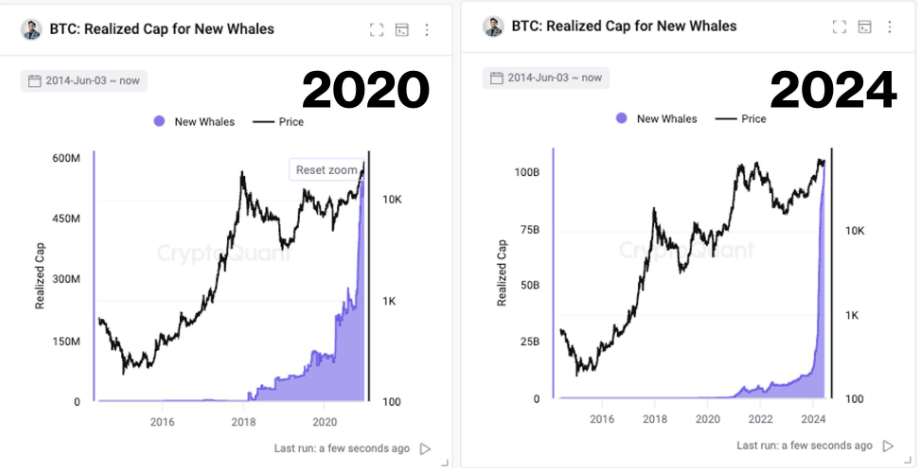

The CEO of blockchain analysis firm CryptoQuant made important statements. He mentioned that Bitcoin‘s (BTC) on-chain market outlook resembles the period of 2020, which preceded the peak of the last bull cycle at the beginning of 2021.

Famous Figure’s Bitcoin Commentary

Ki Young Ju, the CEO of one of the well-known companies in the market, made important statements to his thousands of followers via X. Commenting on Bitcoin’s price movement, Ju noted that BTC has been in a consolidation phase for over six months, reminiscent of the period four years ago when on-chain activities rapidly increased.

Ju explained that during this period, BTC worth $1 billion was added to whale wallets, considering the potential significant effects on the market.

Bitcoin has the same atmosphere as mid-2020. Back then, BTC hovered around $10,000 for six months with high on-chain activities, later emerging as OTC (over-the-counter) transactions. Now, despite low price fluctuations, on-chain activities remain high, and $1 billion is added to new whale wallets daily.

Ju also shared a graph indicating the “holding intensity” of Bitcoin owners. He mentioned that this metric helps understand the investment approach adopted by Bitcoin holders and how close each Bitcoin is to a scenario where it remains untraded.

Looking at the graphs, there is a constant upward trend in investment and hodl intensity over this 14-year journey, and the analyst states that this contributes to BTC’s increasing adoption as an investment vehicle.

Bitcoin holders are becoming increasingly inclined to hold rather than sell. This shows that Bitcoin is now seen more as a store of wealth than a commercial asset.

How Much is 1 Bitcoin Now?

While the famous figure commented on BTC’s transformation into a value preservation tool, eyes were also on the Bitcoin price. As of the time of writing, BTC is trading at $68,764.

On the other hand, the market cap stands at $1.35 billion, while the 24-hour trading volume increased by 89% due to price movements in the market, reaching $32 billion.

Sellers are seen exerting significant pressure in the market. The RSI value dropped to 37 in the last 24-hour indicator, indicating a selling intensity.

Türkçe

Türkçe Español

Español