After the Fed’s interest rate decision, the most challenging week for cryptocurrency investors is now behind. While the price of Bitcoin has climbed to $43,475, it has not yet managed to stay there permanently. On the other hand, a new decision was made regarding the ETH ETF application. What are the details of the last decision and the possible scenarios?

Ethereum News

The United States Securities and Exchange Commission (SEC) recently postponed its decision on the spot ETF application proposed by Invesco and Galaxy Digital. At the same time, we saw an update in the BTC ETF application file of Invesco and Galaxy Digital. Such file updates are accepted as a result of ongoing communication with the SEC. This month the SEC has held talks with many potential ETF issuers, which fuels optimism in the market about approval.

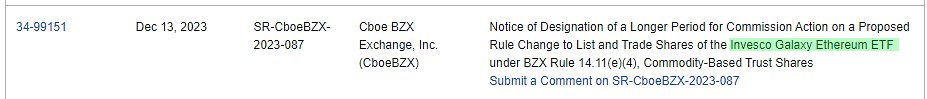

In a notification dated December 13, the SEC announced that it has postponed its decision on the application that would allow the Cboe BZX Exchange to list the Invesco Galaxy Ethereum ETF. Accordingly, a decision is expected to be made on February 6, 2024.

> “The 45th day after the publication of the notice for this proposed rule change is December 23, 2023. The Commission is extending this 45-day period. The Commission sets February 6, 2024, as the date to initiate proceedings to determine whether to approve or disapprove the proposed rule change.”

The Race for ETFs Gains Momentum

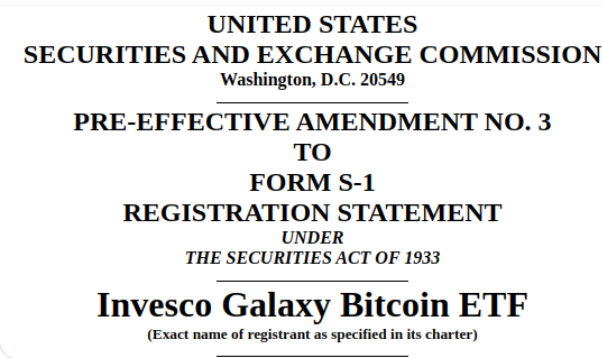

Invesco and Galaxy Digital were emboldened to revive their BTC ETF application after BlackRock made a spot Bitcoin ETF application in June. They also applied for a spot ETH ETF in September.

A Bloomberg ETF analyst wrote the following a few minutes ago regarding the BTC ETF file update;

> “Invesco is committing to only cash creation according to their newly updated S-1s. This is a very big clue that the SEC is determined to initially allow ETFs to be created only in cash (which we also hear in the background). Still, many were waiting to see if BlackRock could influence the SEC on in-kind investments.”

Analysts are talking about January 10 as the date when everything will be clear. If the SEC is going to give approval, we might see this happening around these last dates.

Türkçe

Türkçe Español

Español