Crypto currency markets’ cumulative value is once again targeting $2.1 trillion, which is promising for altcoins. Investors expecting more rises in altcoins have their eyes glued to the BTC chart, hoping for the weekly close to be near current levels. As of writing, BTC is above the $51,800 region, which seems sufficient for now.

Dogecoin (DOGE)

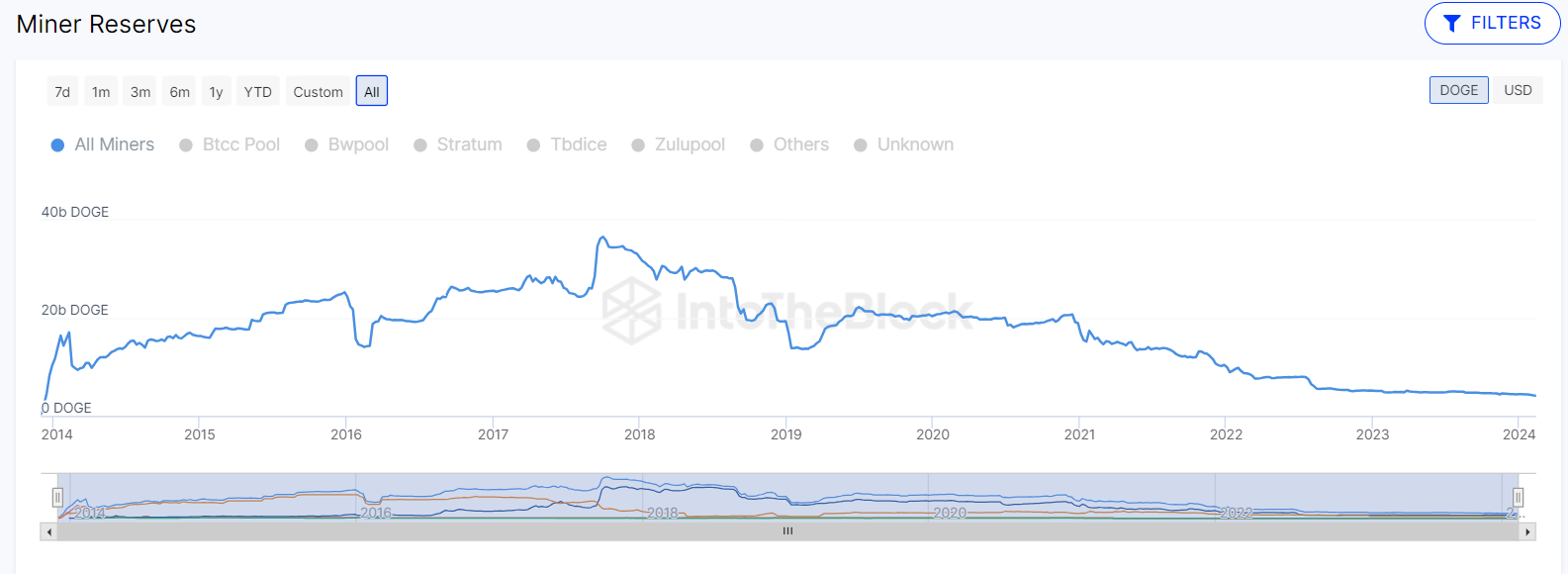

Dogecoin miner reserves have fallen below 4.2 billion for the first time since the end of 2013, with a 5.28% reduction in the last 30 days. This indicates that miners have been selling in massive amounts for a long time. During the glorious days of 2021, these reserves were above 12.8 billion. A significant sell-off occurred in mid-2022, followed by gradual sales.

On February 10, the reserves that had fallen to 4.11 billion began to recover after hitting a bottom. Despite general market optimism, miners’ motivation to sell at very low prices has not been sufficiently reduced. Fortunately, their reserves have significantly diminished, and considering long-term thinkers, we can say that the selling pressure from this front should now ease.

For DOGE price, a few hours ago we shared a comprehensive assessment; the key short-term area is $0.088, and without a weekly close above it, hopes for $0.106 will not flourish. For now, investors need to wait for closes above resistance for further increases.

APE Coin Comments

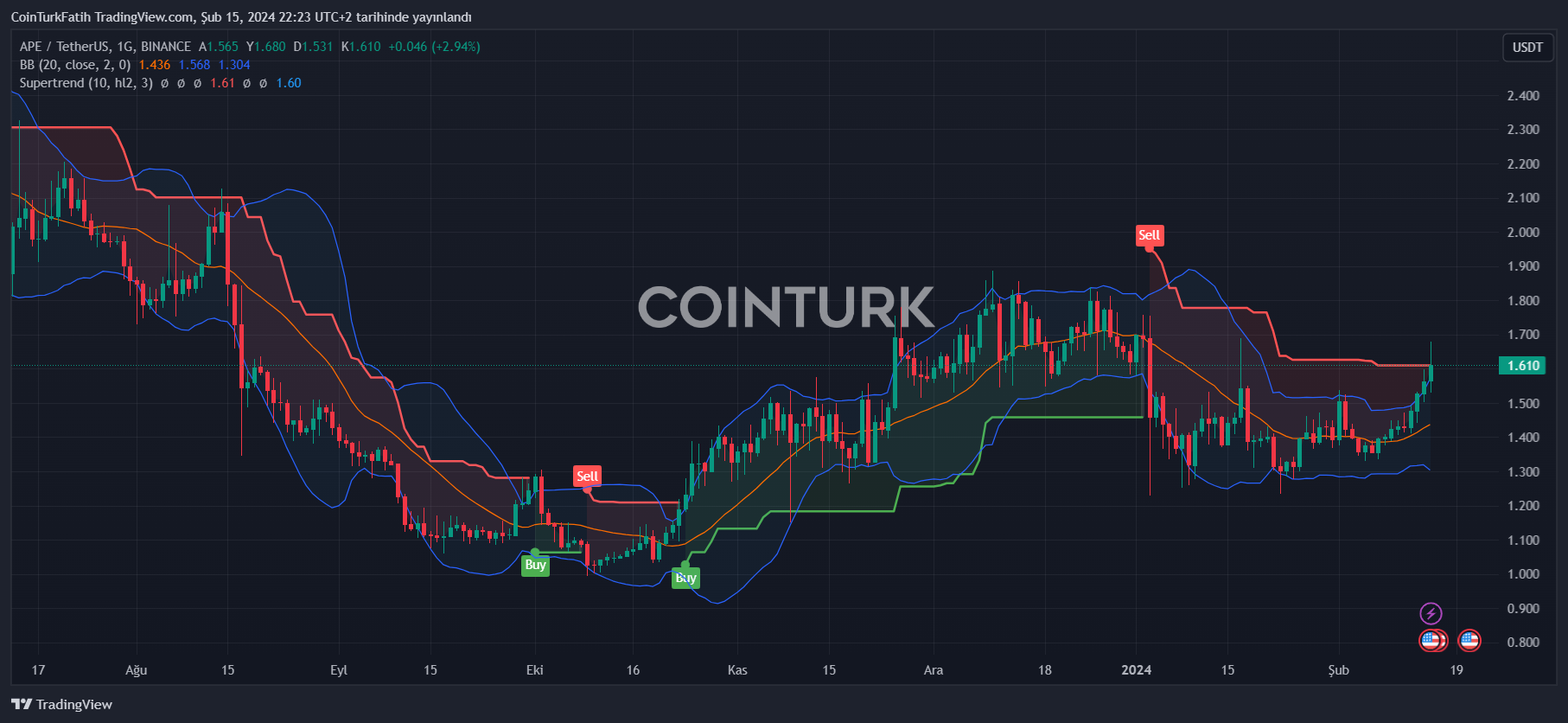

Metaverse, NFT tokens couldn’t withstand the realities of bear markets and lost significant market value. Moreover, they can’t perform above average despite the recent recovery. Of course, one of the issues here is the continuous increase in circulating supply.

SAND Coin is significantly increasing its supply this month, while APE has been doing so with gradual unlocking over a long period. Even though they reached serious peaks when they were first launched, both the fading excitement in the hype category and the growing circulating supplies have put them in a difficult position.

As of writing, the APE Coin price is above $1.6. However, the rejection from the resistance area of $1.68 and the long upper wick suggest that sell-offs are dominant. With a possible BTC correction, a return to $1.5 and $1.33 could be seen.

Türkçe

Türkçe Español

Español