Renowned cryptocurrency analyst Ali Martinez recently stated that the Bitcoin halving planned for April 2024 could lead the leading cryptocurrency into long-term bullish trends, igniting a wave of optimism within the cryptocurrency community.

Expert Opinion on Bitcoin

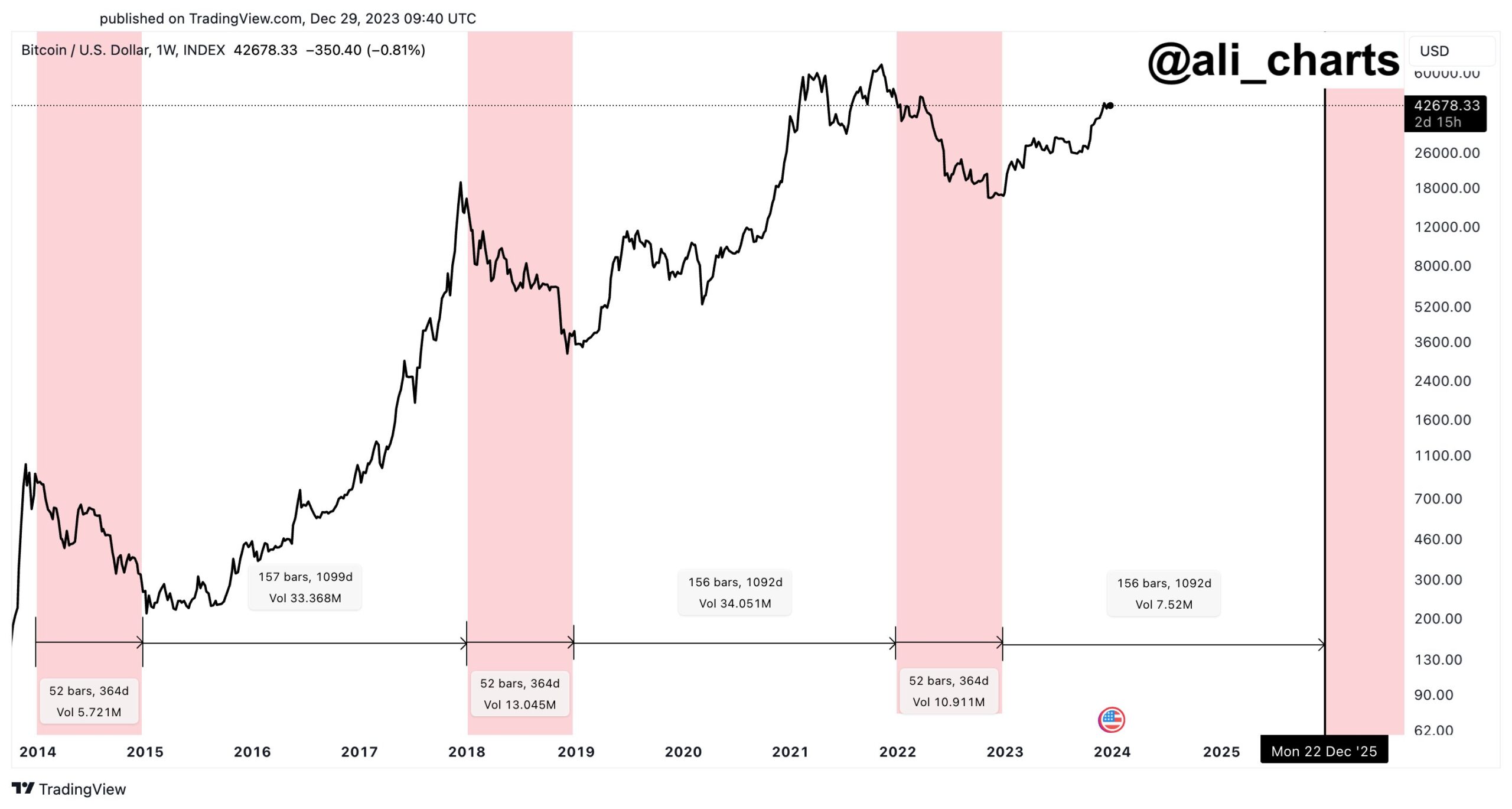

Known for his market analyses, Ali Martinez emphasized the cyclical nature of Bitcoin (BTC) price movements intricately linked to halving events. In a tweet, the analyst noted that Bitcoin’s design revolves around four-year cycles, is affected by halving events, and often reflects price movements.

Historically, this model has meant a three-year uptrend followed by a one-year correction. According to Ali Martinez, this cycle suggests BTC is currently in an uptrend with potential to extend until December 2025. The critical moment for Bitcoin, the upcoming halving, is expected to occur when the 740,000 block milestone is reached. This event may require the block reward to drop from the current 6.25 tokens to 3.125 tokens. Considering the network averages a block every 10 minutes and the variable time required to create new blocks, the exact date of the halving is unpredictable.

The Halving Process in Bitcoin

The most recent Bitcoin halving occurred on May 11, 2020, resulting in a significant drop in mining rewards from 12.5 tokens to 6.25 tokens per block. As expected, the limited supply contributed to a bullish scenario. Bitcoin’s value rose from $6,877 a month before the halving, on April 11, to $8,821 during the event. Despite notable volatility following the event, the price continued to rise over the next year, reaching $49,504 on May 11, 2021. According to the latest market data, Bitcoin’s current price is at the $42,831 level. The cryptocurrency has experienced a marginal decline of 0.22% in the last 24 hours but has shown an overall positive trend with an 11.89% increase over the past 30 days.

Türkçe

Türkçe Español

Español