The volatility in cryptocurrencies continues after the Federal Reserve’s recent actions, and the market direction is still not determined as of early February. The excitement around ETFs has somewhat faded, and statements made by the Federal Reserve Chairman could prompt investors to be cautious this month. So, what do the current data tell us?

Bitcoin (BTC)

Bitcoin turned downward following the Non-Farm Employment data, which came in at 353,000 versus the expected 185,000. This figure, almost double the forecasts, has previously triggered significant market downturns.

The numbers support the view that restrictive economic policies have not harmed the economy as much as assumed. This situation is triggering sell-offs due to the possibility that the Fed may maintain its tight monetary policy for a longer period. For now, even if BTC prices rise, we may feel the negativity of these data for some time.

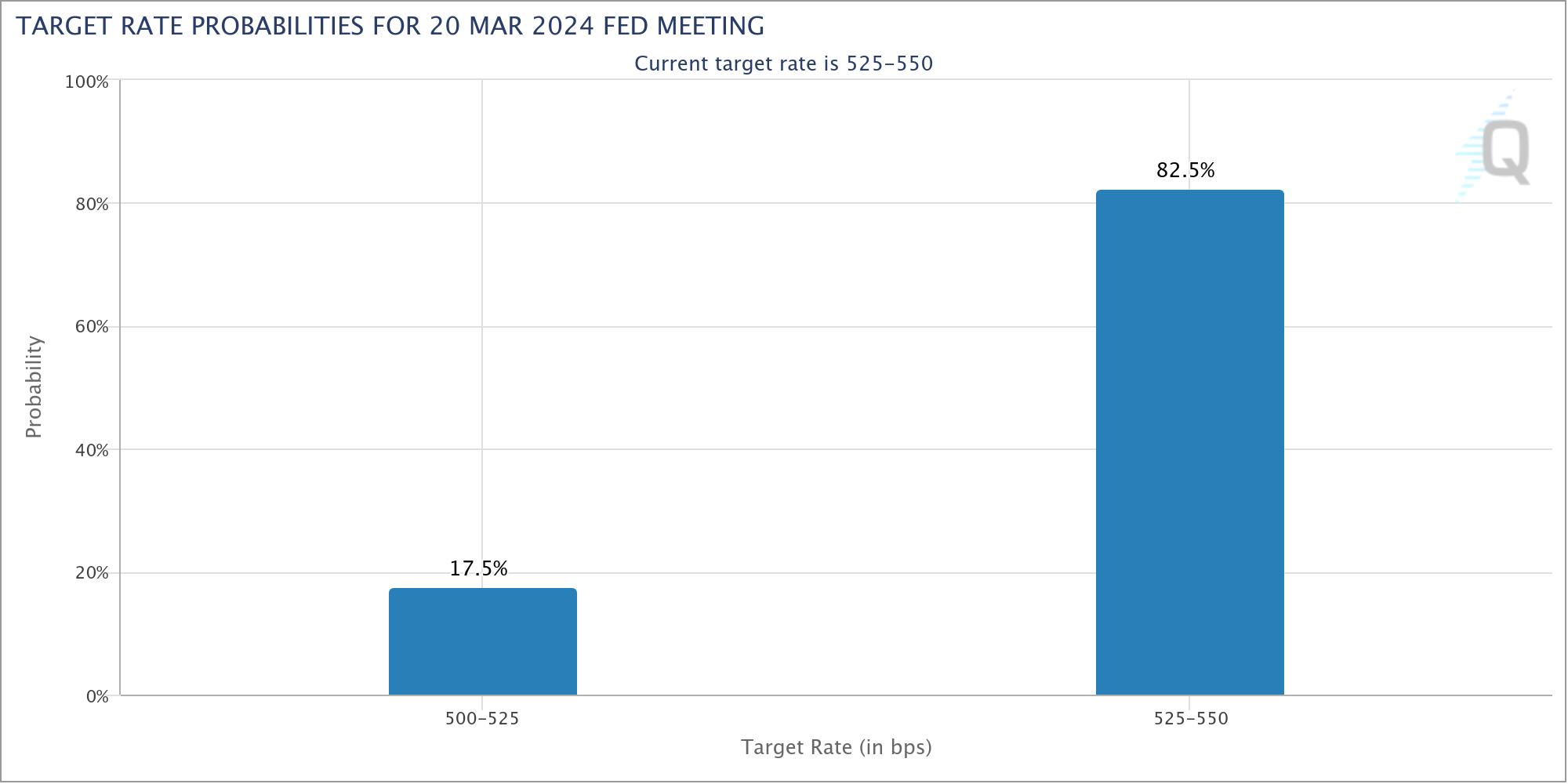

According to data from CME Group’s FedWatch Tool, the expectation for a rate cut in March has dropped from 45% to 17%. This forecast was at 80% just weeks ago. However, the belief remains strong that a cut will occur in May, and at the March meeting, Powell could take steps that dampen optimism, as he did days ago.

Crypto Market Forecast

Caleb Franzen, founder of Cubic Analytics, discussed the risks of excessive optimism in his market forecast shared on social media. He draws attention to the market’s expectation for a relaxation in employment but does not seem very hopeful. Financial commentator Tedtalksmacro, on the other hand, was more optimistic about the long-term effects beyond the short-term impact of employment figures.

“Strong employment data are good in the long run; they just stood out too much when the market was pricing in discounts – it’s a wake-up call…”

While positive for the US economy and potentially good for the long term as it allays recession fears, this situation negatively affects the outlook for investors in risk markets who were expecting faster rate cuts.

According to data from Arkham, daily inflows to the custodian Coinbase dropped to 4,400 BTC at the time of writing. This is below the previous days’ inflows and the continuation of the weakening in GBTC outflows is extremely important.

Daan Crypto Trades wrote the following;

“Total net inflows were +38 million dollars yesterday, so another day of inflows, albeit small.”

Türkçe

Türkçe Español

Español