Ethereum price has increased by 58% over the last 30 days, outperforming the general crypto market by 14%. Despite not being able to sustain levels above $4,000, Ethereum has reached its highest price in over two years, closing the gap with the leading cryptocurrency Bitcoin during this period.

Notable Data for Ethereum

Some investors argue that Ethereum’s bull run is solely dependent on the decision regarding a spot Ethereum exchange-traded fund, which could create a potential sell-the-news scenario if fully priced in the first weeks. The final decision by the U.S. Securities and Exchange Commission is expected by May 23, with Bloomberg analysts indicating a 35% probability of approval.

Other factors contributing to the recent price increases include the planned Dench network upgrade on March 13. The hard fork process is expected to significantly reduce transaction fees with Ethereum’s scaling solutions, addressing a long-standing issue. Notably, the 7-day average Ethereum transaction fee has been above $4 since November 2023.

Ethereum investors enjoy a 4% yield when participating in the network’s proof-of-stake contracts, but demand for Ethereum largely depends on the ecosystem’s activity. Growth in the Ethereum ecosystem, regardless of Layer-2 ecosystems, is beneficial for Ethereum’s price as it is used as collateral in some decentralized applications and is necessary for validating and processing transactions on the base layer.

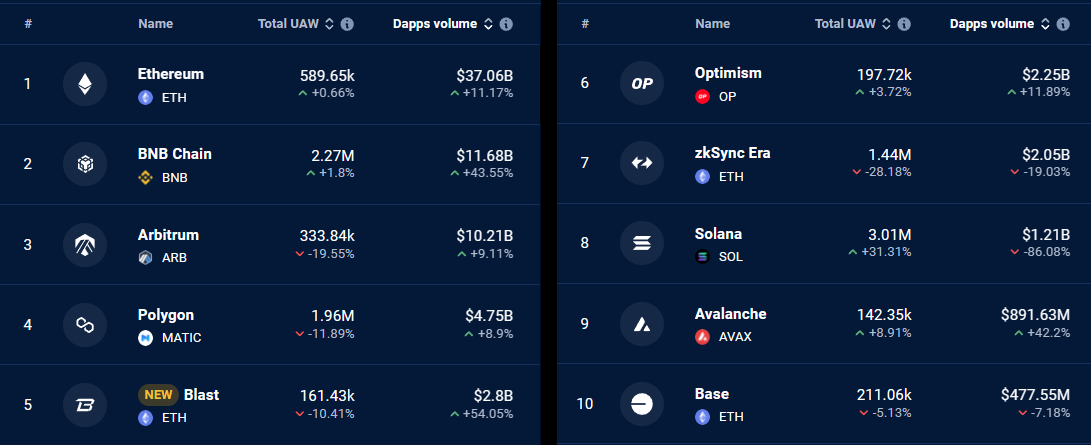

Recent data leaves little doubt about Ethereum network’s dominance, especially when including Layer-2 solutions. Moreover, even during periods when transaction fees were $20 or higher, the Ethereum mainnet gathered around 590,000 active addresses and volumes continue to rise. However, it is necessary to have a more detailed view to understand whether growth is limited to a handful of projects due to airdrop events or other factors that may have temporarily increased demand.

Ethereum and the Futures Market

Professional investors need to analyze Ethereum futures to assess whether they doubt Ethereum’s ability to turn $4,000 into support. Monthly futures contracts in the markets must trade at a 5% to 10% premium over normal spot markets to account for extended settlement periods.

The annualized futures premium for Ethereum, often referred to as the base rate, reached an 18-month high on March 11. Levels above 25 typically indicate excessive optimism, but it does not necessarily mean an imminent risk as investors may look for alternative funding methods when opportunities arise.

Similarly, high premiums attract arbitrage investors who may short futures while simultaneously buying spot Ethereum, balancing the equation in the medium term. Consequently, no matter how bullish investors may be, the longer Ethereum stays above $4,000 with high futures premiums, the greater the risk of a sell-off.

Türkçe

Türkçe Español

Español