Spot Bitcoin ETF approval has everyone looking forward to the next big announcement. Profit-taking has tempered the excitement. However, as the final decision dates for Ethereum ETF applications approach in the coming months, they will become a much more central focus for investors.

Spot ETH ETF

High optimism for the ETH price is due to reasons such as its growing ecosystem, staking income, and the advantage of negative inflation gained with the transition to Proof of Stake (PoS). This will also enable qualified investors to access a different crypto product than BTC with a potential ETF approval. While BTC remains limited as a store of value, Ethereum embodies the narrative of next-generation technology finance.

There are several reasons to be optimistic about the near-future approval of spot Ether exchange-traded funds (ETFs). The first reason is, of course, the Bitcoin ETF approvals. The SEC has not explicitly legitimized it but has given approval, suggesting the same could be done for ETH.

Secondly, Ether must be seen as a commodity by the SEC. Gensler repeatedly states that most altcoins are securities. His admission that even a small portion are commodities is significant because ETH is very different in structure from other cryptocurrencies and is completely decentralized.

Ether has received assurances from many individuals/institutions, including the US Commodity Futures Trading Commission, the UK’s Financial Conduct Authority, and Bloomberg’s ETF analysts, that it is a commodity.

After the Spot Bitcoin ETF

According to a recent survey by Bitwise Asset Management, 98% of clients with crypto investments aim to increase their crypto investment in 2024 and support ETH. Fidelity’s research director Chris Kuiper recently explained at length why Ether is a better option for institutional investors than Bitcoin.

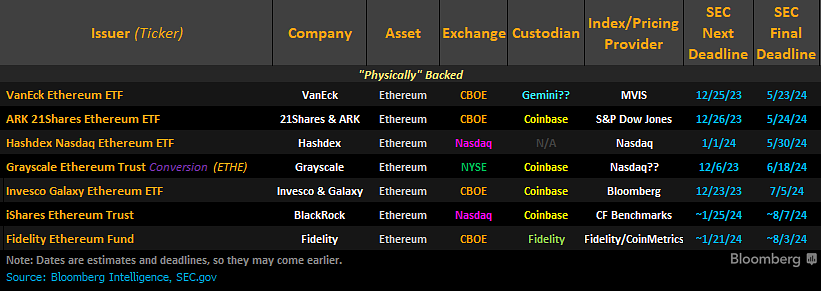

Applications awaiting SEC approval, such as the Fidelity Ethereum Fund, WisdomTree Ethereum Trust, and BlackRock’s iShares Ethereum Trust, will reach their final decision dates by mid-year, and these financial giants will strive to attract investors to this more appetizing Ether narrative.

Under these conditions, Ether, with a market value smaller than Bitcoin’s, is expected to gain value much more rapidly and may even reach five-figure sums.

Türkçe

Türkçe Español

Español