With only 12 days left until the fourth Bitcoin halving, the cryptocurrency community is once again in an excited state of anticipation. Speculations are flying about Bitcoin‘s potential to surpass the $100,000 threshold, while Joe Consorti from Theya Research’s comprehensive analysis further ignites this excitement and expectations.

Excitement Peaks 12 Days Before Bitcoin Halving

This event, which occurs every four years for Bitcoin, is known for halving the new block mining rewards and historically triggers a significant rise in momentum. The current scenario seems to be in line with the trends we’ve seen in the past.

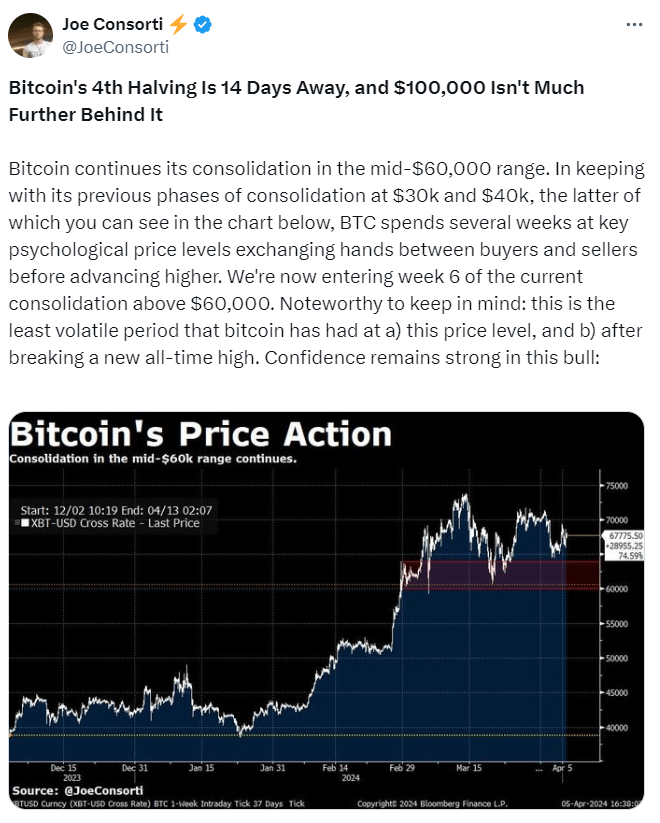

Consorti’s analysis, titled “Bitcoin’s 4th Halving is 12 Days Away and $100,000 Isn’t Far Behind,” begins by focusing on the ongoing consolidation phase of Bitcoin. According to Consorti, this phase marks a critical period before a potential bull run. He explains:

“Bitcoin continues its consolidation. In line with previous consolidation stages at $30,000 and $40,000, BTC spends several weeks at key psychological price levels where buyers and sellers exchange hands before a rise.”

Bitcoin Spends Time at Price Milestones

As Consorti points out, Bitcoin’s consolidation above $60,000 is entering its sixth week. The stability at this price level is creating strong market confidence, potentially leading to new all-time highs.

However, the analysis does not only focus on Bitcoin’s own dynamics; it also takes into account broader market dynamics. In particular, it highlights breaks in correlation in the current cycle.

According to Consorti, markets are influenced by factors such as businesses extending their debt maturities with still-low interest rates in 2021 and the US Treasury’s massive fiscal deficit at crisis levels. This is causing traditional economic indicators to diverge from stock market performance and inadvertently benefiting asset prices like Bitcoin.

The Role of ETFs and the Spot Market

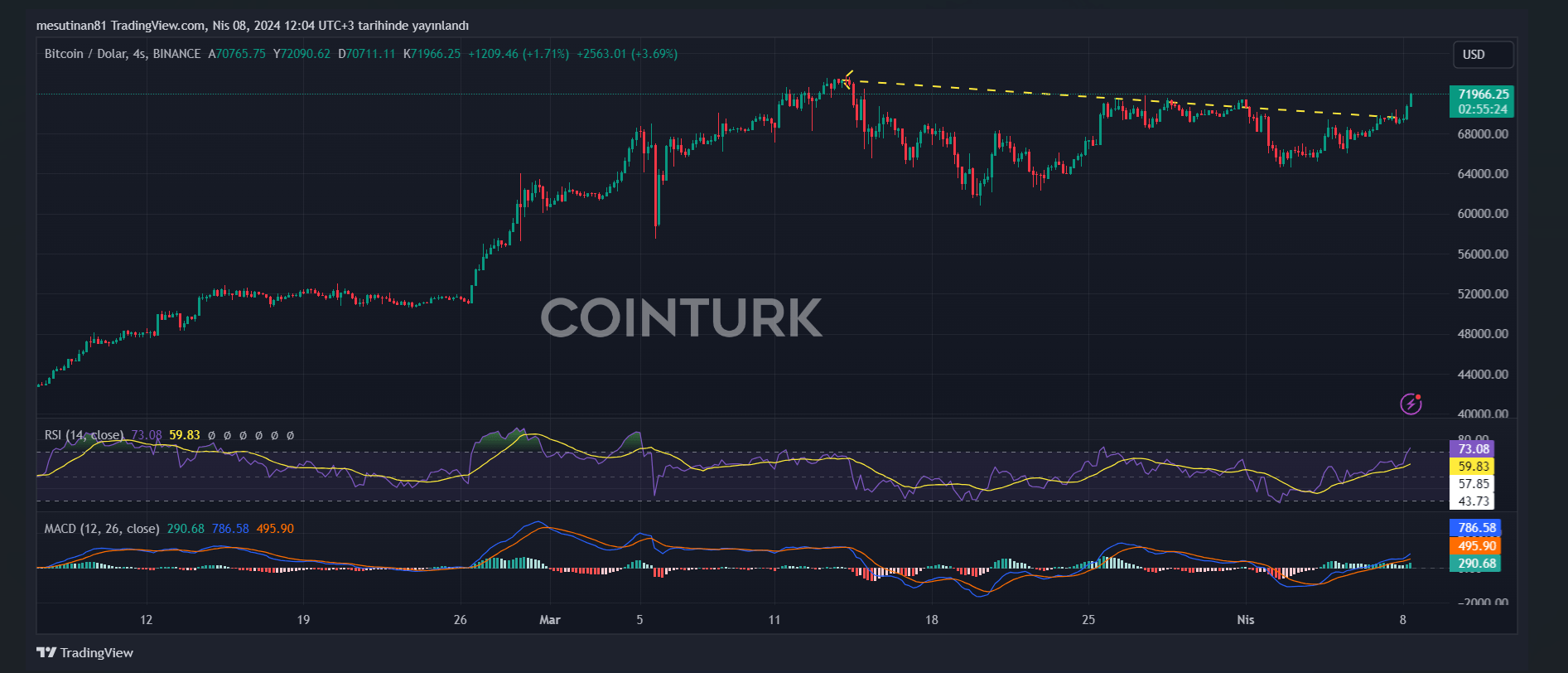

According to Consorti, the behaviors of Bitcoin ETFs and their interactions with the spot market play a significant role in the market. His analysis suggests that the slowdown in net inflows to Bitcoin ETFs indicates a healthy market structure, and strong volume supports this view.

Active trading of ETF shares and the observed consolidation in the spot market indicate a healthy market movement. Analysts state that this situation creates a stable foundation for the Bitcoin price and sets a positive stage for the upcoming bull run. Consorti comments at this point:

“During this consolidation period, the spot market has really taken control of Bitcoin price movements. This will mean a more stable foundation for the upcoming bull run and increases my confidence that this consolidation is coming before a move to higher levels rather than lower ones.”

As of writing this article, the Bitcoin price has surpassed $72,000.

Türkçe

Türkçe Español

Español