As excitement grows for spot ETFs, regulated Chicago Mercantile Exchange (CME) has taken the top spot in the list of largest Bitcoin (BTC) futures exchanges, displacing crypto exchange giant Binance for the first time in two years.

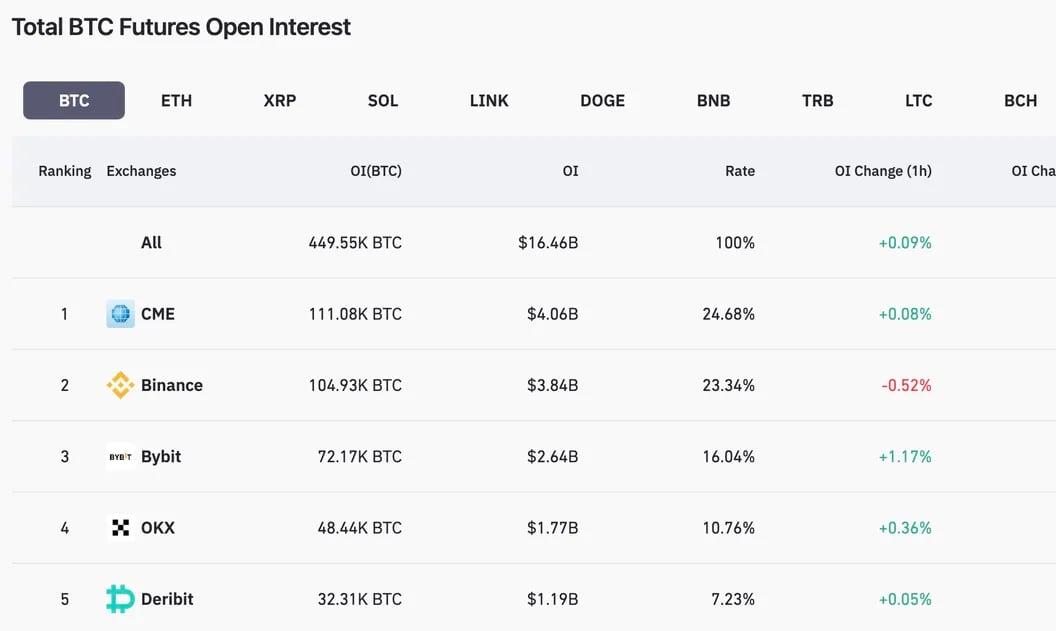

According to data platform CoinGlass, CME has taken the lead among futures and perpetual futures exchanges with approximately $4.07 billion in open interest (OI). CME rose to the top with a 4% increase and a 24.7% market share in the last 24 hours. Meanwhile, Binance’s OI fell by 7.8% to $3.8 billion. CME offers trading opportunities in traditional futures contracts with predetermined expiration dates. On the other hand, Binance and other crypto exchanges offer perpetual contracts or non-expiring futures contracts.

The change in ranking occurred amidst significant leverage decline across the crypto market and a sharp drop in Bitcoin‘s total OI from $12 billion to $2 billion. The decline disproportionately affected Binance investors compared to CME market participants.

Bitcoin rose to around $38,000 in previous days and then sharply declined to $36,000 after it was revealed that a legal entity named “iShares Ethereum Trust” is registered in Delaware. A similar movement occurred before iShares’ owner BlackRock filed for a spot Bitcoin exchange-traded fund (ETF) in June.

CME’s Rise to the Top

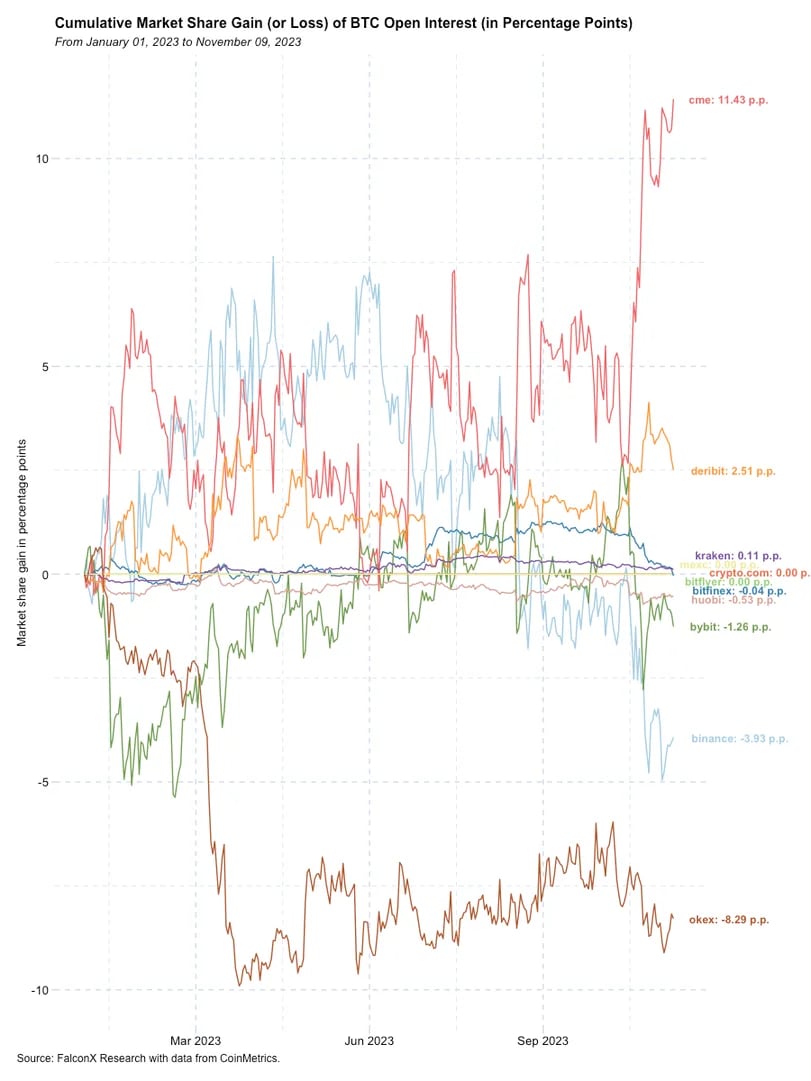

CME’s ascent to this year’s top spot has gradually highlighted the increasing demand of institutional market participants to buy and sell large and established cryptocurrencies. A 2020 article published by Bitwise Asset Management stated that CME’s Bitcoin futures market consistently and statistically leads the spot market.

David Lawant, research director at FalconX, commented on this development to CoinDesk, stating, “CME has gained market share throughout most of 2023, but it has intensified in the past few weeks with the excitement around spot Bitcoin ETF applications.” Lawant also added, “Considering that CME is primarily used by large traditional financial institutions, this shows how interested this audience is in cryptocurrencies.”

Türkçe

Türkçe Español

Español