Following the application of the world’s largest asset management company, BlackRock, to the US Securities and Exchange Commission (SEC) last week to launch a spot ETF, the price of the altcoin king <a href="https://en.coin-turk.com/ethereums-realized-market-value-reaches-highest-level-in-8-months/”>Ethereum (ETH) rose to $2,100. However, facing some selling pressure after this peak, ETH is currently trading around $2,000.

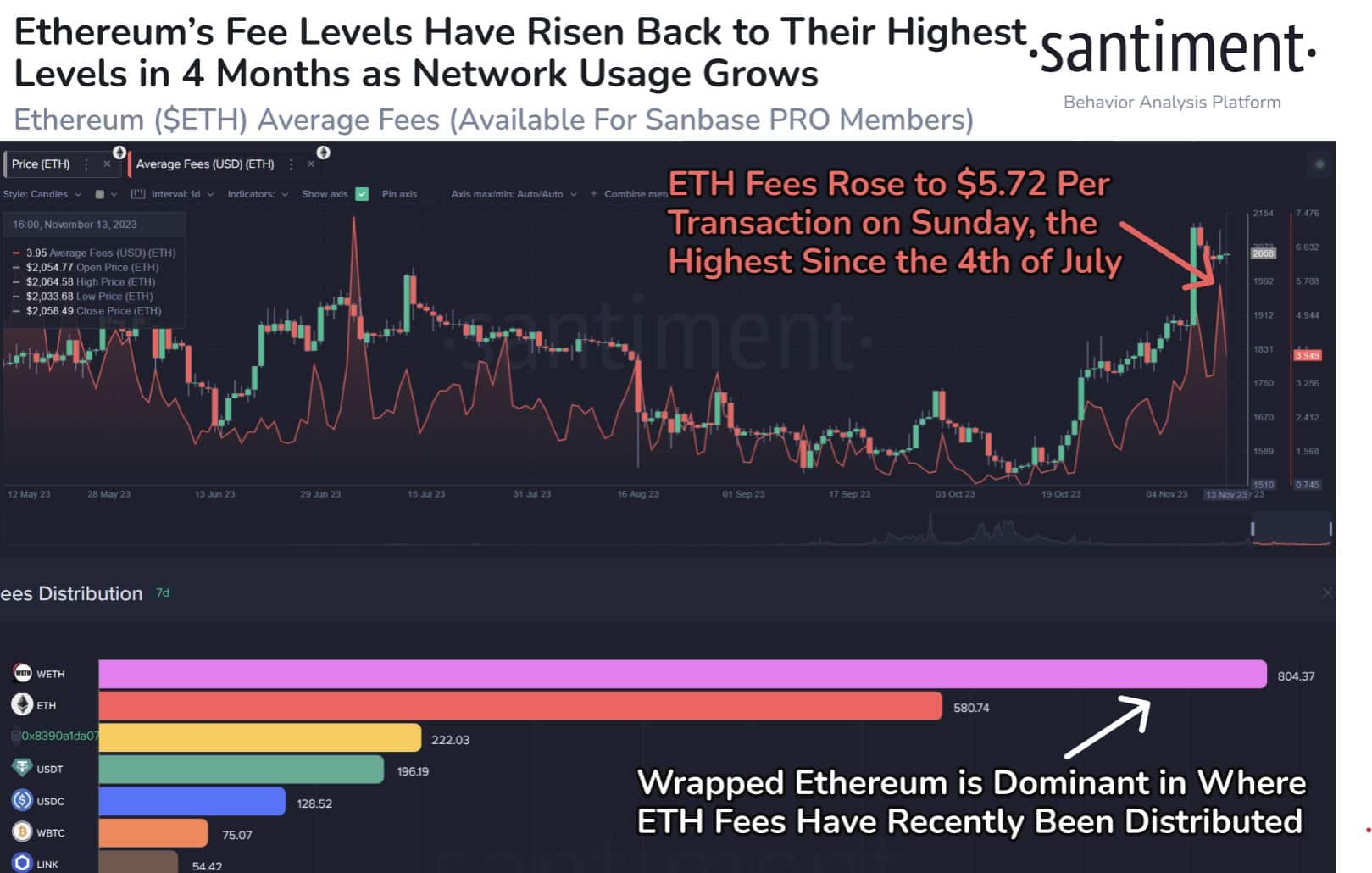

Ethereum Network Transaction Fees at the Highest Level in 4 Months

This week, transaction fees on the Ethereum network reached the highest levels not seen since July, reaching up to $5.72 per transaction. According to on-chain data provided by Santiment, the increase in transaction fees was not surprising, considering the rise in Ethereum’s price above $2,000 and the increase in network activity.

However, it should be noted that the current transaction fees are still at relatively lower levels compared to the peak of $14 seen in May.

ETH Price and Option Data

The chart of Ethereum shows a temporary pause in the market following the recent price increase, indicating a consolidation phase that is considered healthy for creating new support levels. Ethereum’s price remaining above both the 50-day and 100-day moving averages signals an overall upward trend. Additionally, the Relative Strength Index (RSI) on the daily timeframe has pulled back from overbought levels, potentially creating room for a new upward price movement.

Continued support above both the 50-day and 100-day moving averages for Ethereum’s price could potentially lead to another rally supported by increased adoption and positive market sentiment. Furthermore, a breakout above the upper band of the Bollinger Bands after a contraction could indicate the beginning of another upward phase.

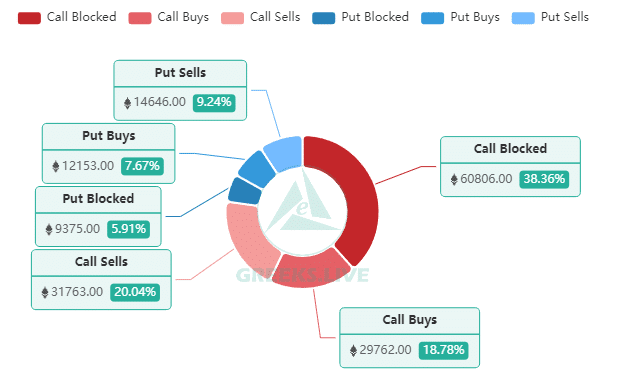

Furthermore, recent trading data shows a significant increase in block transactions for Ethereum. Opening 60,000 options accounted for 40% of the total volume of the day, reaching a nominal value of $120 million. One notable recent transaction was the closing of an approximately $50 million long position by a previous market maker.

During the ongoing bull market, large Ethereum whales have made significant profits by opening long positions in October. These major players continue to hold their positions, expecting further gains in a bullish market environment.

Türkçe

Türkçe Español

Español