The cryptocurrency market came under selling pressure after a strong rally earlier this week. Cardano (ADA), which ranks high on the list of altcoins attracting significant investor interest, also experienced its share of the market-wide sell-off. So, what’s next for ADA according to on-chain data and technical analysis?

The Number of Cardano Whales’ Transactions is Rapidly Increasing

On-chain data shows that the recent price rally of ADA is supported by a strong increase in blockchain activity and transactions by whales. Leading on-chain data platform Santiment reported that the altcoin’s price increased by over 10% on November 2nd and by 36% in the past two weeks.

According to Santiment, the price increase coincided with increased on-chain activity, wallet address activity, and whale transactions on the Cardano network, reaching levels not seen in the past three months.

Furthermore, Cardano continues to show a strong presence in the decentralized finance (DeFi) market. According to DeFiLama data, the total value locked (TVL) in assets on the Cardano network has reached $215 million.

ADA Price Analysis and Expectations

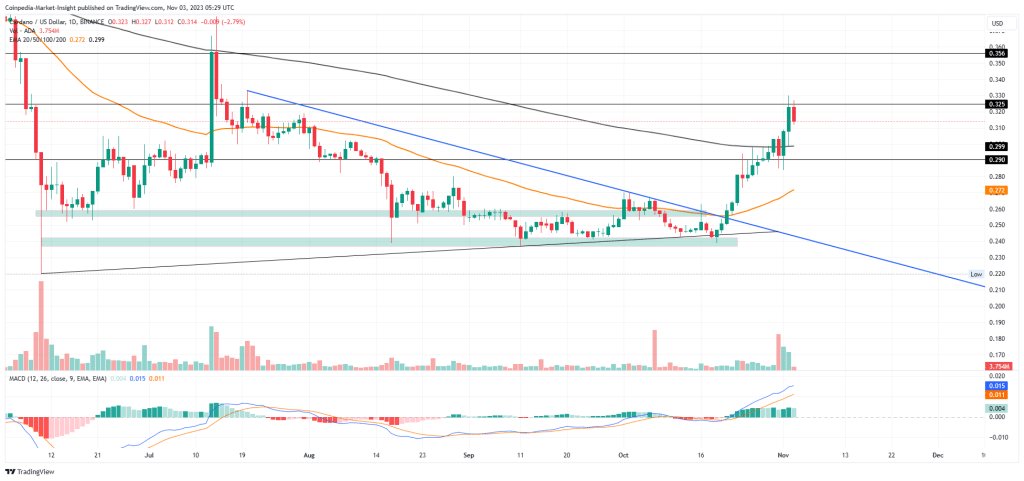

ADA’s price is potentially gaining momentum to surpass the $0.325 resistance level. Additionally, a broader market recovery could initiate an early uptrend in Cardano, breaking through key resistance levels. If the price surpasses the $0.325 threshold, a breakout rally could pave the way for reaching $0.40 after surpassing $0.35. On the flip side, a pullback from $0.325 could lead to a retest of the $0.30 level.

Crypto analyst John Morgan shared his expectations for ADA. In line with a research report, the analyst believes that the altcoin’s price could potentially increase by around 43% with a sudden surge in trading volume. As of the latest data, Cardano’s ADA is trading at $0.3196, recording a 2.40% increase in the past 24 hours.

Türkçe

Türkçe Español

Español