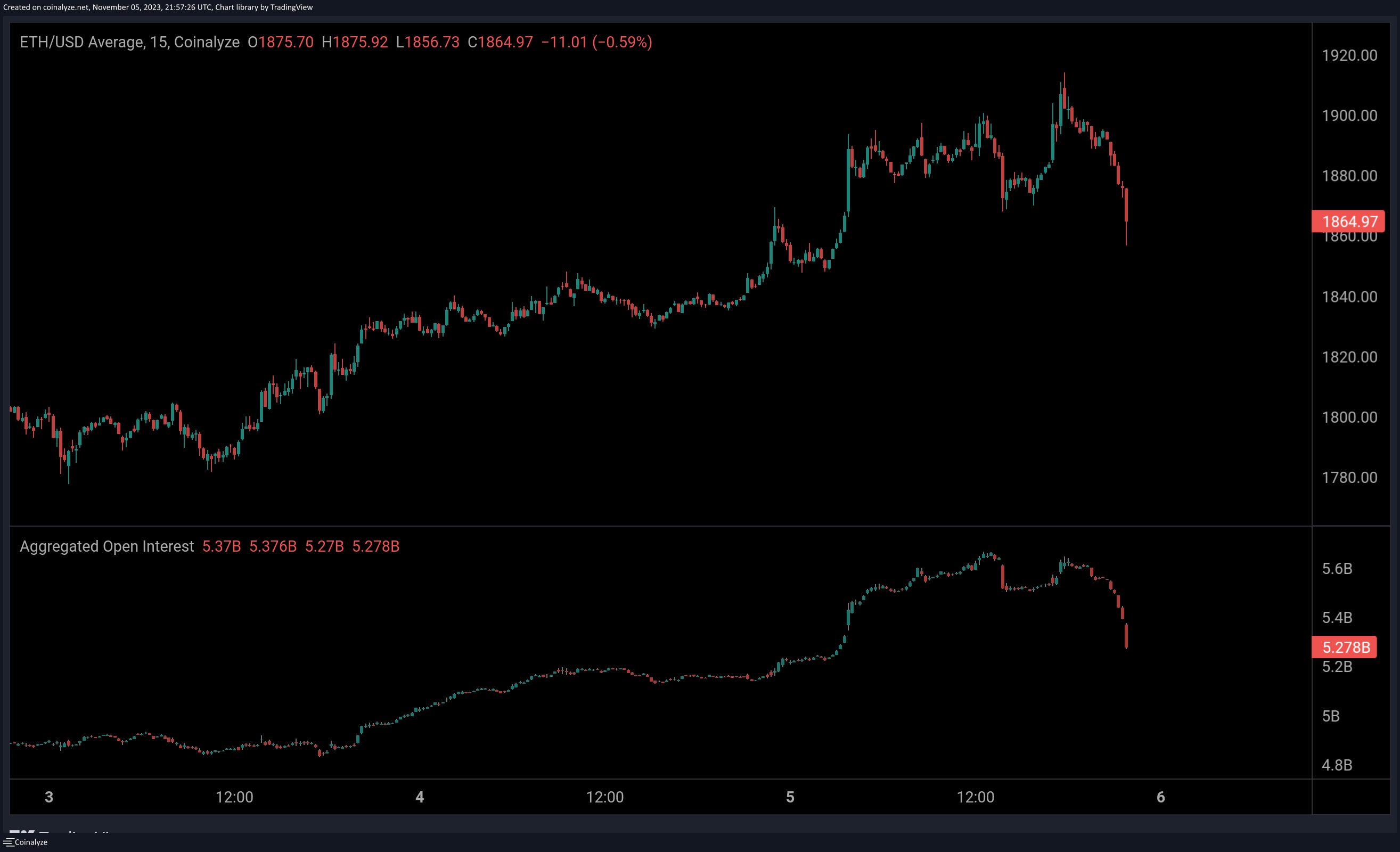

The price of the altcoin king Ethereum has surged over 16% in the past month, surpassing $1900 for the first time since August. This comes as Bitcoin takes a breather around $35,000 and altcoins start to move. While market sentiment remains positive, Ethereum’s price came under pressure after millions of dollars’ worth of Open Interest (OI) was wiped out following a significant increase last week.

$400 Million Worth of Open Interest Vanishes in Ethereum

On the weekend, on-chain crypto analyst Maartunn stated, “Ethereum caught my attention. Open Interest (OI) has increased by over $600 million in recent days. Volatility will increase very soon.” Investors are expecting Ethereum to reach $2,000 as Bitcoin remains strong around $35,000.

In today’s ETH analysis following the weekend, Maartunn highlighted that $400 million worth of OI was wiped out in a single day, erasing all the gains in OI over the past few days. As a result, Ethereum’s price likely remained under pressure for a retracement or correction. The probability of a correction is low due to positive market sentiment, but the likelihood of a pullback is high.

For those unfamiliar, OI is a term commonly used in futures and options markets. OI represents the open positions of one party in a futures contract (positions that have not been closed yet). Open positions indicate how much commitment an investor has made to a particular contract or the direction of their position.

ETH Price Analysis

Meanwhile, whales are withdrawing ETH from cryptocurrency exchanges amidst the overall recovery in altcoins. While this move by whales is generally considered a sign of an upward trend, the trading volume needs to be closely monitored to ensure there is no correction.

The daily chart of ETH currently shows the price moving within a descending channel formation, indicating a potential 16% drop if the formation plays out. Indeed, the high volatility observed around the $1830 level proves it to be a strong resistance level.

Experienced crypto analyst Credible Crypto stated that the price chart of ETH is extremely clean and the $1400 – $1500 range is a buying zone on higher timeframes, meaning it is a support zone or a bottom area. The analyst believes that unless there is a major development, the price of the altcoin king will not drop below $1500 again. Additionally, it is predicted that before reaching $2000, Ethereum will first test $1700.

According to the latest data, ETH has risen by 0.63% in the past 24 hours and is currently trading at $1899. The lowest and highest prices in the past 24 hours were $1863 and $1911, respectively. Furthermore, the trading volume has increased by 42% in the past 24 hours.

Türkçe

Türkçe Español

Español