Despite its single-digit price offering an entry opportunity for a long time, only a few investors dared to take the plunge in the challenging environment of bear markets. With the Bitcoin price climbing back above $60,000, popular altcoins also gained momentum. BTC is no longer at its November 2021 levels, and its monthly gains alone are over $15,500. So, what will happen to Chainlink (LINK)?

Chainlink (LINK) Commentary

We have long said that one of the most impressive gains for the bull season could be achieved by LINK Coin. The excitement in the RWA area has not fully spread yet, and despite this, the price is above $20. If we see major financial institutions making more moves in the tokenization of real-world assets during the more mature days of the bull season, this will give LINK Coin a great opportunity to realize its potential.

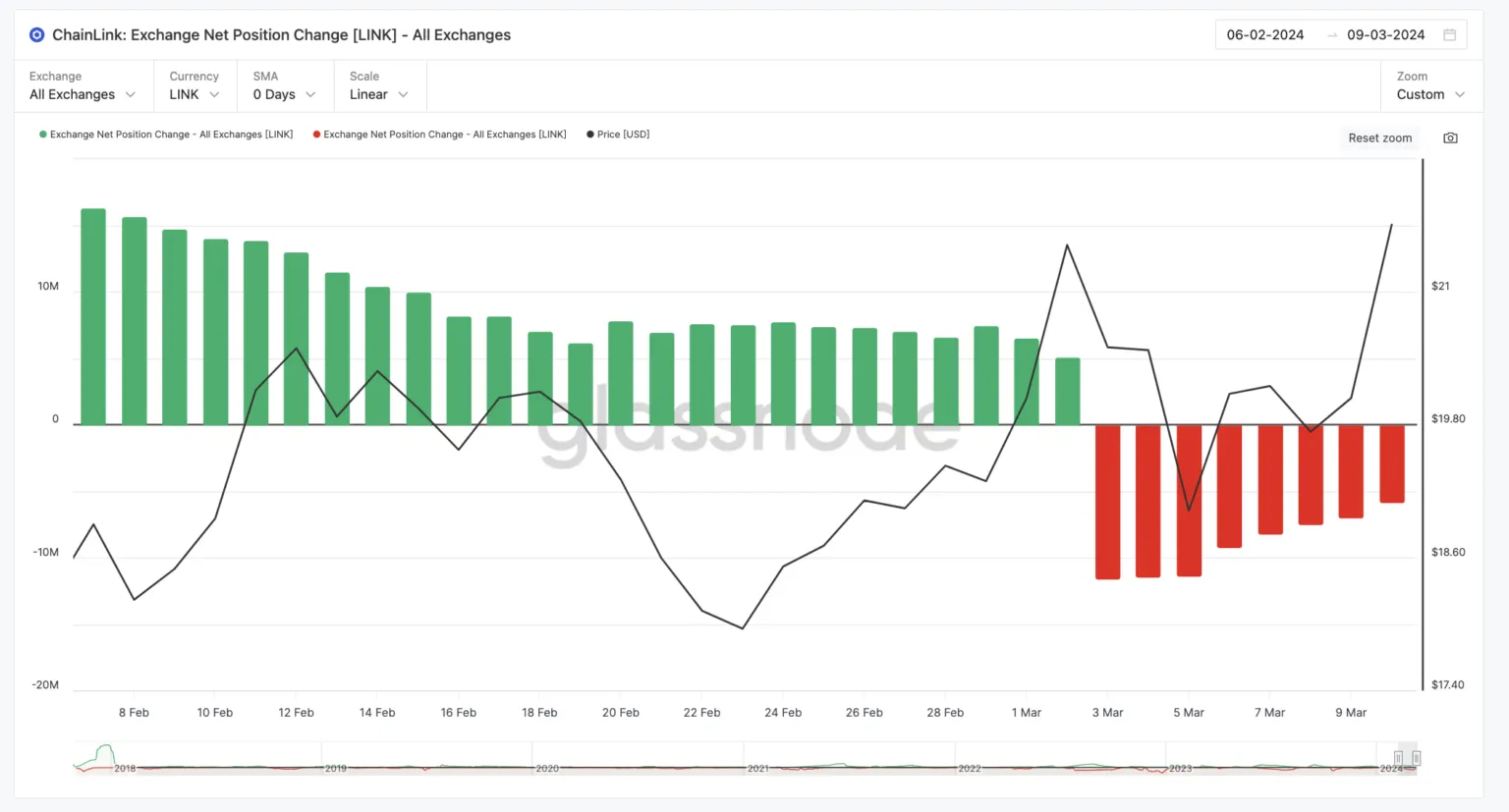

On the other hand, a surprise announcement regarding the expansion of the LINK Coin staking pool could also be a serious trigger for the price. Moreover, while we saw net inflows to exchanges in February and March, we are now witnessing net outflows.

In other words, investors are withdrawing their LINK Coin holdings from exchanges to their own wallets. The exchange entries on March 3rd reflect a clear sense of optimism among investors.

LINK Coin Price Prediction

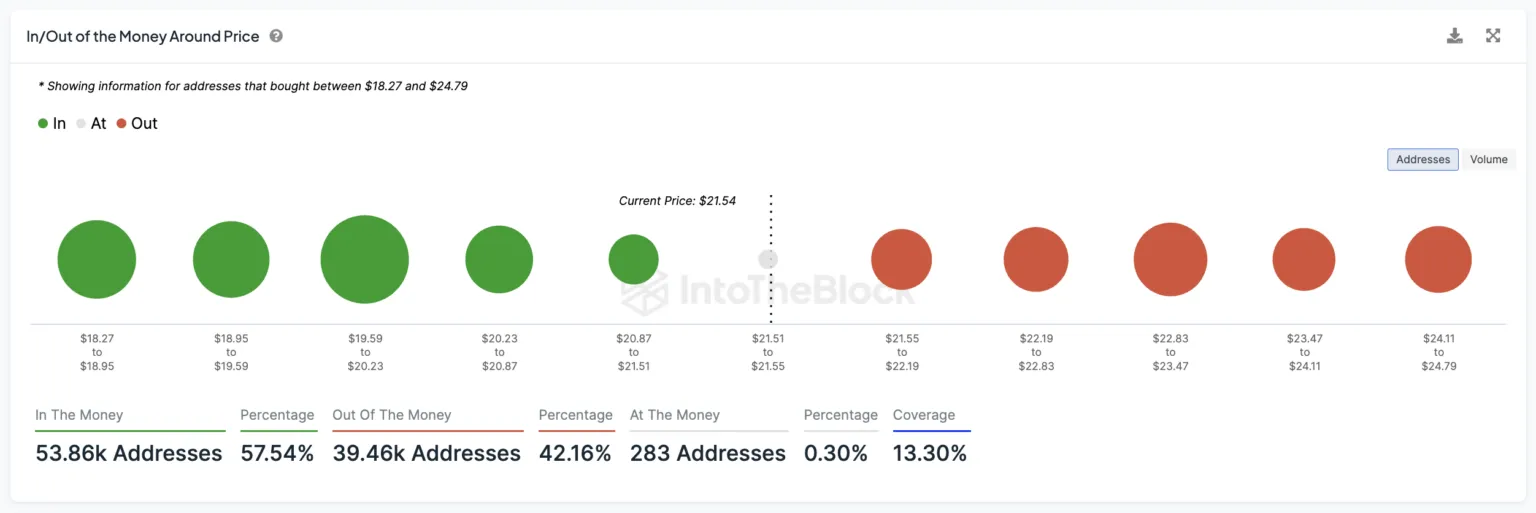

Furthermore, the In/Out of the Money chart suggests that investors are in a profitable position “without panic.” There is strong support between $18.27 and $20.87, and if the price can stay above this area, the rally could accelerate.

Up to the cost chart, there is sufficient room for a rise towards $24.79, and minor profit-taking seems manageable with the support of net exchange outflows. If BTC can stay strong above $72,000 and LINK Coin makes moves to boost motivation (more announcements related to the Swift partnership, other partnerships, expansion of the staking pool, etc.), $24 does not seem unattainable.

If the bulls can push the price to $24, LINK Coin will have returned to a key area for the first time since December 2021. If LINK Coin price loses the strong support at $20.7, sales could continue below $19.45 in this scenario as well.

Türkçe

Türkçe Español

Español