BTC price returned to its current range 9 days ago and has been finding buyers above $50,500 for more than a week. The balancing of ETF inflows has led to sales that pushed the price below $52,000. Bulls are now gathering strength to attempt new highs while risk appetite remains weak. So, what is the latest situation with popular cryptocurrencies?

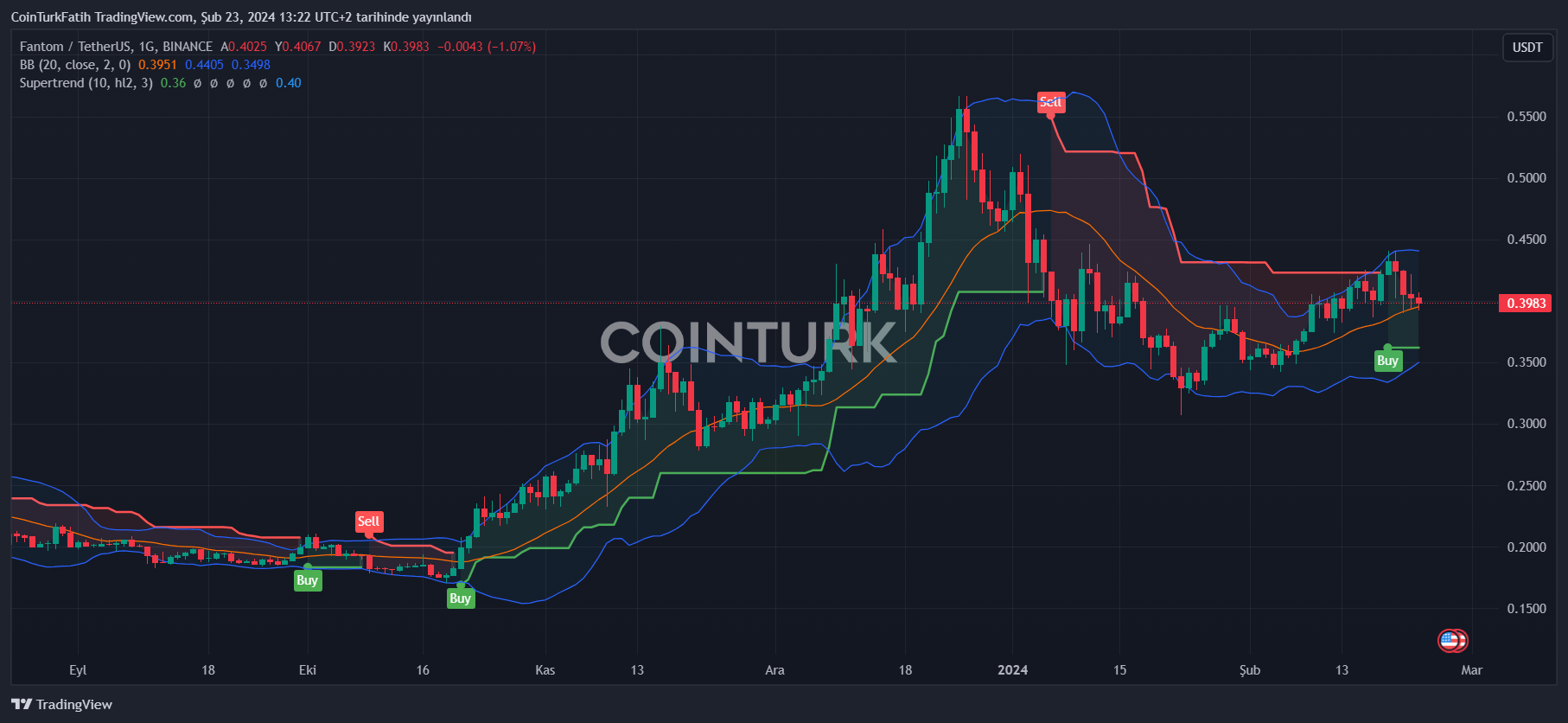

Fantom (FTM)

Fantom, a popular DeFi altcoin, has endured a challenging bear market, and the team’s lead figure’s departure and return have shaken it. Fortunately, things are looking up for now. After hitting a low of $0.3 on January 23, the price climbed to the $0.44 mark. The price increase, a result of the improved market sentiment, could not break through this resistance zone.

To retest the resistance of $0.568 from the end of December, the price needs to see closures above the $0.42-$0.44 resistance area. However, if it fails to do so, we could see a drop to $0.363 and $0.308. A deeper correction could target the October 2023 bottom at $0.295.

Depending on Bitcoin‘s price, investors will be watching for weekend fluctuations in BTC price. If we see a significant ETF inflow today, the resistance level could be surpassed over the weekend.

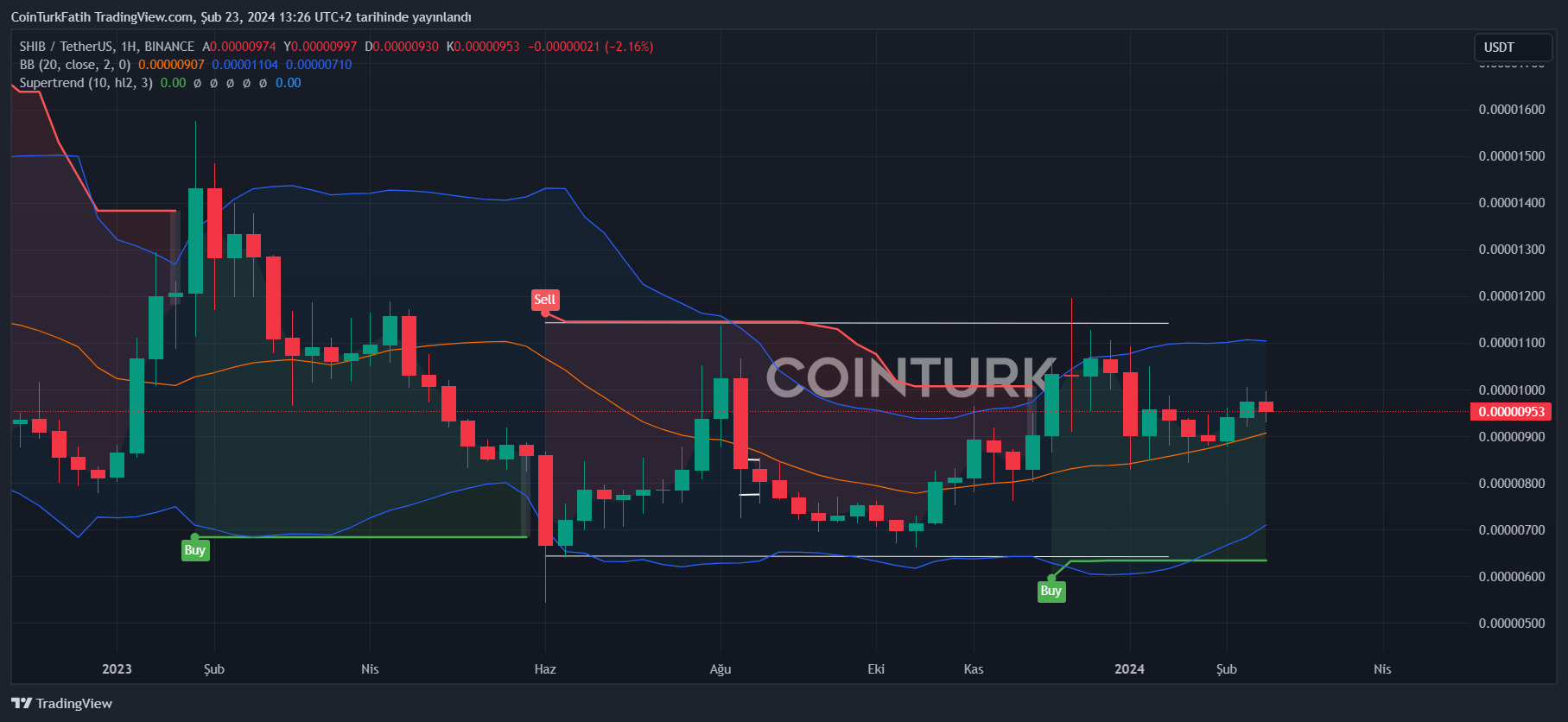

Shiba Coin

Shiba Inu, the second-largest meme coin by market value, has yet to surpass the $0.00001004 level. The price, fluctuating between resistance and the $0.00000932 support, is not receiving the expected boost from Shibarium. In the coming hours, we will likely see one of the classic volume drops, and SHIB may fall back to support.

In a potential downturn scenario, the supports at $0.00000853 and $0.00000756 are in view. If resistance is broken, a rally could extend up to $0.00001574.

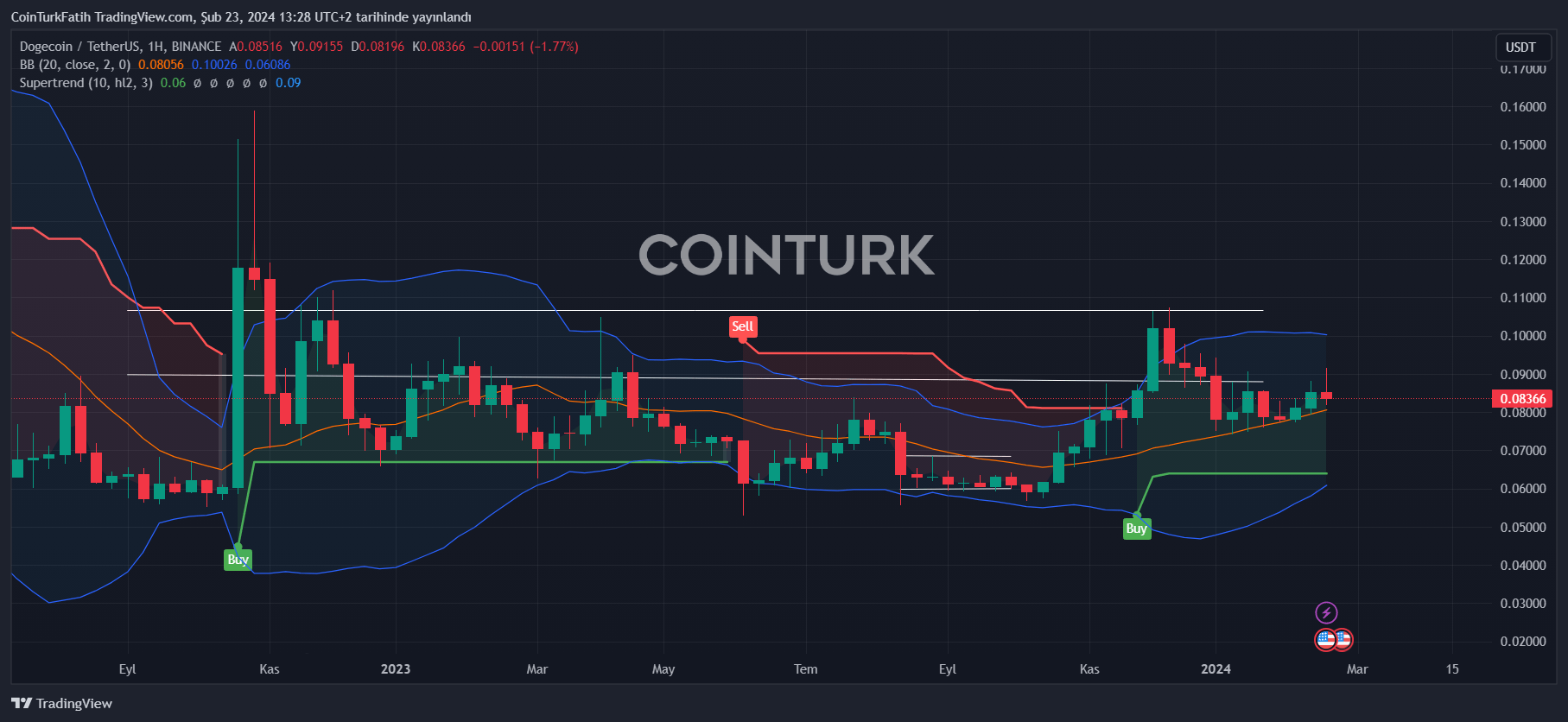

What Will Dogecoin’s Price Be?

DOGE investors saw the price above $0.088 as a selling opportunity, and the sell-off accelerated with the BTC decline. If permanence above this region cannot be sustained, sales may continue down to the $0.077 support. Below that, there is support at $0.0708.

In an optimistic scenario, if the resistance area is breached, the parallel channel’s upper line at $0.106 becomes the target. A clear turnaround will be watched for weekly closures above $0.106-$0.12.

Türkçe

Türkçe Español

Español