Bitcoin’s (BTC) halving process is expected to be completed in April 2024. However, due to the natural variability and probabilistic nature of mining blocks, an exact date is not known.

Expectations for the Bitcoin Halving

Halving reduces the reward that Bitcoin miners receive by half. According to the crypto analytics firm Glassnode, the Bitcoin halving could occur on April 23, 2024, but this is subject to change. OKLINK, which provides a countdown of approximately 80 days, expects the Bitcoin halving date to be April 22, 2024.

Additionally, according to the data, there are currently 11,603 blocks left until this event. Bitcoin mining rewards will be reduced from 6.25 BTC to 3.125 BTC. The Bitcoin halving events of 2012, 2016, and 2020 were followed by significant bull runs. Consequently, expectations for the next Bitcoin halving are also increasing. Expert crypto analyst Ali Martinez highlights four key points to consider as the Bitcoin halving approaches.

Four Key Scenarios for BTC

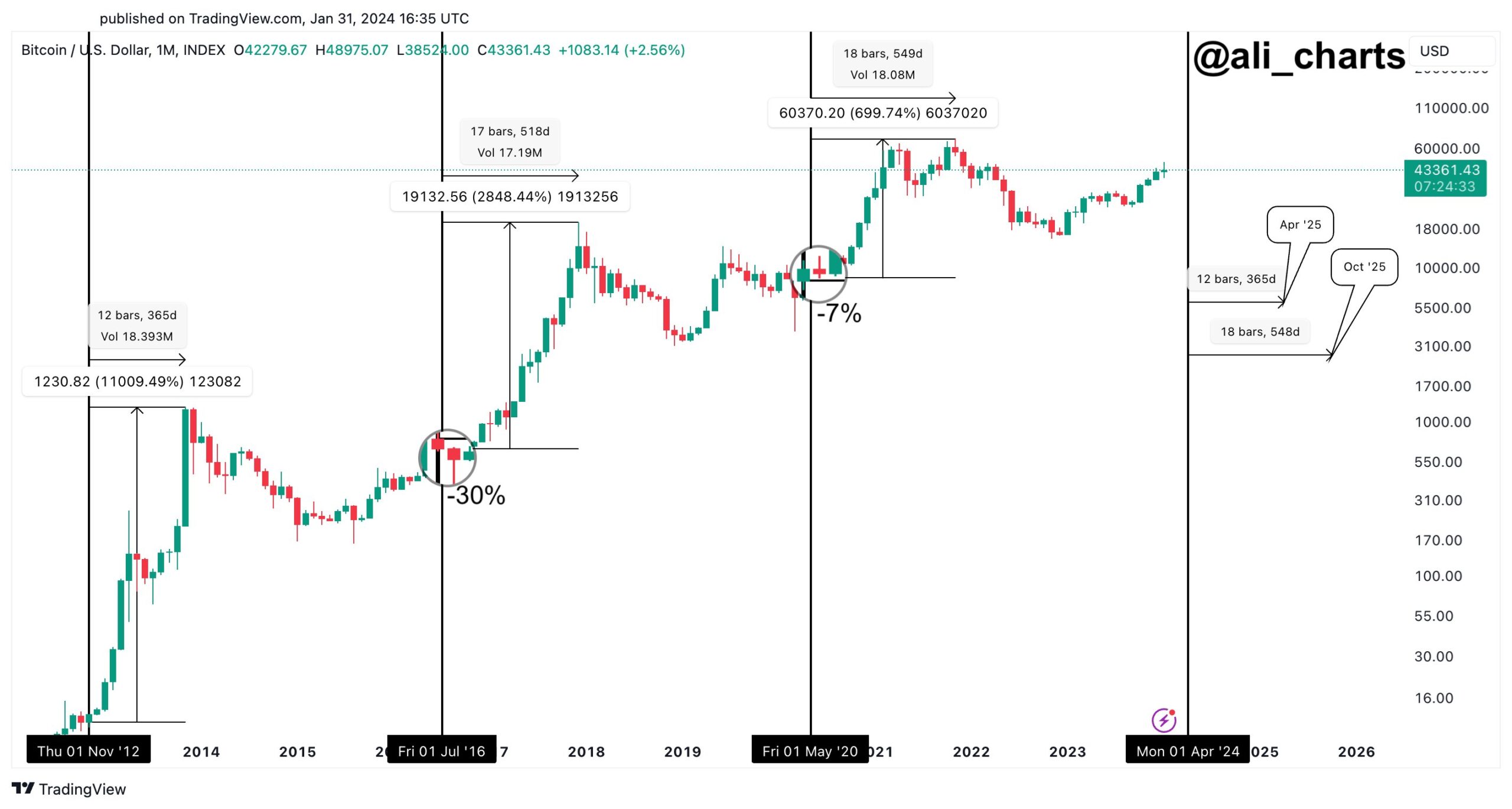

Considering that the Bitcoin price could react negatively or positively to the halving event, some scenarios should be noted. The first is corrections after the halving. According to the senior analyst, Bitcoin experienced corrections of 30% and 7% within a month after the 2016 and 2020 halvings, respectively. In this scenario, Bitcoin reacts negatively to the halving event. The second is a significant rise after the halving.

The analyst observed that after the 2012, 2016, and 2020 halvings, BTC increased by 11,000%, 2,850%, and 700%, respectively. In this most anticipated scenario, Bitcoin responds positively to the halving event, triggering a bull run. The third scenario focuses on the durations of bull markets. After each halving, the bull markets lasted 365 days, 518 days, and 549 days, respectively. The fourth scenario is the next market peak. According to the expert, if the upcoming bull market follows historical trends, the next Bitcoin market peak could be expected around April or October 2025.

Türkçe

Türkçe Español

Español