Crypto data platform CryptoQuant’s founder Ki Young Ju, recently shared on social media platform X his concerns about the continuous capital inflow into spot Bitcoin Exchange-Traded Funds (ETFs) and warned about the potential repercussions if this trend continues. Ju’s comments came amidst a notable increase in entries into spot Bitcoin ETFs, which have exceeded the $10 billion mark for the first time since their launch in January.

Warning of a Potential Sell-Side Liquidity Crisis

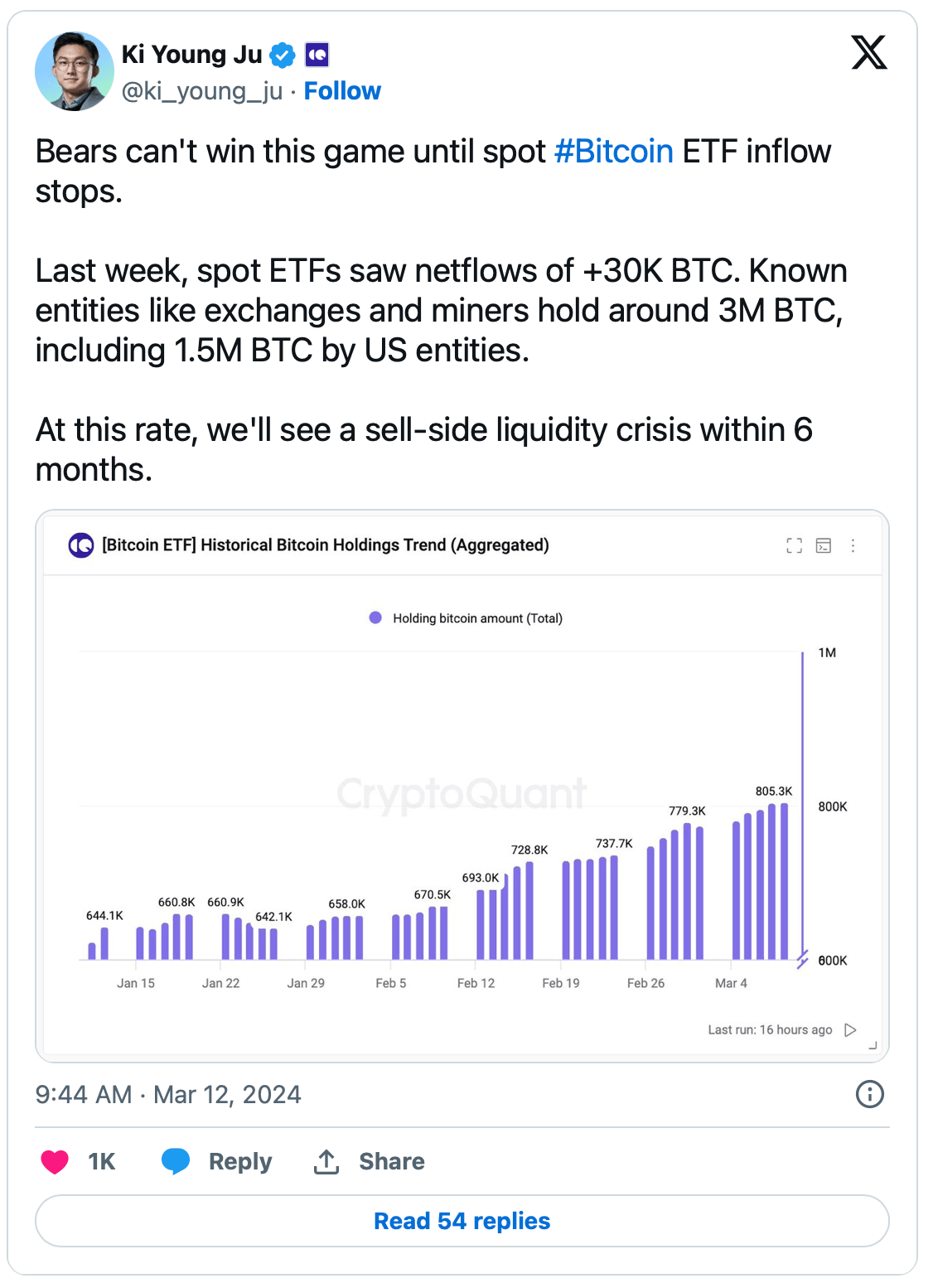

Spot Bitcoin ETF‘s creation has led to a serious situation, emphasized Ju, noting that bears cannot win this game until the entries stop. According to data, last week alone, spot Bitcoin ETFs saw net entries exceeding 30,000 BTC. Currently, large institutions such as exchanges and miners hold approximately three million BTC, with more than half under the control of US-based institutions.

The increase in entries into spot Bitcoin ETFs has raised concerns among market observers about the potential for a future sell-side liquidity crisis, while Ju warned that the impact on Bitcoin’s price when reaching the breaking point due to demand for spot ETFs could exceed market expectations. He mentioned that a sell-side liquidity crisis could reach a cyclical peak beyond predictions due to limited sell-side liquidity and a weak order book.

Ju highlighted the ongoing trend, noting a significant increase in the amount of BTC held in “accumulation wallet addresses,” characterized by addresses that only receive transactions. He also added that he expects the anticipated sell-side crisis to emerge within 6 months.

Bitcoin’s Rise Continues, Fueled by ETF Inflows

Recent data shows a significant increase in strong entries into spot Bitcoin ETF products in the US market. On March 12th alone, net entries into these products exceeded $1 billion, reaching a record level.

Bitcoin, powered by the intense interest in spot ETFs, continues its rise by setting new records. Most recently, on March 12th, the largest cryptocurrency reached a new peak by rising to $73,311 after hitting a record of $73,000. According to current data, Bitcoin is trading at $73,275, up 2% in the last 24 hours.

Türkçe

Türkçe Español

Español