In the United States, amidst ongoing speculation about the likelihood of spot Ethereum exchange-traded fund (ETF) approvals, Coinbase’s Chief Legal Officer Paul Grewal stated that the Securities and Exchange Commission (SEC) has no good reason to reject ETF applications.

What’s Happening on the Ethereum Front?

While awaiting a decision on Ethereum ETPs, Grewal wrote about the misinformation surrounding Ethereum, stating:

“Millions of Americans own Ethereum; it has been vital for crypto since its 2015 launch; and Ethereum is not a security, it’s a commodity.”

Grewal mentioned that Ripple Labs, the Commodity Futures Trading Commission (CFTC), and federal courts have recognized Ethereum as a commodity. He pointed out that the SEC’s own litigation attorneys provided additional arguments against classifying Ethereum as a security in recent comparisons made between Ethereum and Bitcoin, and continued:

“The SEC has no good reason to reject Ethereum ETP applications, and we hope they will not try to invent one by questioning Ethereum’s long-established regulatory status, which the SEC has repeatedly approved. The law doesn’t work that way, and Americans deserve better.”

On March 20th, it was revealed that the Ethereum Foundation removed a Warrant Canary from its website following a voluntary and confidential investigation by an unspecified government authority, according to the foundation’s GitHub repository. Ethereum Foundation developer Pablo Pettinari commented on the matter on February 26th:

“This commitment removes part of the subtext because we received a voluntary investigation with confidentiality from a government authority.”

The removed Warrant Canary image indicated that the Ethereum Foundation had not been contacted in a manner that would require non-disclosure by any institution. Additionally, the text stating that the foundation had never been in contact with any agency anywhere in the world in a manner requiring non-disclosure was also removed. Meanwhile, Fortune reported that the SEC is conducting a legal campaign to classify Ethereum as a security and referred to subpoenas received by crypto companies related to an investigation concerning Ethereum.

Individuals from companies that received the subpoenas said the investigations were specific to the Ethereum Foundation. Moreover, while some firms received subpoenas recently, others received them after Ethereum transitioned to a proof-of-stake (PoS) consensus system with an update called The Merge in September 2022.

Shortly after The Merge, Gensler suggested that assets in a PoS contract system could be considered securities because investors rely on the efforts of others to make a profit. Crypto lawyer Preston Byrne, on March 20th, stated:

“If the SEC is going to try to weaken the claim that Ethereum is like Bitcoin, it will do so by referring to the distribution of assets in the presale.”

ETF Store President Nate Geraci suggested looking at comments made by Commission Member Hester Peirce following the approval of a spot Bitcoin ETF to gauge the SEC’s likelihood of approving spot Ethereum ETF funds.

Prominent Figures Weigh In on ETF Predictions

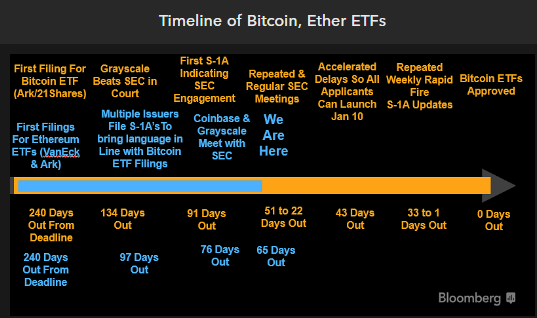

Initially optimistic, Bloomberg ETF analysts Eric Balchunas and James Seyffart recently lowered their expectations for spot ETF approvals to 25% by May 23rd, the deadline for the SEC to decide on the first spot Ethereum ETF application by Ark and 21Shares.

The analysts pointed out differences in the SEC’s comment process for spot Bitcoin ETF approvals compared to the timeline for spot Ethereum ETF applications. The SEC recently postponed decisions on several spot Ethereum ETF funds and informed VanEck on March 20th that it was the latest contender with a decision postponed until May 23rd. Fidelity and Grayscale also modified their applications this week to include staking. Seyffart shared:

“Fidelity is not giving up on Ethereum ETF funds and is not giving up on the SEC allowing them to stake within the ETF. Our base case remains that these will not be approved.”