Since December 2020, the SEC has been battling Ripple. That’s almost 3 years. During this process, Attorney John E. Deaton, who supports XRP coin investors and discusses the latest developments in the case, took to Twitter again. Ripple was once again on his agenda.

Lawyer’s Comment on the Ripple Case

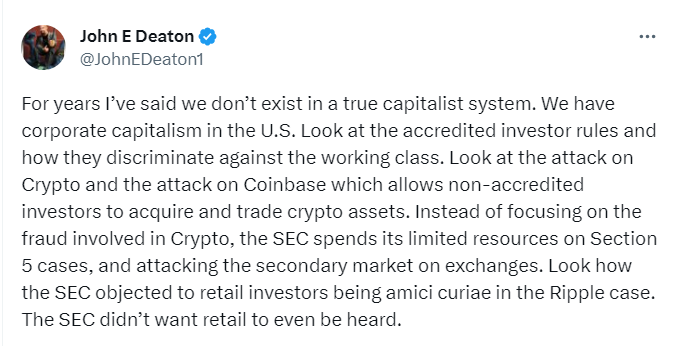

XRP supporter Attorney John E. Deaton believes that the actions taken by the Securities and Exchange Commission (SEC) against the crypto industry are not intended to protect investors. So why is the SEC suffocating crypto companies? Deaton says that the SEC’s actions are driven by concerns to protect corporate capitalism rather than prioritizing investor protection.

Deaton previously described SEC’s actions targeting Coinbase and Ripple as attacks on cryptocurrencies. In his recent comment, he touched on various topics such as accredited investor rules, SEC’s regulatory approach to cryptocurrencies, and its position regarding individual investors in the Ripple case. According to the legal expert’s analysis, the fact that the SEC allocates limited resources to Section 5 cases and focuses on targeting the secondary market in exchanges instead of addressing fraud in the crypto industry demonstrates misplaced priorities. He claims that this approach could potentially hinder innovation and impede the growth of the emerging cryptocurrency industry.

The lawyer also said the following:

“While Democrats shout at Republicans and Republicans shout at Democrats, every election changes nothing. It’s all nonsense. George W. Bush, like Obama, saved the car companies. When it comes to rescuing banks, there is no difference between Bush and Obama, even though banks may be the cause of the problem. The same would have happened during the Trump era. They saved General Motors and Chrysler, but later, GM and Chrysler filed for bankruptcy. When a pizza shop owner or bakery owner makes bad decisions, they fail. We don’t save them. However, when it comes to airlines, banks, car manufacturers, etc., we have to save them because if we don’t, it will cause maximum pain and threaten someone’s re-election. The beauty behind Bitcoin was that anyone with a smartphone could participate in free markets. No banks. No money transfer companies. No intermediaries.”

Statements from XRP Coin Lawyers

Deaton also reminded that the SEC opposed amicus briefs from individual investors in the Ripple case. He argues that this stance shows the regulator’s reluctance to consider the opinions of individual investors and strengthens the perception that the regulatory institution may prioritize the interests of large financial institutions over individual investors.

Deaton emphasizes an important concern about the perceived double standard in crypto regulation. He criticizes SEC Chairman Gary Gensler for holding numerous meetings with Sam Bankman-Fried, the former CEO of offshore crypto exchange FTX, who faced allegations of defrauding users, while not engaging in dialogue with proactive organizations like Coinbase. Deaton is disturbed by this inconsistency in the SEC’s approach.

Türkçe

Türkçe Español

Español