After witnessing a significant rise last week, the price of Ethereum (ETH) has begun to stabilize around $3,500. Due to this stagnation, many shareholders decided to realize their profits. According to the latest data, the first ETH holder exchanged 17,770 ETH at a rate of $3,503 for 62.24 million DAI.

Whale Sales in ETH

The mentioned investor collected approximately 14,280 ETH worth around $2.6 million at an average price of only $182, covering purchases made from March 2017 to April 2021 from Gemini and Bittrex. With a profit reaching 23 times their initial investment, the gain amounts to $59 million. This whale’s sale of 17,770 ETH is providing a significant influx of money into the market.

This situation is particularly noteworthy as there are enough buyers to absorb all the sold ETH. It could also exert a downward pressure on the price in the short term. However, the overall impact may depend on market sentiment. If the sale triggers a panic sell-off, the price could fall further. If the market sees this as a healthy correction or if the whale is simply taking profits, others may see it as a buying opportunity, and the price could stabilize and potentially recover, according to experts.

Factors Influencing ETH’s Rise

At the time of writing, ETH is trading at $3,571.59, which is 27% below its all-time high. The ETH price had tested the $3,674.23 level twice in the past few weeks. If ETH manages to break through this level, it could end the downtrend observed since the drop from $4,081.55. ETH could likely head towards the $4,081.55 resistance once again.

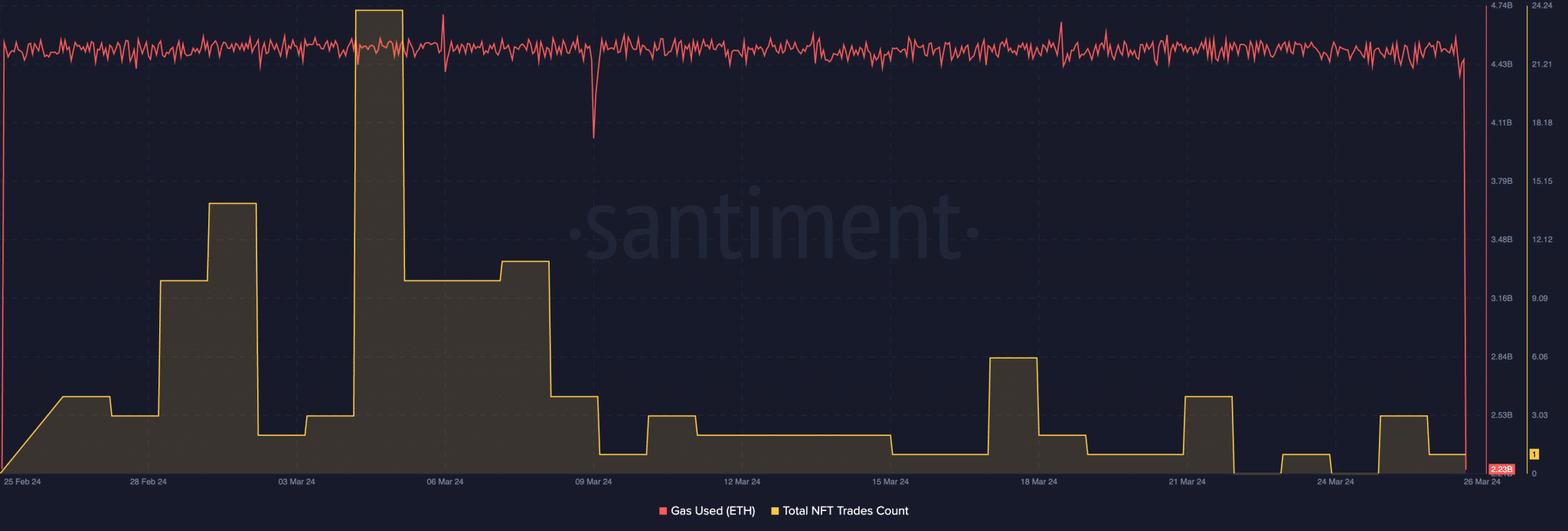

However, the token’s CMF (Chaikin Money Flow) has shown a decline over the past few days. This could indicate a decrease in money flow towards ETH. It suggests that ETH’s price might see a period of sideways or downward movement before starting to recover. The popularity of the Ethereum ecosystem could positively contribute to ETH in the future. The gas usage on the Ethereum network remained consistent over the past month, indicating a highly active ecosystem. However, the overall number of NFTs traded on the network has significantly decreased in the last few days. This could indicate a decline in interest in NFTs within the Ethereum ecosystem and potentially harm long-term network activity.