June was nightmarish, and July started badly, but crypto markets are overcoming their biggest fears. The selling pressure from MtGox returns, which worried the markets for years, began during our peak days. However, it did not result in as bad an outcome as feared. With the completion of MtGox returns through Kraken and Bitstamp channels, investors breathed a sigh of relief.

Why Did Altcoins Rise?

Most of the MtGox returns are over, and BTC is still above $69,000. As short-term FUD disappears, investors can breathe easier in the long term. Another significant reason for the rise in Ethereum and other altcoins was Trump’s statements. What Donald Trump said at the Bitcoin 2024 conference in Nashville exceeded even optimistic investors’ expectations.

On July 29, ETH price, which saw an increase of nearly 4%, approached the $3,400 mark. The government holds BTC assets, and Trump promises to keep all of them in reserves. Republican Senator Cynthia Lummis announced a bill proposing that the US Treasury accumulate 1 million BTC within five years.

Trump is making these moves to prevent China and European countries from dominating crypto innovation. While this is a good argument for the election, Harris and his team are also looking for ways to present themselves more moderately to crypto investors. This competition could mean the end of the hate-filled crypto crackdown during the Biden era. Regardless of who is elected, crypto investors will be the winners in such a scenario. However, crypto investor voters will likely support Trump after his promises.

Crypto Predictions

The Fed will announce its interest rate decision on July 31, and after the balanced recent data, the Fed’s dovish tone is expected to become more apparent. Some experts, including former New York Fed President William Dudley and economist Mohamed El-Erian, say that interest rates are high and could cause serious problems if they continue. They also believe that “aggressive interest rate cuts” are now needed.

We can say that the optimism on the macroeconomic front also supports cryptocurrencies. This situation reveals the developing environment for crypto from all sides. In September, the interest rate cut forecast was 57% in the previous month, but now it is around 90%. US bond yields also moved in this direction and fell.

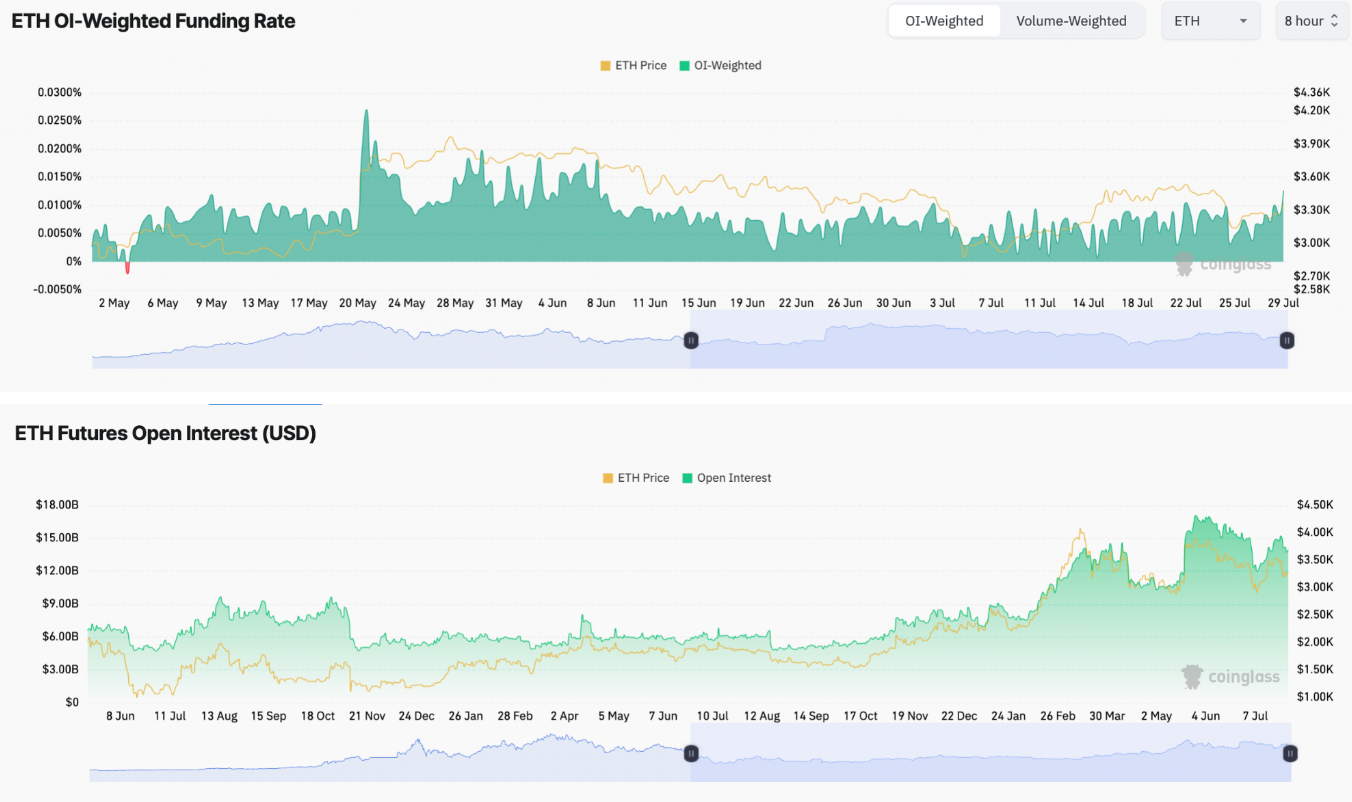

A significant recovery in ETH prices will support the rise of altcoins. The funding rate for ETH in futures reached 0.26% weekly from 0.014%. This shows that those taking long positions are strengthening. Open interest fell from $15.22 billion to $14 billion. Probably, short sellers are retreating.

$3,460 is a key point for ETH, and a breakout in the channel seen in the chart could trigger a new test at $3,600. Thus, $4,094 will be targeted again.

Türkçe

Türkçe Español

Español