Bitcoin (BTC) continues to fight to turn the $28,300 resistance level into support. At the same time, ETF applications are being updated, and potential issuers who have managed to communicate with the SEC are increasing investors’ hopes. Another development supporting the sentiment of a rise in Ether has also occurred.

Ethereum Addresses Break Records

As tensions in the Middle East continue to rise, the price of oil has become volatile again. The Fed meeting is also approaching, and the latest data has not been very good. However, the potential approval of a spot BTC ETF that fuels market sentiment has also excited Ether investors.

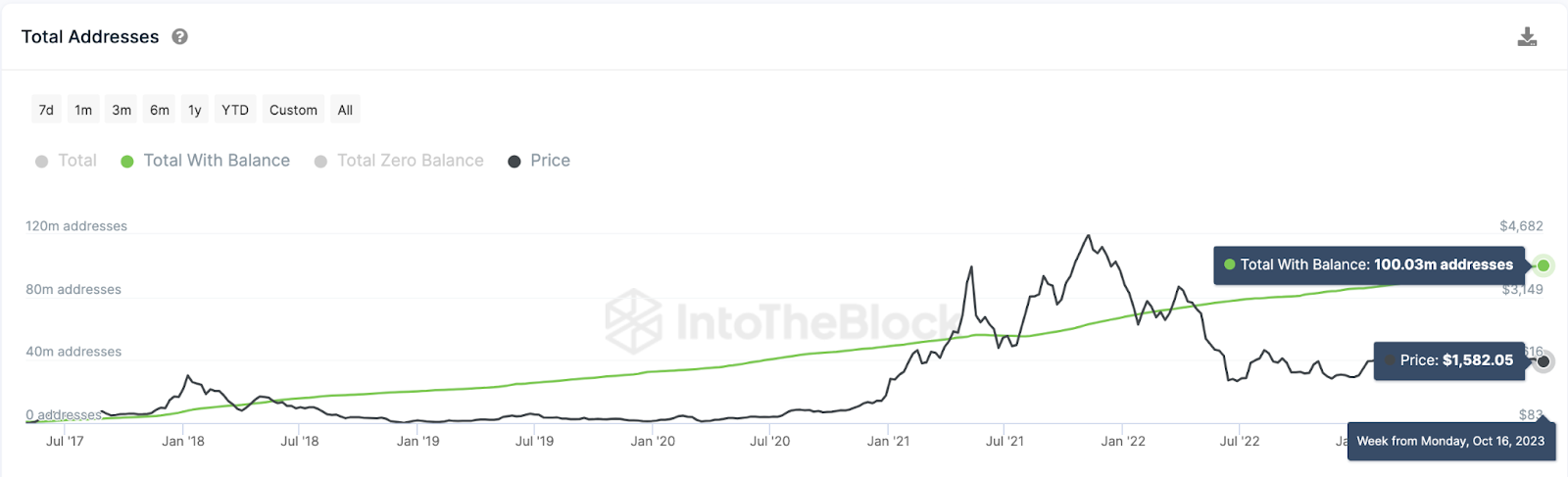

We often talk about the importance of on-chain data. With the Merge that took place on September 15, 2022, energy consumption decreased by 99.988% and the network entered a period of negative inflation. However, with the decline in average transaction fees to the lowest level in 3 years, a short-term inflationary period began. Despite all these developments, the number of addresses with significant balances on the Ethereum network has exceeded the 100 million threshold.

According to on-chain data compiled by IntoTheBlock, Ethereum set a new record in the metric of addresses with significant balances on October 16. While there were around 57.6 million addresses with significant balances on September 15, 2022, it has reached 100 million in approximately 13 months.

Ethereum (ETH) Analysis

The “Rate of New Adopters” continues to increase along with addresses with significant balances. Despite the decrease in transactions on the network, the successful preservation of the $1,500 support amidst the increase in user count and macro-level negatives is a positive development for Ethereum investors.

On-chain data suggests that Ethereum could initiate a strong rally targeting $5,000. However, for this to happen, the main resistance wall at $1,900 needs to be quickly overcome. If the increase in on-chain data continues, network participants can gather the strength to overcome challenging resistances.

This would propel the Ethereum price above the $1,900 resistance in the medium and long term. However, the potential sudden drop in BTC price and the loss of the $1,500 support could lead to a deeper local bottom around $1,400 in the opposite direction.

In summary, while on-chain data appears supportive for the ETH price, it is crucial for the BTC price to maintain a positive market sentiment.

Türkçe

Türkçe Español

Español