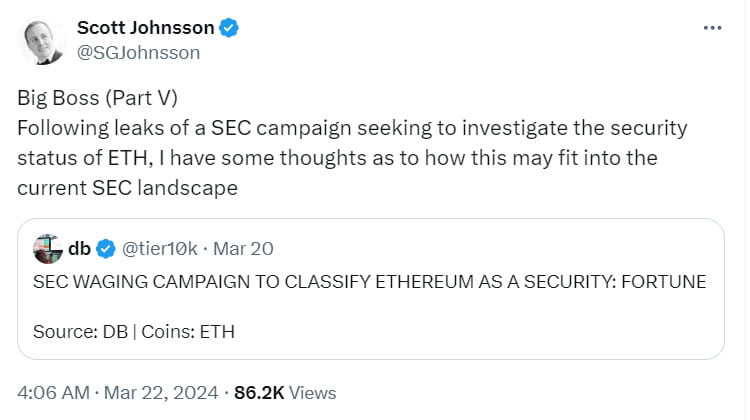

According to a crypto lawyer, the reported investigation into Ethereum and its foundation could be a way for the securities regulator to comfortably reject Ethereum ETF applications and satisfy senators without undermining ongoing cases. On March 22, Scott Johnsson, a partner at Van Buren Capital and a finance lawyer, shared his views on why the SEC might have initiated an investigation into Ethereum and the Ethereum Foundation.

Prominent Figure Makes Noteworthy ETH Comments

Johnsson suggests one theory is that the SEC is using the investigation to appease crypto skeptics demanding a tougher stance from the agency. Earlier this month, Democratic senators Jack Reed and Laphonza Butler called on SEC Chairman Gary Gensler to refrain from approving more spot crypto ETFs. Senator Elizabeth Warren also vocally expressed her disapproval of these investment products.

Another theory gaining interest recently is that the SEC might be using the investigation as a way to reject spot Ethereum exchange-traded funds because a non-correlated objection might not be valid. Johnsson shared his thoughts on the matter:

“The SEC needs a non-correlated objection to reject Ethereum spot ETF applications this year.”

SEC’s Attitude Towards Ethereum

The crypto lawyer explains that rejecting spot Ethereum ETF funds based solely on correlation analysis could be a temporary fix, as correlation levels improve over time. Correlation defines the difference between spot market prices and futures prices and has been a significant argument for the SEC when approving or rejecting crypto ETP funds.

However, earlier this month, ETF analyst Eric Balchunas said that the correlations between futures and spot are not that strong, and he added that he was not so optimistic about Bitcoin ETF funds. Johnsson believes the investigation will also help the SEC reject spot Ethereum ETF applications while avoiding undermining its legal arguments against Coinbase and Binance.

In June 2023, the SEC accused Binance and Coinbase of offering unregistered securities under the guise of 19 tokens. However, Ethereum was not among these assets. In an interview with Bloomberg TV earlier this month, SEC Chairman Gary Gensler was directly asked about Ethereum’s status as a security, to which he responded with his usual ambiguity without answering the question.

Ultimately, it is suggested that the SEC might opt for a softer approach by claiming an ongoing investigation into Ethereum’s security status instead of implementing definitive sanctions.

Türkçe

Türkçe Español

Español