On Wednesday, the Fed will announce its interest rate decision, and Powell’s forthcoming messages will be crucial amid a busy agenda. As there is no meeting scheduled for April and tariffs are set to be implemented, it is anticipated that the Fed has been working on the possible impacts of these tariffs on the economy and will clarify its measures. What are the experts thinking?

Expectations for Fed Interest Rate Decision

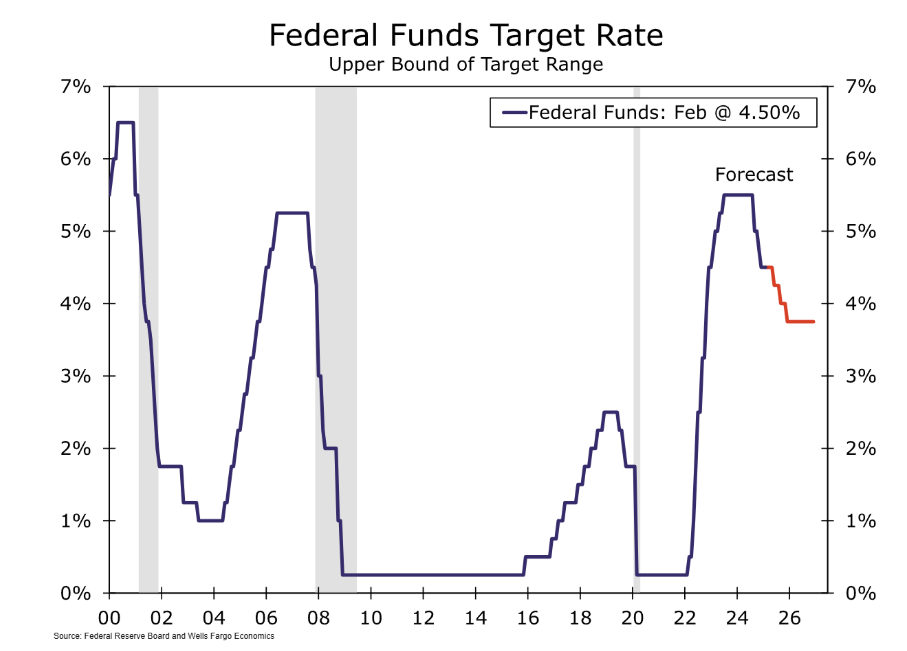

Markets expect interest rates to remain stable at 4.5%. Considering that we began this year with expectations for a single rate cut, an early reduction would be surprising. Nonetheless, the shift of the anticipated rate cut from December to June and the increase in expectations for up to three cuts is a positive sign.

If the Fed announces a surprise rate cut, it would be unexpected, potentially triggering a rapid market rally due to unpriced risks. The interest rate decision seems largely determined, with the main focus now shifted to the Summary of Economic Projections. If we hear a statement emphasizing uncertainties about returning to the inflation target, it will likely suggest a slowdown in future rate cuts.

Insights from Financial Institutions

Wells Fargo analysts indicate that the January meeting was cautious, noting weak consumer spending early in the year. They believe gradual cooling in the labor market and persistent inflation above the Committee’s 2% target is noteworthy, although it is declining. They forecast a total reduction of 75 basis points over the remaining year, considering additional cuts in September and December.

Unicredit, while not expecting a rate cut at this meeting, highlights the uncertainty brought by tariffs. They note that Powell emphasized patience in adjusting rates due to inflation slightly above target and a balanced labor market. Additionally, UBS anticipates a stronger message regarding price stability at the FOMC meeting, with no expected rate cuts in the near term, pointing to the risk of balance sheet reductions.

Türkçe

Türkçe Español

Español