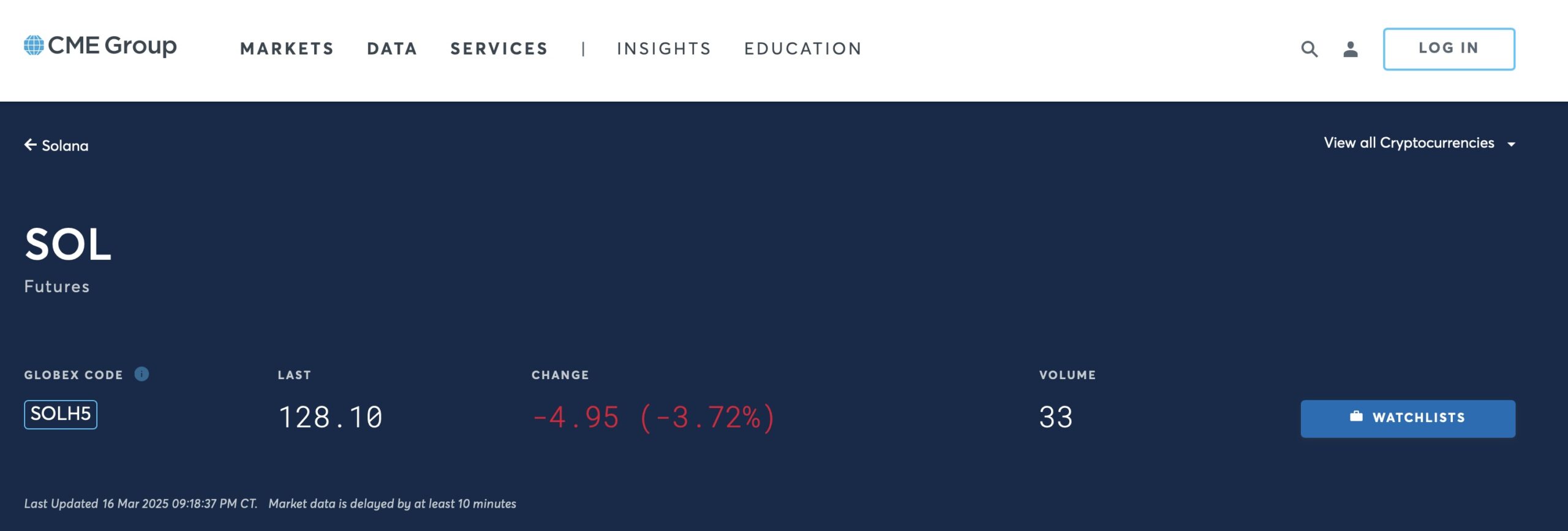

FalconX, a cryptocurrency brokerage firm based in San Mateo, has successfully executed the first block transaction for CME Group’s Solana  $172 futures. This transaction was conducted with StoneX, a financial services company, right before the launch of Solana futures today. The futures, announced by CME Group in February, are believed to pave the way for a spot ETF approval for altcoins.

$172 futures. This transaction was conducted with StoneX, a financial services company, right before the launch of Solana futures today. The futures, announced by CME Group in February, are believed to pave the way for a spot ETF approval for altcoins.

CME Group’s Solana Futures Gain Momentum

CME Group is applying a strategy similar to its Bitcoin  $0.000041 and Ethereum

$0.000041 and Ethereum  $2,601 initiatives to Solana. Following the launch of these futures, there is potential for an ETF approval in future discussions. The company has indicated that it will release Solana futures in response to high market demand.

$2,601 initiatives to Solana. Following the launch of these futures, there is potential for an ETF approval in future discussions. The company has indicated that it will release Solana futures in response to high market demand.

The futures will be offered in two different options: standard contracts of 500 SOL and micro contracts of 25 SOL. These contracts will be settled in cash based on the CME CF Solana-Dollar Reference Rate, which will be determined every day at 16:00 London time.

The overall market for cryptocurrency futures at CME Group has also grown significantly. Reports indicate an average daily contract volume of 202,000 since the beginning of the year, reflecting a 73% year-on-year increase. Additionally, the average open interest has risen to 243,600, representing a 55% growth.

Spot Solana ETF Approval on the Horizon

The launch of CME Group’s Solana futures could serve as a trigger for spot Solana ETF approvals, as several prominent fund managers have submitted ETF applications to the SEC.

Franklin Templeton formally applied for a spot Solana ETF with the SEC in February. Managing over $1.5 trillion in assets, Franklin Templeton is recognized as a significant player in the market. Alongside Franklin Templeton, firms such as Grayscale, 21Shares, Bitwise, VanEck, and Canary Capital have also made official attempts for a spot Solana ETF.

If these ETFs are approved, it is anticipated that Solana will see increased adoption by institutional investors. This is because ETFs present an opportunity for traditional financial institutions to invest in Solana within a regulated environment.

What is FalconX?

FalconX is a cryptocurrency brokerage firm catering to institutional investors. The company has reported executing $1.5 trillion in transactions across over 400 cryptocurrencies while serving more than 600 institutions. It has continued its growth by acquiring Arbelos Markets earlier this year.

Türkçe

Türkçe Español

Español