While the price of Bitcoin continues to rise along with altcoins, the largest altcoin by market value is showing very few signs of life. What is frustrating is that Ethereum is in this situation despite negative inflation, the transition to PoS, and its massive ecosystem. Moreover, it is not possible for the BTC price to keep rising in a way that supports it continuously.

Is Ethereum (ETH) Dead?

The price of ETH has only increased by 45 percent since October. This is the case even though giants like Fidelity and BlackRock have applied for spot ETH ETFs. Many potential issuers will strive to get ETH ETF approvals after successfully obtaining BTC ETF approvals, and the groundwork for this has already been laid. However, the ETH price seems to be indifferent to all this.

While Ethereum’s rival Solana has shown an increase of over 310% in two months, the ETH/BTC trading pair is at its lowest level in 18 months. In other words, the ETH price is at the bottom of 18 months against BTC, and the 45% rise in dollar parity doesn’t mean much yet.

What’s worse, the ETH/BTC parity is testing the support of the neckline. If there is a break here, much larger losses would not be surprising. Of course, this does not mean that Ethereum is dead, but it does not change the fact that it is showing weak signs of life.

The Future of Ethereum

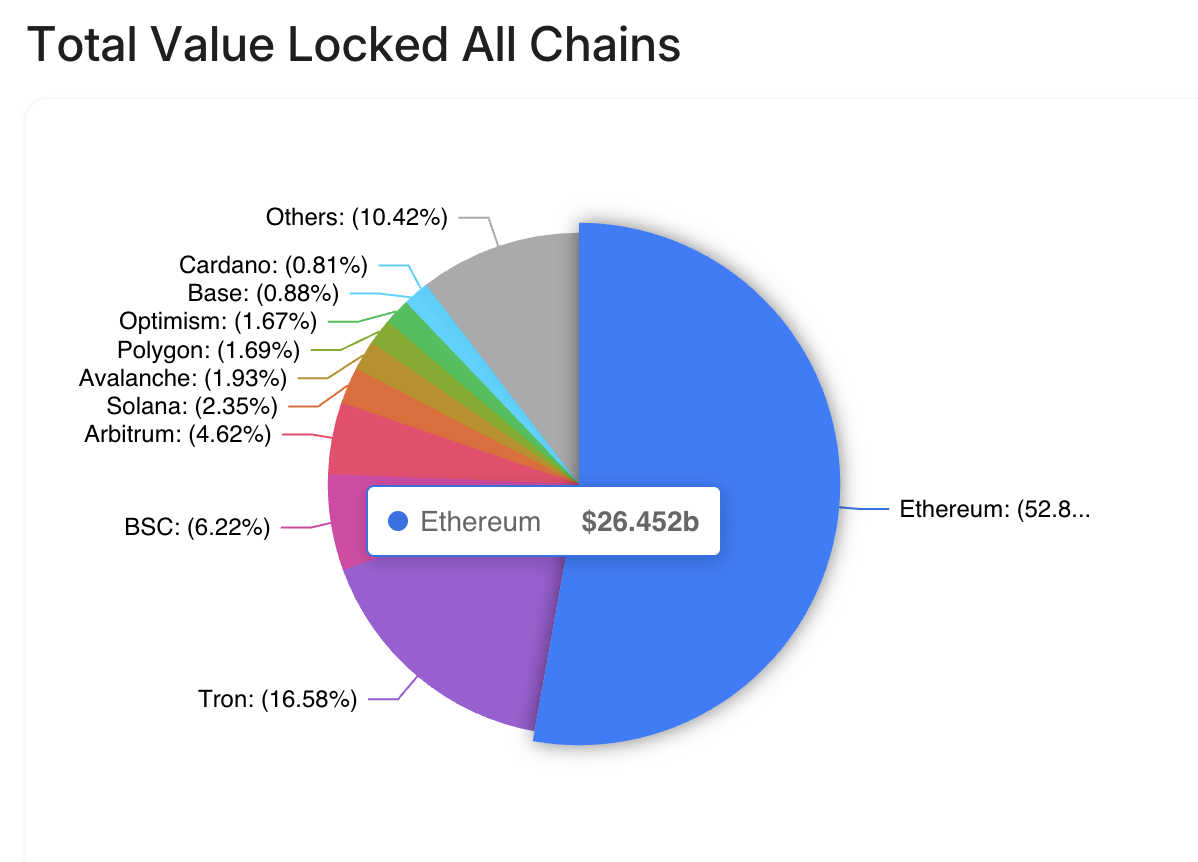

Despite being criticized for its price, Ethereum’s solid network fundamentals and massive ecosystem could keep it standing for a long time. With a TVL exceeding $26.45 billion, Ethereum has almost 26 times the network value of Solana, which has outperformed it in terms of price performance. The total value of locked assets in the network is referred to as TVL.

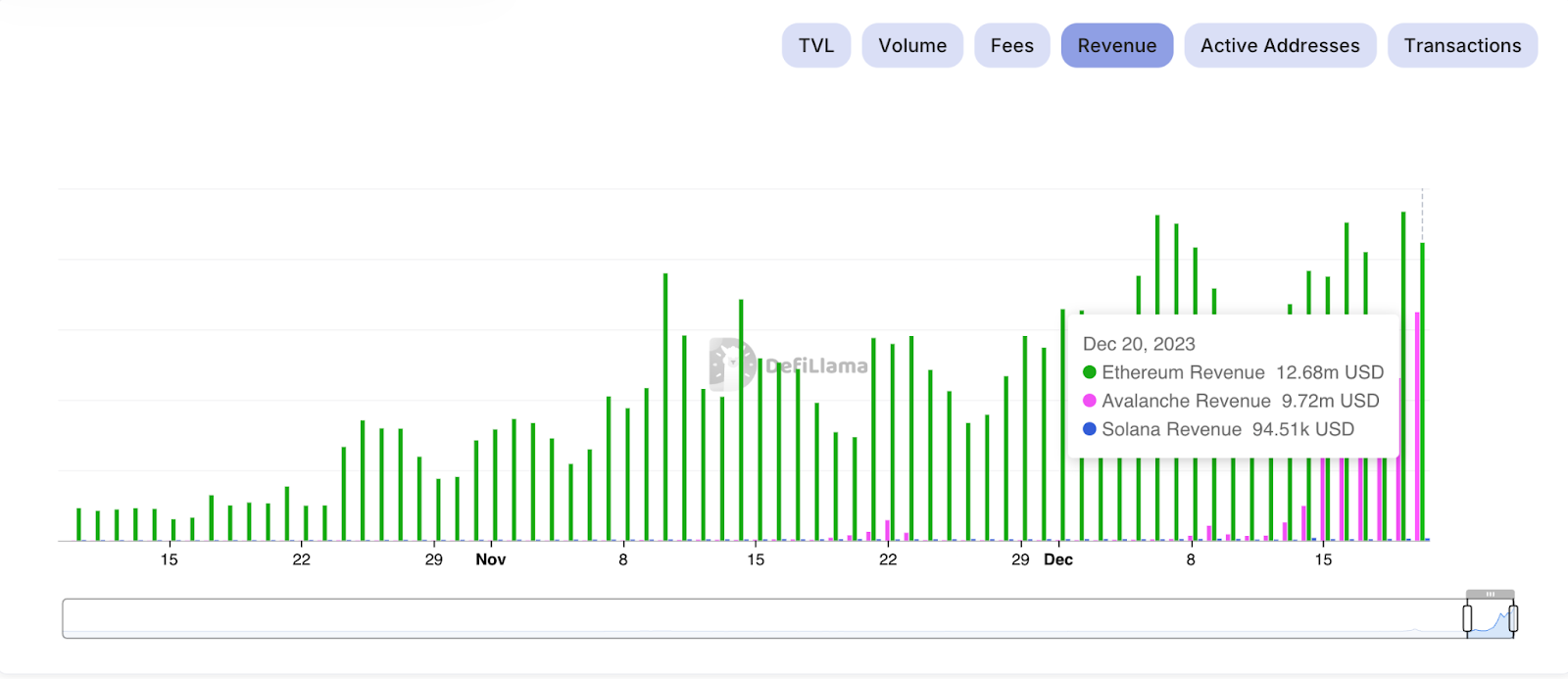

In addition, the screenshot below shows that Ethereum has more revenue than both Avalanche and Solana combined. It is the only profitable network when compared to its competitors, with nearly $3 billion in annual earnings. Moreover, increasing transaction fees and heavy transactions also increase the amount of burned tokens, which will be a strong price catalyst in the long term due to supply scarcity.

Due to various fundamental factors, Ethereum is not even at the beginning of a bull run, and interest may shift here after the BTC ETF approval, making it the most sought-after asset. Of course, it is impossible to see the future, and technically, when Ethereum dies one day, no one can say it was impossible.

Türkçe

Türkçe Español

Español