On July 23, Spot Ethereum ETFs made a remarkable debut, marking a significant milestone in the cryptocurrency market. These ETFs, led by BlackRock’s ETHA, saw an impressive inflow of $107 million. Bitwise Asset Management’s Chief Investment Officer Matt Hougan expressed optimism about the future of crypto ETFs, predicting that other cryptocurrencies, including Solana, could soon see their own ETFs in the market.

Ethereum ETFs Could Pave the Way for Solana

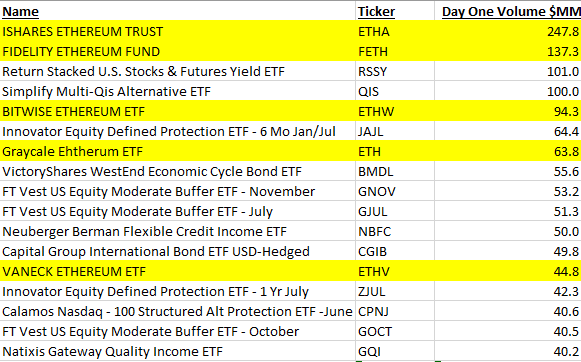

Hougan highlighted the success of Ethereum ETFs, including Bitwise’s own ETH ETF (ETHW), which saw over $200 million in inflows on its first day. He noted that the trading volume for these new ETFs reached nearly half a billion dollars, contrasting with the average ETF that typically sees about a million dollars in trading on launch day. This extraordinary trading volume places Ethereum ETFs among the most successful ETF launches in history, following Bitcoin ETFs.

The approval and successful launch of these Ethereum ETFs have significant implications for the broader crypto market. Hougan suggested that this marks the beginning of a new era for crypto investment, predicting that multiple crypto-based ETFs will become widespread by 2025.

He emphasized that applications for Solana ETFs by VanEck and 21Shares are already in place, indicating growing interest in expanding the ETF market to include other altcoins.

Comments on Ethereum ETFs

Experts in the field also weighed in on the success of Ethereum ETFs. Bloomberg analyst Eric Balchunas noted that ETHA ranked first in first-day volume among all new launches last year, excluding Bitcoin ETFs. VanEck’s Head of Crypto Asset Research Matthew Sigel highlighted the excellent performance of Ethereum ETFs, emphasizing their strong trading volumes.

Hougan predicted that institutional investors would play a more significant role in inflows to Bitcoin and Ethereum ETFs. Currently, institutional investors account for 5-6% of Bitcoin ETF inflows, but Hougan expects this percentage to rise to 50%.

Blockchain Capital’s General Partner Spencer Bogart estimated that Ethereum ETFs could see over $10 billion in inflows within the first 12 months. Bitwise Research Director Ryan Rasmussen predicted that the price of ETH could reach an all-time high of between $6,500 and $7,500.

Türkçe

Türkçe Español

Español