One of the most important figures in traditional finance, Buffet, can be said to hate cryptocurrencies. Although he makes indirect crypto-focused investments through his companies, every time Buffet takes the microphone, he says he hates crypto or something similar. So, in terms of earnings performance, has BTC already surpassed him?

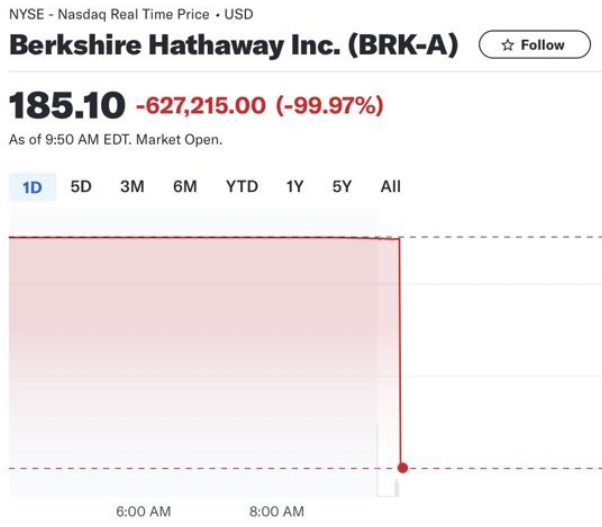

Berkshire Hathaway Dropped

On June 3, Berkshire Hathaway’s shares dropped by 99%. This was due to a technical glitch on the New York Stock Exchange (NYSE), which was exciting at the moment. The exchange halted trading in many major stocks to resolve the issue. Before the trades closed, NYSE announced that all trades resulting from the technical issue would be canceled.

Berkshire and Bitcoin

Since 2015, Berkshire Hathaway’s shares have dropped nearly 100% against Bitcoin. Although the 99% drop mentioned earlier was due to a technical issue, the weekly performance graph of BRK.A and BTC/USD reveals Bitcoin’s success in terms of price.

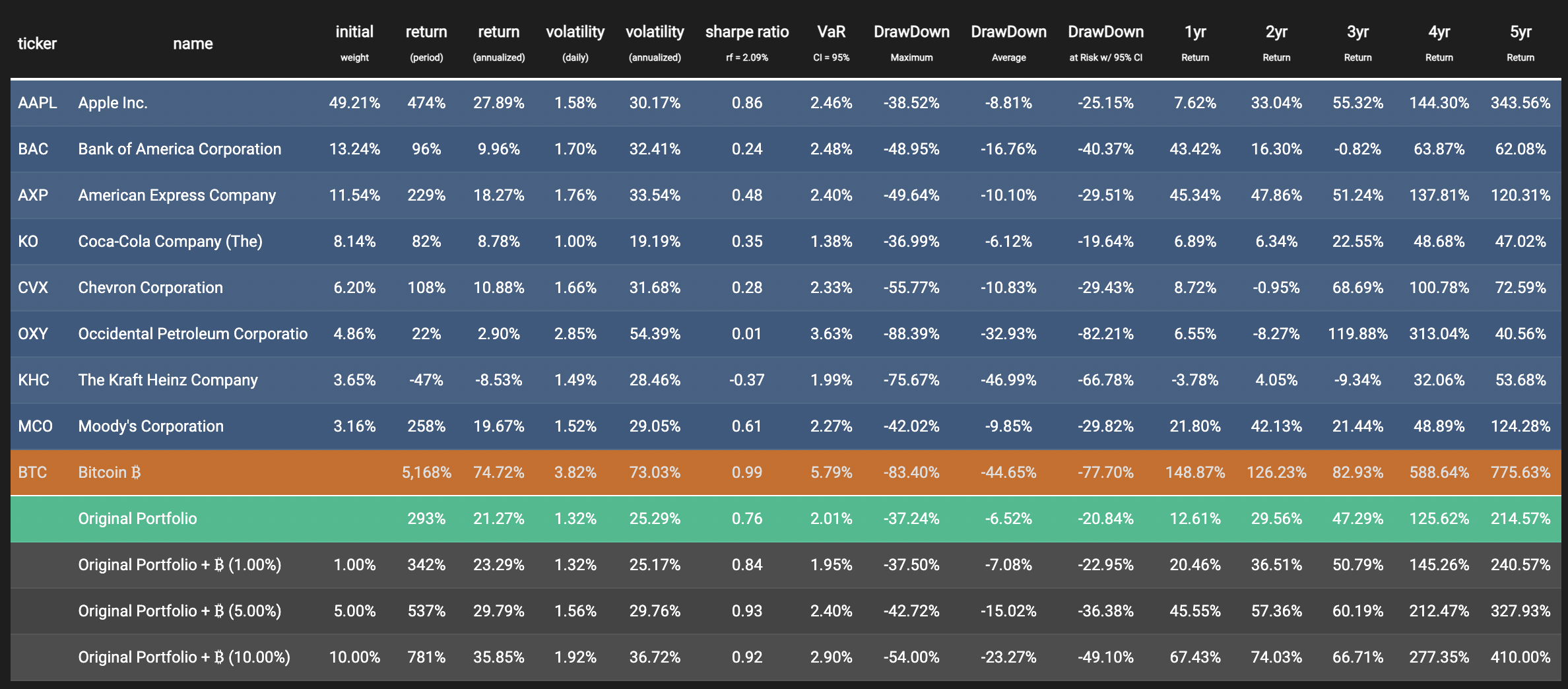

According to results obtained from the Nakamoto Portfolio simulator, if just 1% of Berkshire Hathaway’s portfolio, which includes shares of major brands like Apple, Bank of America, and American Express, had been allocated to Bitcoin (BTC), the 5-year gain could have increased from 214% to 240%. In a scenario where a larger portion, say 5%, was allocated to BTC, the gain rises to 328%.

Bitcoin’s total market value has increased exponentially as Buffet continues to curse it. Nowadays, it is around 1.3 trillion dollars, while Berkshire Hathaway is valued at under 900 million dollars. BTC has even surpassed the 1.2 trillion dollar value of the social media giant META. Buffet has long mentioned that he wouldn’t spend even 10 dollars on all BTC, claiming it has no value.

Compared to Gold at 15.8 trillion dollars, Bitcoin still has more potential. Moreover, comparing the first-quarter performance of the Gold ETF in 2004 with the first-quarter performance of the BTC ETF in 2024 makes this more convincing. Perhaps in the internet age, people will truly trust the Bitcoin network, which is protected by consuming more energy than dozens of countries, instead of the yellow metal.