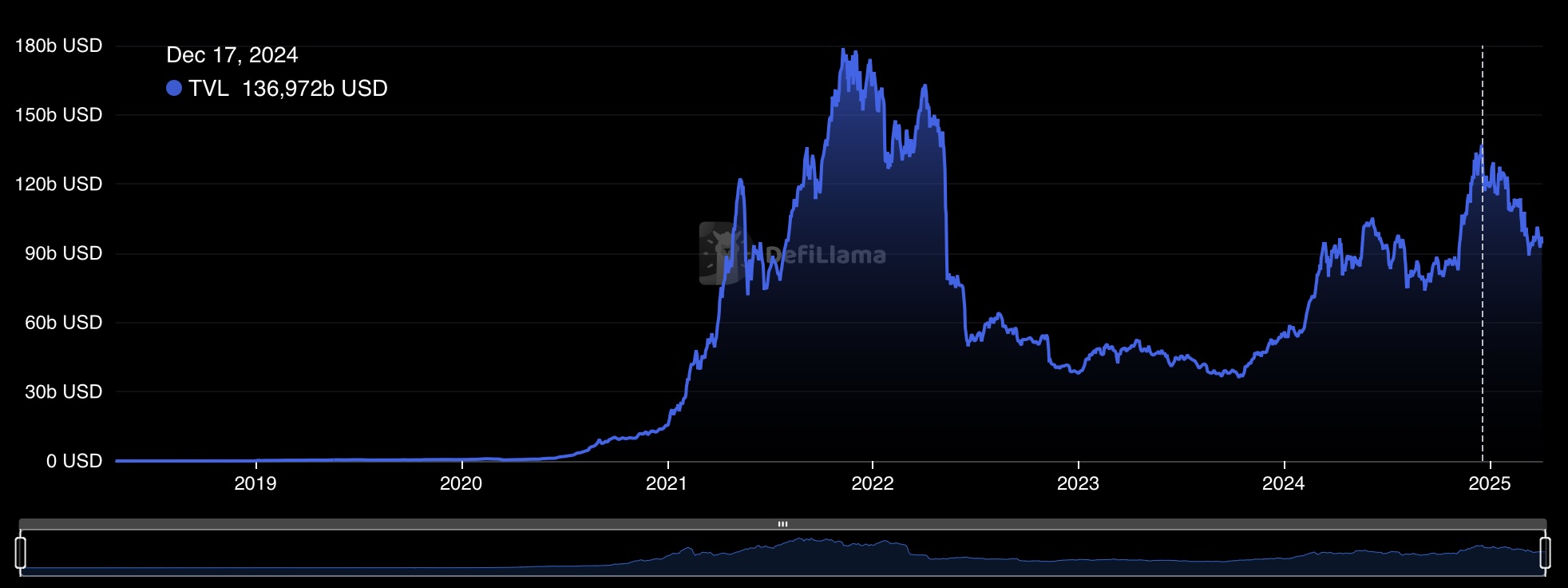

The crypto sector, particularly in decentralized finance (DeFi), has seen its total value locked (TVL) drop by over 30% in the last four months due to global economic pressures. According to DefiLlama data, the current TVL in DeFi stands at approximately $94.49 billion. This marks a significant decrease from a high of $137 billion in mid-December, with a temporary dip to $88 billion in March. The downturn in the DeFi sector parallels a broader decline across the cryptocurrency market.

Global Economic Impact on TVL

The recent decline in DeFi’s TVL is not an isolated issue. The crypto market initially surged after President Donald Trump’s reelection in November, only to reverse course in the first quarter. Early optimism from Trump’s crypto-friendly policies quickly gave way to uncertainties, notably following the imposition of mutual tariffs on trade partners, which shook investor confidence.

According to Vincent Liu, CIO of Kronos Research, such fluctuations significantly impact the DeFi sector. The decline in active wallets on Ethereum  $3,094 and Bitcoin

$3,094 and Bitcoin  $91,081 networks reflects a loss of user confidence. Increased competition, price corrections, and economic uncertainties further complicate the situation.

$91,081 networks reflects a loss of user confidence. Increased competition, price corrections, and economic uncertainties further complicate the situation.

Bitcoin’s drop from $108,000 in January to $78,000, along with Ethereum’s fall from $4,000 to $1,700, are contributing factors to the losses in DeFi’s TVL.

DeFi Sector Still in Development

Kevin Guo, Director of HashKey Research, notes that the DeFi sector is still not fully matured. Despite significant advancements over the last few years, the sector faces challenges in integrating financial products and institutional actors. As a result, systems that do not offer the same level of security and competitive rates as traditional exchanges find it difficult to attract large investors.

Guo also points out that individual investors face problems accessing DeFi. Complex interfaces, high transaction fees, and difficulties in the custody process limit interest in the sector. Meanwhile, professional investors still prefer licensed exchanges for liquidity and trading tools.

Liu emphasizes the need for innovative solutions and stable prices for the crypto sector to regain momentum. He suggests that forthcoming inflation data and potential reversals in Trump’s tariff policies could create a more positive market atmosphere.

Nick Ruck, Director of LVRG Research, believes that DeFi will continue to be a robust investment area in the long term. He argues that regulatory frameworks encouraging institutional integration with blockchain and real-world assets will enhance DeFi’s appeal.