The general uncertainty in the crypto market continues to raise questions for many altcoins, including Bitcoin. Despite Bitcoin’s price rising to $67,000, a notable altcoin that doubled shortly after its emergence last month and then faced a significant drop has caught attention in the market.

Ethena Comments

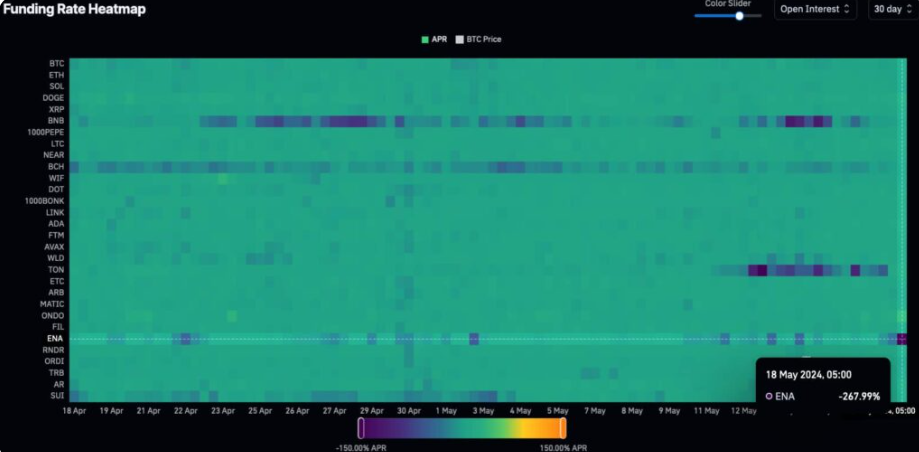

Ethena (ENA) surprisingly showed negative funding rates early on May 18 and was heavily shorted in the derivatives market. The existing open interest in the market leaned towards short positions against ENA. This situation suggests that ENA might be facing a short squeeze.

The most evident indicator of a short squeeze warning in Ethena is the massive negative funding rate. Data provided by CoinGlass showed that ENA short sellers were paying long-position investors 268% APR.

On the other hand, as of the time of writing, Ethena has the 25th largest open interest (OI) among all cryptocurrencies, with $194.21 million in open positions. ENA’s OI value, one of the largest OI/MCap ratios, represents 16% of its $1.19 billion market cap.

Ethena (ENA) Price Target

As of the time of writing, ENA is trading at $0.76 after a 20% increase in the last 24 hours, indicating that the price movement may have started. There was a noticeable 12.5% increase in the 24-hour open position rate, while the open interest rose by 35.48% to $541.55 million. Additionally, during the mentioned period, a $283.67 million short position was opened with a 50.54% dominance.

In the event of a short squeeze, the token could potentially reach two significant price levels. The first target is the $0.84 region, where a large portion of the liquidation is located, with a short position liquidity pool between $0.83 and $0.89. The second significant price level is at $1.08.

If these price levels are reached, Ethena investors could potentially gain between 7.7% and 38% from the current price levels.

On the other hand, since its emergence, Ethena has caused significant concerns among a large part of the crypto community, failing to create a general sense of confidence regarding its long-term targets.

Türkçe

Türkçe Español

Español