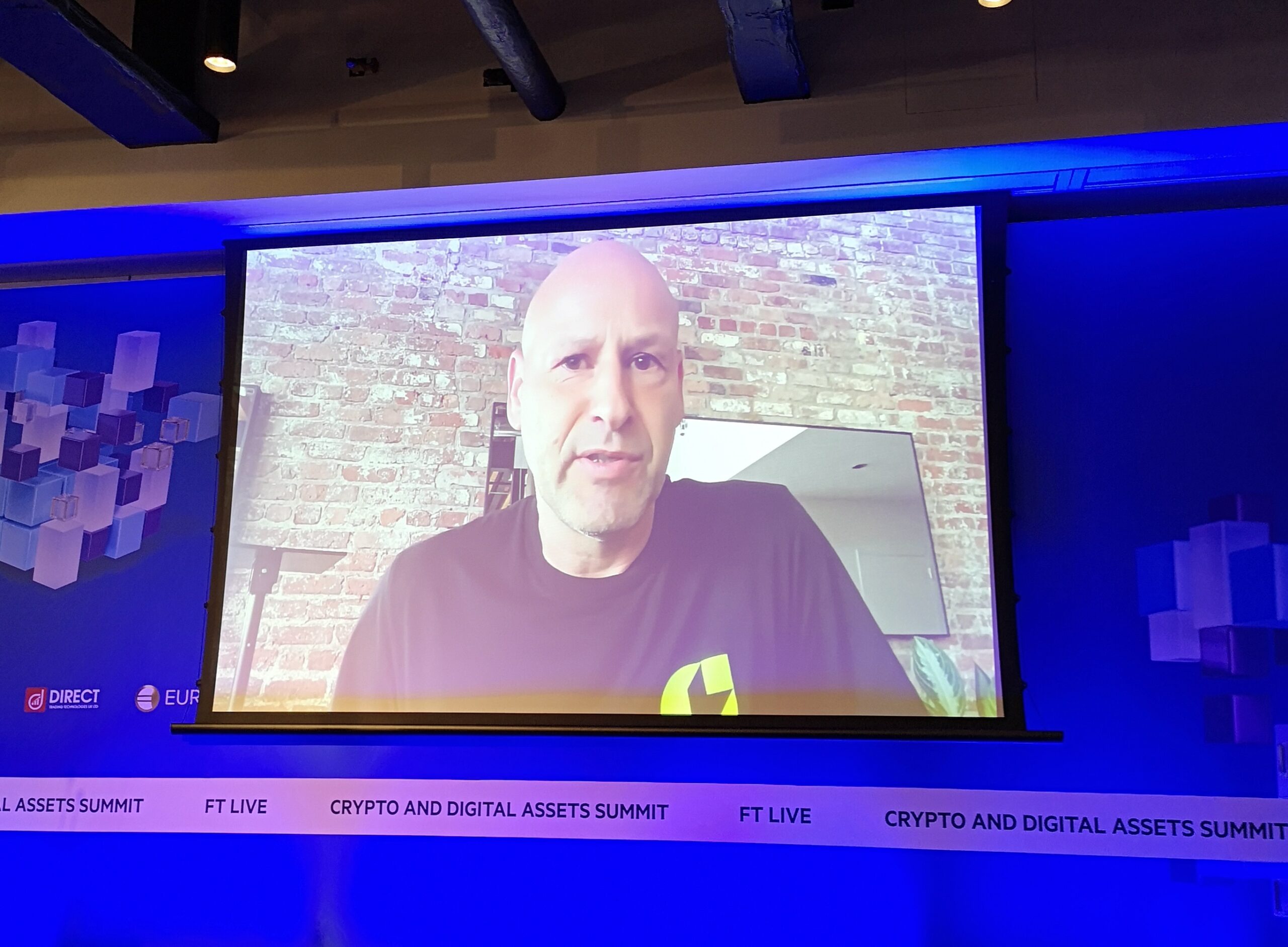

Ethereum co-founder Joseph Lubin believes that the Securities and Exchange Commission (SEC) is intentionally blocking innovations that threaten the current financial status in the United States. Speaking at the Crypto Asset Summit in London hosted by FT Live, Lubin discussed Consensys’ decision to sue the SEC after receiving a Wells notice from the US securities regulator.

Prominent Figure Makes Striking Statements

MetaMask wallet architects and CEO of Consensys mentioned that sanction actions are designed to create fear, uncertainty, and doubt within the cryptocurrency industry, and are pushing the company to move offshore.

“It seems like the SEC has reclassified Ethereum as a security without telling anyone. Instead of clear communication and rules, they are opting for a strategic series of sanction actions.”

Lubin mentioned that considering the Commodity Futures Trading Commission (CFTC) had previously classified Ethereum as a commodity, his measures against the SEC aim to gain more clarity from US courts. The CEO of Consensys also highlighted the upcoming deadline for the SEC to make a decision regarding the approval of Ethereum spot exchange-traded funds (ETFs).

“We believe there is a flurry of activity designed to ensure they can claim their actions are not capricious should they reject Ethereum spot ETF funds.”

Lubin noted the SEC’s realization of how much capital flowed into the ecosystem following the approval of spot Bitcoin ETF funds:

“Considering the massive improvement in scalability and usability, they are likely concerned about the influx of interest and capital into our ecosystem.”

Banking Sector and Crypto Solutions

Lubin also suggested that the possibility of banking sector customers moving their assets to digital forms using decentralized finance structures could frighten many banks and other financial institutions:

“The SEC probably does not want to see an innovation wave that could really alter the landscape.”

A positive outcome against the SEC could have wide-ranging effects on the cryptocurrency and technology environment in the US. Lubin mentioned the dangerous precedent set by the SEC’s claims that Coinbase and MetaMask wallets act as broker-dealers. He added that the idea of a software piece acting as a broker-dealer is absurd:

“We disagreed on whether we need to register MetaMask as a broker-dealer. The idea of having to register a user’s wallet as a broker-dealer is chilling.”

Consensys CEO concluded that the entire technology sector in the US could be affected by the actions of the securities regulator.