Altcoin king Ethereum (ETH) is showing signs of potential recovery based on the support of altcoin whales after a week-long downturn. However, recent on-chain data presents a conflicting trend. According to this, significant amounts of ETH have been moving in and out of the Coinbase exchange in the last 24 hours, leading to potential concerns about selling.

Millions of Dollars in ETH Moved Between Coinbase and Wallets

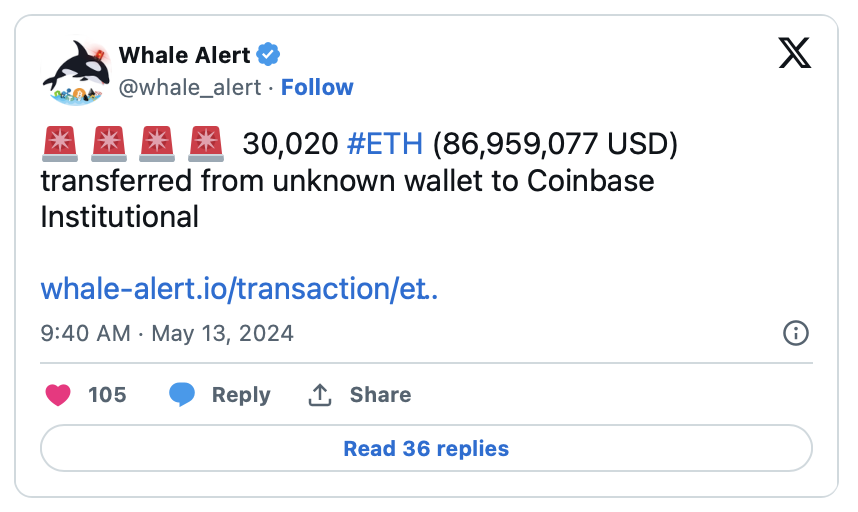

According to data from the cryptocurrency data platform Whale Alert, which tracks major movements on blockchains, high amounts of ETH were transferred to and from Coinbase in various transactions, causing potential sale-related fears among observers. The largest of these transactions involved the transfer of approximately 86 million 959 thousand 77 dollars worth of 30,020 ETH from an anonymous wallet address to Coinbase Institutional. The reasons behind these transfers are not fully known, but the size of the movement indicates it could be a significant market activity.

Another notable transfer involved moving 7,701 ETH in two separate transactions and transferring 7,882 ETH from Coinbase Institutional to anonymous wallet addresses. While the immediate impact of these transfers on the price of the altcoin king remains unclear, ETH has not yet surpassed the critical $3,000 level, indicating ongoing market uncertainty.

According to data from the crypto data and price platform CoinMarketCap, ETH is currently trading at $2,977 and has seen a modest increase of 2.20% in the last 24 hours. However, the inability to breach the $3,000 level shows that there is a persistent caution among investors within the current market dynamics.

Eyes on the SEC’s Decision on Spot Ethereum ETF

This month, Ethereum faces a significant moment in the US with the SEC’s decision on the spot Ethereum ETF. Bloomberg analysts estimate the probability of this product being approved at 25%, contributing to the uncertainty surrounding ETH’s price trajectory. As a result, investors are cautious, limiting any potential risks associated with a negative outcome of the ETF approval, which in turn restricts upward price movements.

The cautious approach of Ethereum investors explains why the altcoin has struggled to surpass the $3,000 threshold since May 10. The market remains sensitive to regulatory developments and potential events that could stimulate the market, highlighting the importance of monitoring fundamental indicators and investor sentiment in the short term.

Türkçe

Türkçe Español

Español