise with the launch of spot Bitcoin ETFs. Bitcoin mining stocks performed below expectations during this period and exerted pressure on companies‘ revenues following Bitcoin‘s block reward halving.

Significant Drop in Bitcoin Mining Companies’ Stocks

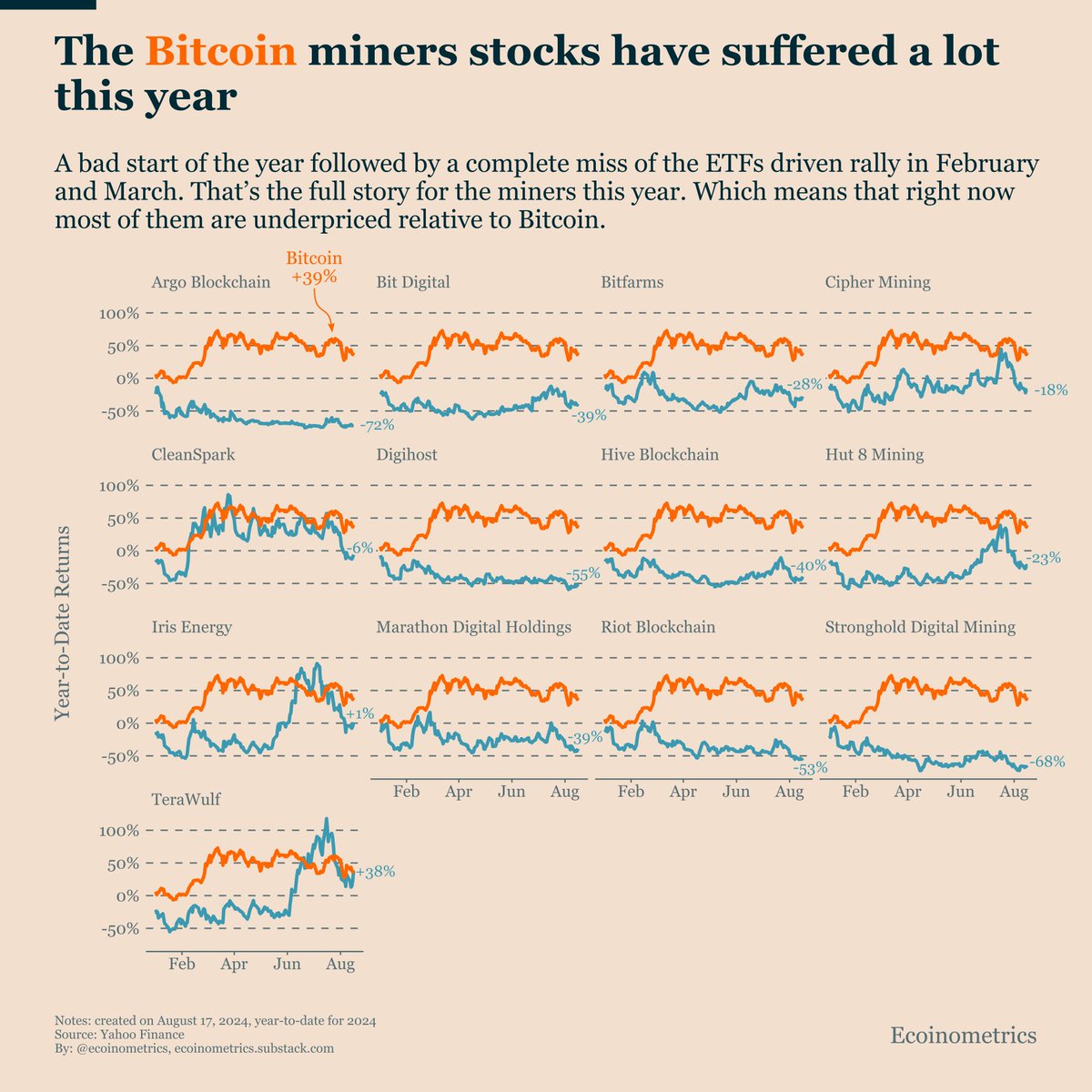

Leading Bitcoin mining companies like Marathon Digital and Riot Platforms saw their stocks lose 30-50% of their value since the beginning of the year. Crypto analysis platform ecoinometrics noted that Bitcoin mining stocks performed poorly in the first quarter of 2024 and missed opportunities following the launch of spot Bitcoin ETFs. The narrow price range of the largest cryptocurrency in the second quarter prevented mining companies’ stocks from gaining momentum.

Historical data shows that Bitcoin mining stocks could outperform Bitcoin in the next bull run. Currently, many Bitcoin mining stocks are considered undervalued. Ecoinometrics stated that if Bitcoin miners behave similarly in BTC’s next parabolic phase, these stocks are significantly undervalued.

Following the block reward halving, leading mining players are restructuring their operations and preparing for the future with new equipment purchases. Last week, Marathon Digital purchased 4,144 BTC through $300 million in convertible bonds.

Price Surge Expected by End of September

On the other hand, Bitcoin’s price consolidation phase may soon end. Over the weekend, Bitcoin tried to surpass $60,000 but failed to break this critical resistance. Currently, the largest cryptocurrency is trading at $58,549, down 1.36%, with a total market cap of $1.115 trillion.

Famous analyst Rekt Capital noted that 125 days have passed since Bitcoin’s 4th block reward halving. Historical data reveals that Bitcoin’s parabolic rally started 160 days after the block reward halving. Therefore, BTC’s price is expected to surge by the end of September.

Türkçe

Türkçe Español

Español