Dogecoin (DOGE), despite a nearly 32% increase in the past period, continues to face expectations of ongoing price corrections due to a lack of bullish signals. This situation not only presents a view against a broader market recovery but can also be interpreted as a decline in investors’ interest in DOGE.

Dogecoin and Investor Outlook

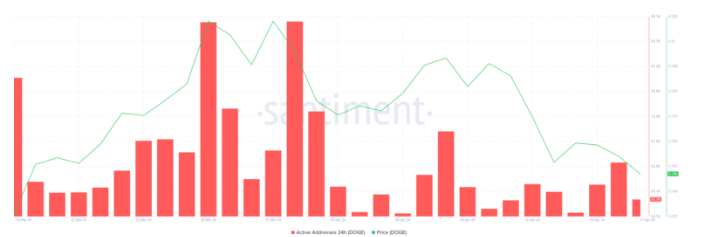

The decreasing confidence of investors significantly impacts Dogecoin‘s price. Looking at the number of daily active addresses specifically for DOGE, it is seen that the average number of DOGE investors transacting on the network has dropped to 57,000.

This situation also marks the lowest value observed in the last six months. In contrast, data from the last days of October 2023 shows that 41,900 active addresses were transacting.

Based on this view, a growing lack of confidence among DOGE investors could further strengthen the possibility of a decline.

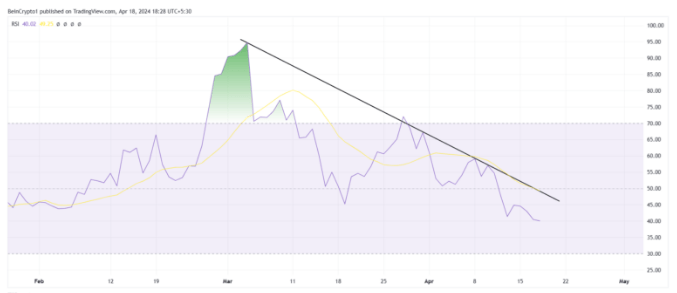

On the other hand, a drop in the Relative Strength Index (RSI) is also among the observed factors. Currently, the RSI continues to be below the neutral line at 50.0, moving towards a bearish neutral zone.

Such a pullback could potentially deepen corrections and disappoint DOGE investors.

DOGE Price Outlook

As of today, Dogecoin is trading at $0.1505, just above a 1% increase, and continues to stay below the $0.151 line. Before the recent price corrections, DOGE was caught in a rising wedge, and a breakout in this pattern could have pushed the meme coin to $0.127.

However, the price movement did not occur as expected. The breakout happened sooner than anticipated, and the correction also occurred earlier than expected, leading to a further drop in Dogecoin’s price. This situation faces DOGE with a fear of decline, needing a 13% increase to reach $0.127.

However, if the resistance seen at the $0.151 level potentially turns into a bounce point, it could invalidate the bearish outlook for the meme coin. It is conceivable that DOGE could rise to a target of $0.160 following this process as part of a price recovery.

Türkçe

Türkçe Español

Español