The cryptocurrency market continues to stay neutral, led by a distinct consolidation phase of Bitcoin (BTC). Meanwhile, two cryptocurrencies show potential for a short squeeze as the week progresses.

Current State of Cryptocurrencies

Last week’s global geopolitical tensions caused significant unease in the market, negatively impacting the overall outlook for cryptocurrencies. In this environment, which triggered a sudden drop, crypto investors began to open leveraged short positions, which are thought to possibly backfire.

Interestingly, when traders take short positions, liquidity pools form in the form of collateral assets that the crypto exchange can liquidate if the price of the asset being traded rises above a known target.

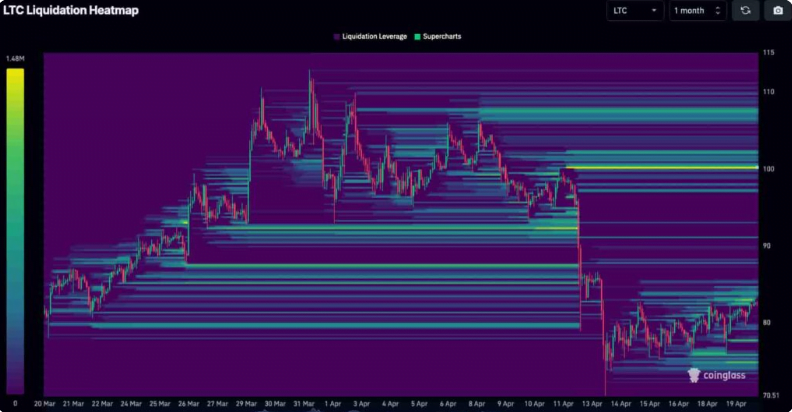

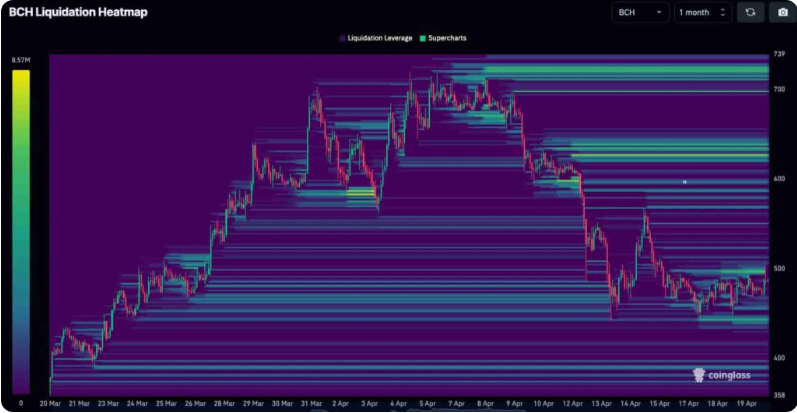

The liquidation of multiple short positions can push the price upwards, a phenomenon traders call a short squeeze. Notably, liquidity pools that stand out in terms of price have been observed particularly in Litecoin (LTC) and Bitcoin Cash (BCH).

Will Litecoin (LTC) Rise?

According to data provided by CoinGlass, Litecoin first continues to trade at $85.35, following a 5.35% increase today, marking a positive gain.

On the other hand, those who short-sold have taken positions worth $188.34 million, representing 51.54% of the total volume, and continue to manage the 24-hour volume.

While all this is happening, it seems that there are millions of dollars in liquidity pools near the $100 psychological level for LTC. Consequently, a movement towards this potential resistance from current price levels could open up gains of over 21% for investors.

Will Bitcoin Cash (BCH) Start to Rise?

Secondly, Bitcoin Cash, might seize an opportunity to benefit amidst rapidly increasing gas fees for Bitcoin.

However, unlike Litecoin’s single $100 region liquidation pool, BCH appears to have several liquidity pools ranging from $500 to $740. A likely short-term rise and move to resistance at these price levels could bring a significant 40% gain among Bitcoin Cash investors.

However, it’s important to remember that changes can always occur in the cryptocurrency market. Investors should not forget that the mentioned liquidity pools could disappear if they close their positions themselves.

Türkçe

Türkçe Español

Español