The short-term surge experienced on Tuesday increased excitement among investors, suggesting that cryptocurrencies are ready to continue their upward trend. However, a 2.6% drop in the Ethereum (ETH) price over the last 24 hours could diminish hopes for a sudden return to all-time highs.

Critical Level in Ethereum

Ethereum‘s price rose to $4,091 before settling at $3,430. A 38% decrease in 24-hour trading volume to $19 billion could signify waning interest among investors. Another 3% correction in market value reflects a growing downward trend. The price drops over the weekend and earlier this week led to losses for many investors. As Ethereum tests the $3,050 support level from its recent peak, liquidations occurred in the millions.

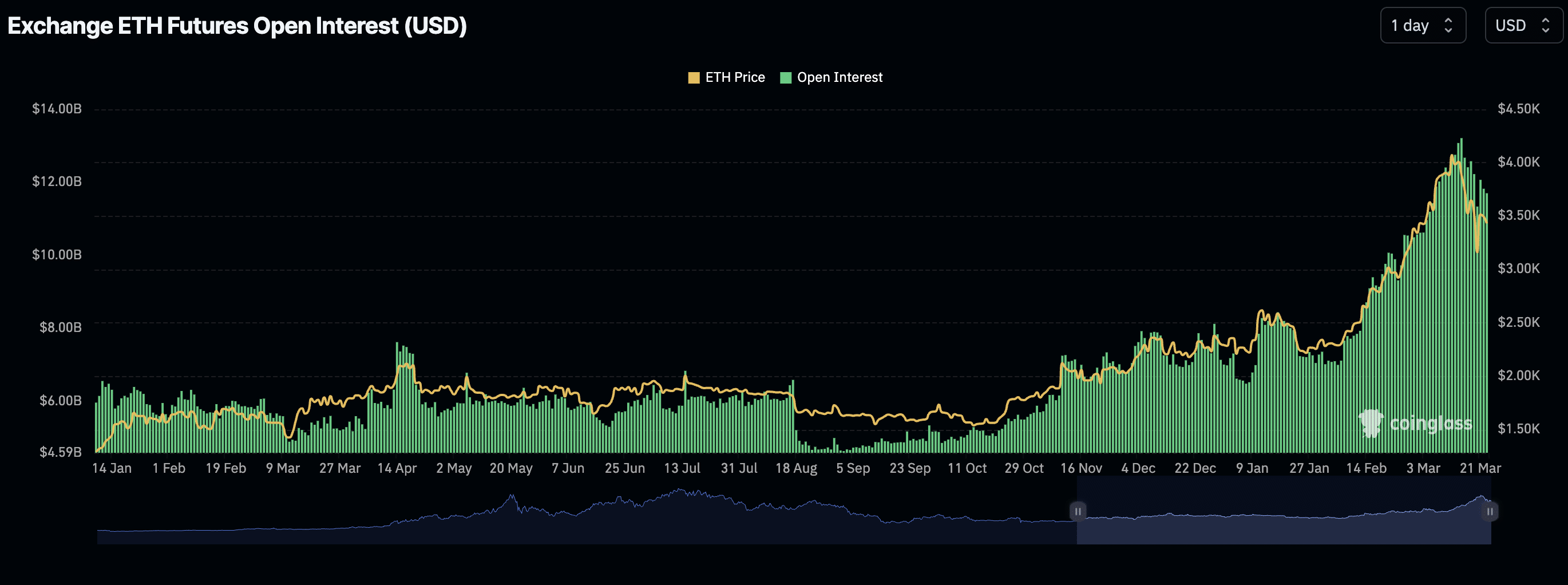

According to Coinglass data, the derivatives market also experienced a slight loss, dropping from a new record high of $13 billion in March to $11.34 billion by the end of the month. Although it showed a notable recovery reaching $11.7 billion, further corrections at the current position cannot be ignored. The decrease in open positions in the derivatives markets indicates reduced trader activity. This could reflect a decrease in liquidity, waning market confidence, and potential changes in market trends.

ETH’s TVL

According to DefiLlama, the decentralized finance (DeFi) Total Value Locked (TVL) metric, which tracks assets in the ecosystem’s smart contracts, fell from its recent high of $57.59 billion to $50.63 billion. As DeFi TVL shrinks, it tends to increase selling pressure. This could mean investors are withdrawing their tokens from staking contracts, leading to further price declines.

Moreover, the token’s future sentiment could be used as an indicator. The recovery seen last week reached $3,640. Due to a lack of momentum, a correction was promptly made. Investors may need more convincing that Ethereum will rise above $4,000 and then to $5,000. Meanwhile, the 38.2% Fibonacci level stands as support, and a bounce from this level for ETH is expected. The Moving Average Convergence Divergence (MACD) indicator is starting to show signs of retreating to the neutral zone despite the uptrend, which could eventually encourage investors to short ETH.

Türkçe

Türkçe Español

Español