Market expectations have relaxed to a single rate cut this year, a stark contrast to earlier predictions. The unsettling negativity surrounding risk markets has prevented BTC prices from reaching six-digit levels, coinciding with the potential sale of Silkroad BTCs at any moment. What insights are Fed members sharing?

Fed Statements

As this article was being prepared, two Fed members shared their evaluations of the markets. The decline in inflation has stalled, and we have recently observed a new increase after months. This suggests that the Fed may not implement another rate cut for an extended period following December’s reduction, aligning with FedWatch data expectations.

In this process, closely following the comments made by Fed members regarding the current situation might be one of the best strategies. Key points from Schmid’s statements include:

- New rate cuts should be gradual and data-driven.

- The labor market is weak but remains healthy.

- The Fed should focus solely on Treasury assets.

- The Fed is close to fulfilling both of its mandates (price stability and employment).

- I want the Fed’s balance sheet to shrink further.

- I am optimistic that inflationary pressures will continue to decline.

- I am positive about growth and hiring expectations.

- I am quite optimistic about the continued decrease in inflation.

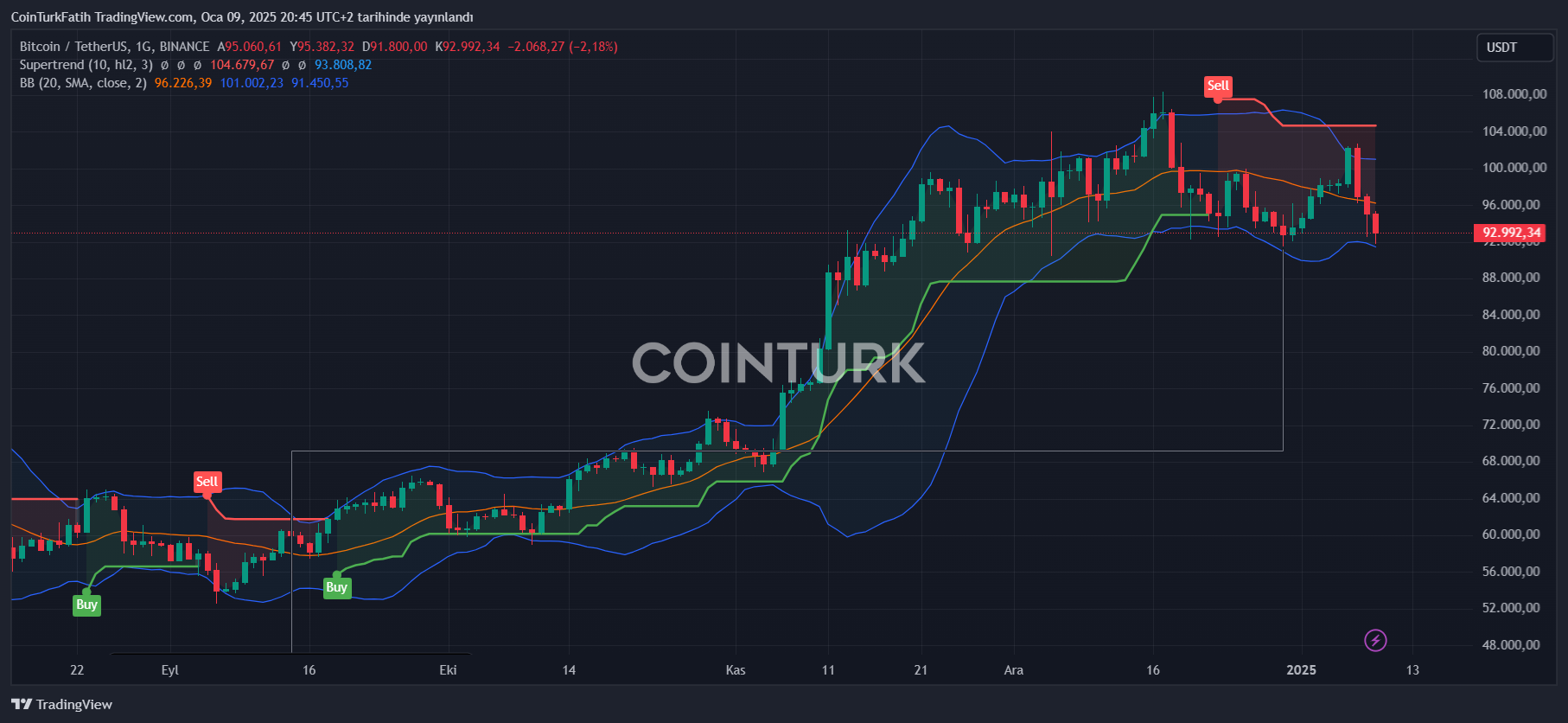

Bowman expressed a more pessimistic view, contributing to BTC being below $93,000 at the time of writing.

- Current policy stance may not be as restrictive as others perceive.

- We should avoid bias regarding the new administration’s future policies.

- I prefer a cautious and gradual approach to adjusting policy.

- Inflation is high, and I see upward risks; progress has stalled.

- Inflation concerns may partly explain the rise in yields of 10-year Treasury bonds.

- Post-election pent-up demand could pose inflationary risks.

- While deterioration in labor market conditions is possible, I see greater risks to price stability.

- The coming months should clarify the new administration’s policies and inflationary pressures.

- Bank regulators should adopt a more pragmatic approach in policymaking.

- The rate cut in December should be the last one.

Türkçe

Türkçe Español

Español