In the cryptocurrency market, it seems that there is a downward pressure led by Bitcoin (BTC). The market’s price movement is considered part of a pullback pattern following Bitcoin‘s historical halving. This model shows that a decline occurs before a rally in cryptocurrencies. Despite the negative outlook of the market, we examined two cryptocurrencies that could attract attention next week. So, what could happen with these altcoins?

Will Ethena (ENA) Rise?

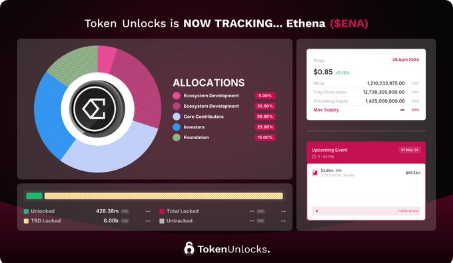

Positioned as a synthetic dollar protocol, Ethena (ENA) is supported by industry pioneers like Arthur Hayes, the founder of BitMEX, who previously led WIF to its peak. Since its emergence, Ethena has continued to stay in the focus of the crypto market. Next week, however, the focus shifts to another topic. Depending on the planned token unlock events, volatility might be high on the ENA side.

Especially Ethena, looking at the circulating supply, about $46 million worth of tokens, representing 3.76% of the existing ENA, will be unlocked. Amid rumors similar to past troubled projects like Terra, how the token unlock will be reacted to is a matter of curiosity.

A recent report by CryptoQuant warns that holders of USDe should maintain a retention rate (the portion of revenue allocated to the reserve fund) above 32% in a bear market outlook to mitigate risks, increasing concern among investors.

On the other hand, the existing 67% Annual Percentage Yield (APY) on the Ethena side has attracted the attention of investors seeking high returns, making Ethena a focal point. This increase in interest has triggered a rise in buying pressure, pushing the token’s market value above 1 billion dollars.

As of writing, ENA is trading at $0.840, showing a daily gain of 2%.

Tron (TRX)

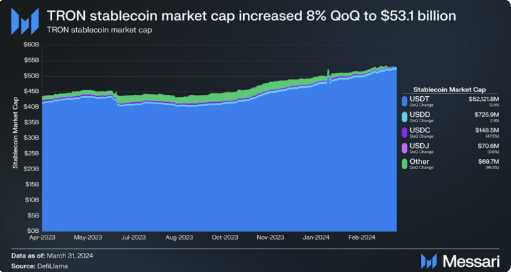

In the short term, Tron (TRX) continues to trade in the positive zone. This situation parallels the growth seen in various metrics of the Tron blockchain in the first three months of 2024.

For instance, the circulation amount of USD Tether (USDT) on Tron surpassed $50 billion in the first quarter of the year. This surpassed level holds significant importance for market participants as the flow of stablecoins is generally crucial for fiat onramps and potentially influences long-term prices.

Furthermore, Tron currently maintains its leadership in active stablecoin addresses, highlighting its significance within the sector.

As of writing, TRX is trading at $0.12051, with a daily increase of 1%, which indicates a 10% rise on a weekly basis.

Türkçe

Türkçe Español

Español