The undisputed leader of the cryptocurrency world, Bitcoin (BTC), has made a move above $43,000 due to strong inflows into Bitcoin ETFs and a decrease in GBTC outflows last week. Consequently, there is a continuing upward price pressure on Bitcoin.

Analyst Commentary on Bitcoin

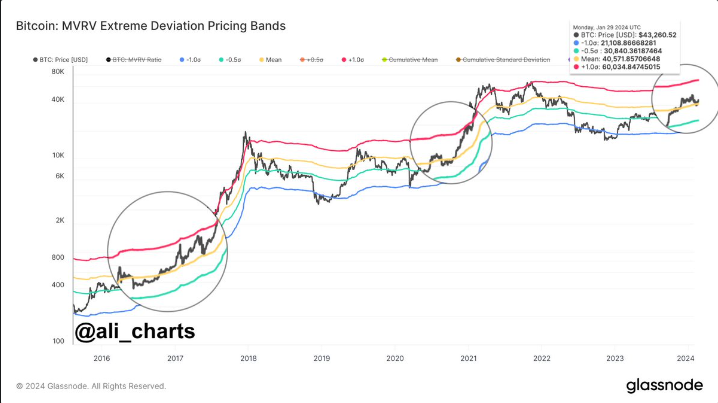

Prominent for his crypto analyses, Ali Martinez recently identified signs that patterns from past bull markets could be repeating. While examining the state of the cryptocurrency, Martinez points to a model that could potentially bring about a strong rise for Bitcoin ($BTC). While the BTC price has returned to the average MVRV level of $40,500, a similar model has emerged in the current market.

Martinez also notes the possibility of BTC experiencing an increase towards the 1.0 standard deviation line, highlighting the potential for the price to reach a level of $60,000.

What’s Next for BTC?

Known as a macroeconomist and noted for his comments on cryptocurrencies, Henrik Zeberg reiterated his expectation for “the biggest crypto rally to date” in a recent post, indicating an increase in bullish sentiment and a return of excitement that could trigger a move towards the previous market peak.

In an interview conducted by WTFinance, Zeberg considered the latest developments in the crypto market and expects the positive outlook to continue into 2024, providing details about the situation. Zeberg added:

Stock and crypto markets should continue to rise. Bitcoin should reach between $100,000 and $150,000. We should also see the S&P 500 reach my target of 6,100, which has been the case for the past one and a half years. All of this is still happening. So in my opinion, there is no change, this is a blow-off top.

Looking at the current Bitcoin price, according to 21milyon.com data, it was trading at $42,928, down 0.04% at the time of writing. It remains a topic of interest whether BTC will directly make an upward move from here or if it will first experience a decline.

Türkçe

Türkçe Español

Español