Ethereum (ETH) is hovering around $3,800 at the time of writing. Bitcoin has been fluctuating between the $66,800 support and the $70,000 threshold for a few days. There are news-driven fluctuations. Besides, June seems to be more favorable for Ethereum compared to many other cryptocurrencies.

June Ethereum Predictions

It’s important not to be too confident because exactly one year ago, the first week of June seemed like a calm week ahead. On the macroeconomic front, everything was calm, there were no significant developments concerning cryptocurrencies, and it felt like a holiday week. However, while everyone was asleep, the SEC was not, and at the beginning of June 2023, they filed consecutive lawsuits against Coinbase and Binance exchanges. Those were exciting days.

If history does not repeat itself, considering the SEC’s potential softening before the November elections, we might not experience such a surprising scenario this time. In fact, there are three details supporting predictions that ETH could have a good period against BTC.

Technical Analysis

From a technical perspective, the ETH/BTC weekly chart looks quite promising. If the pair can sustain its closures above the 0.051BTC level, ETH is likely to achieve significant gains against BTC. Another analyst, Plazma, stated:

“The value of ETH is absurdly low. I am waiting for the day when 10 ETH equals 1 BTC.”

On-Chain

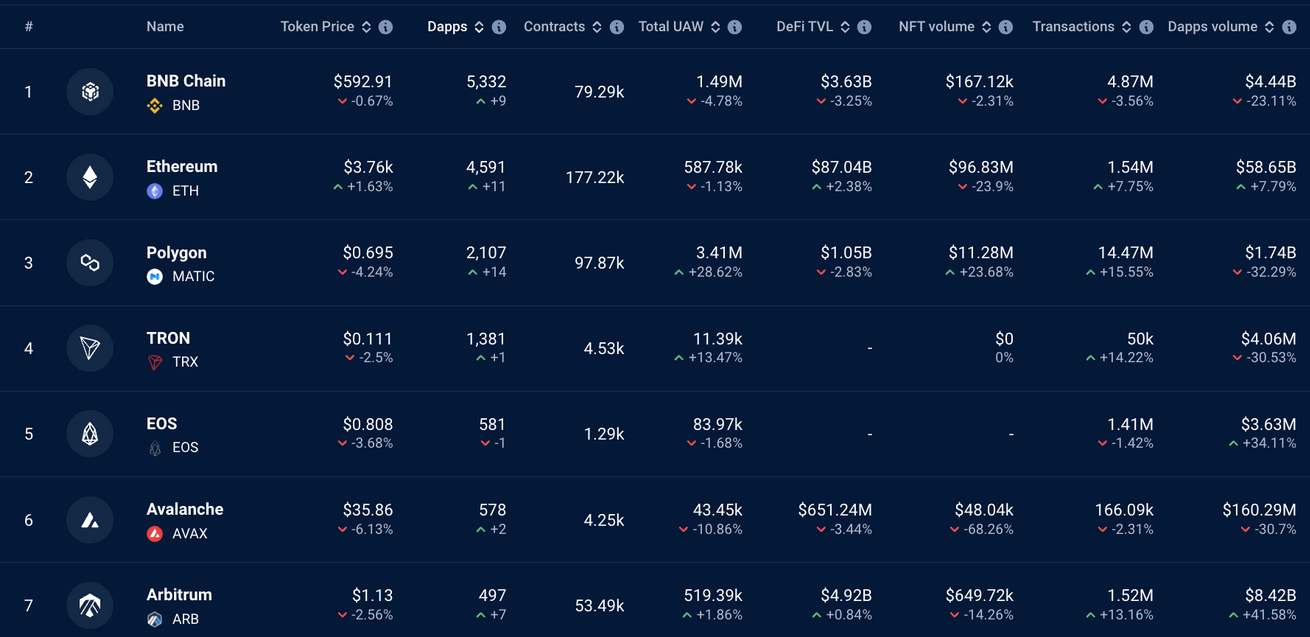

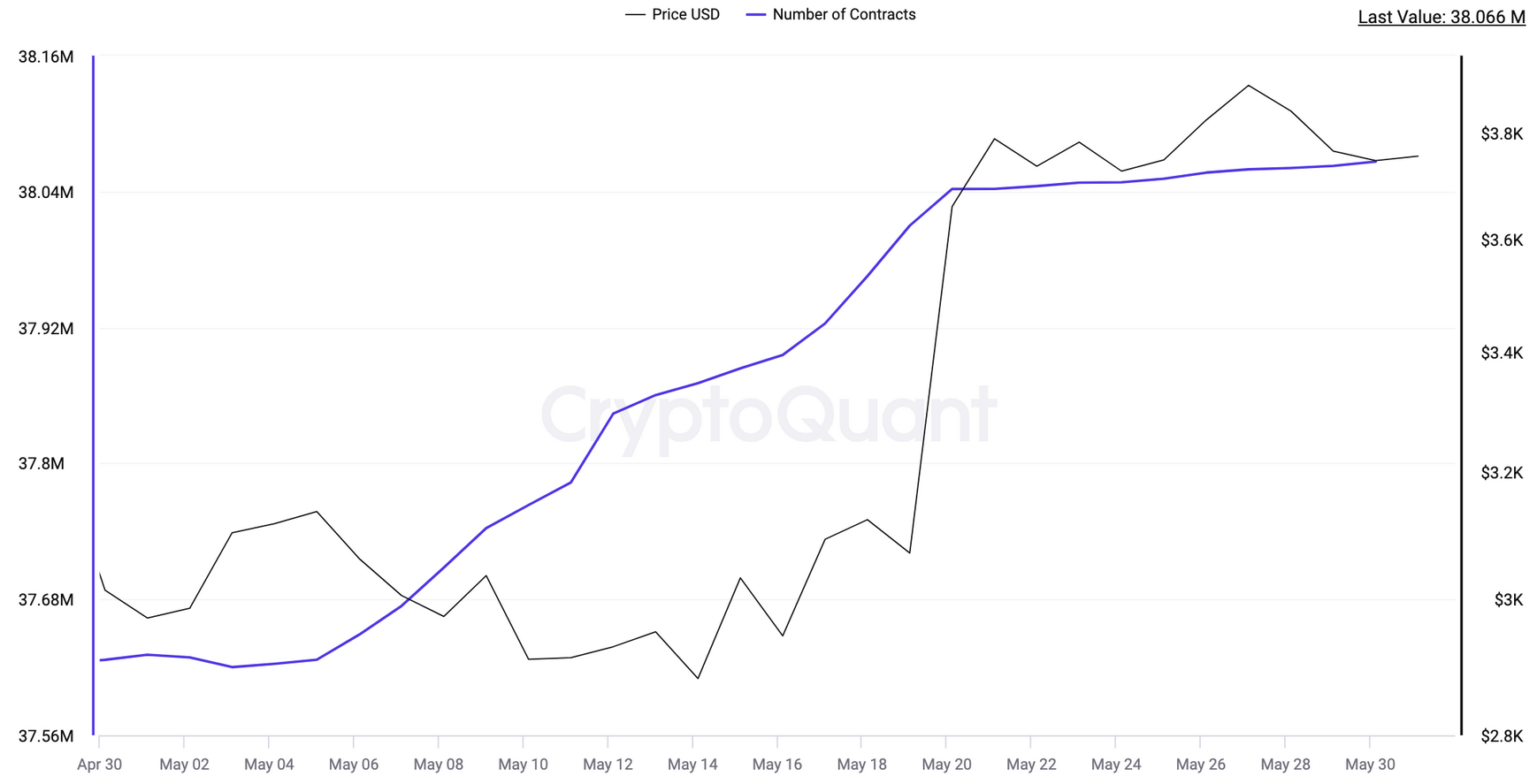

Data from DappRadar indicates a 7.75% increase in transaction volume of applications on the network last week. This is supported by data provided by CryptoQuant. According to CryptoQuant, the number of unique smart contracts on Ethereum jumped to 38,066.

The growth in network activity reflects more demand and interest for Ethereum. This is positive for the ETH price.

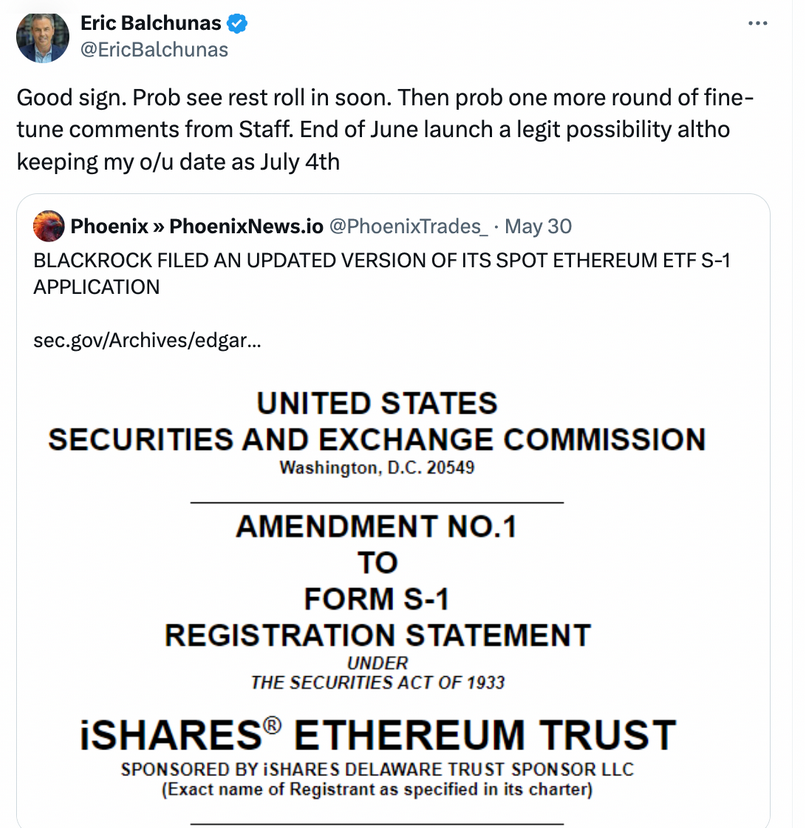

Spot ETH ETF

According to a recent comment by Bloomberg senior ETF analyst Eric Balchunas, BlackRock has now updated the S-1 form for the iShares Ethereum Trust (ETHA) following last week’s approval. This indicates that ETH ETFs will be officially listed on exchanges within June, and this is even a legal obligation. For now, the most reasonable optimistic date seems to be Monday, June 10. Trading and management fees have not yet been determined.

Market participants believe that spot Ether ETFs will be a major trigger for new price peaks for ETH.

Türkçe

Türkçe Español

Español