Financial markets experienced a sharp decline on Tuesday. The S&P 500 lost over 2%, and Bitcoin also fell by 4.5% to around $56,000. The drop in Bitcoin led to a significant increase in long liquidations due to the overall turmoil in the cryptocurrency market.

Indicators Point Downwards for Bitcoin

Bitcoin’s sharp decline followed significant selling pressure observed in major US indices, including the S&P 500. According to Coinglass data shared by cryptocurrency analyst Ali Martinez, the price falling below $56,840 triggered $246.64 million in long liquidations for Bitcoin. Currently, Bitcoin is trading below this level, increasing fears of further market distress.

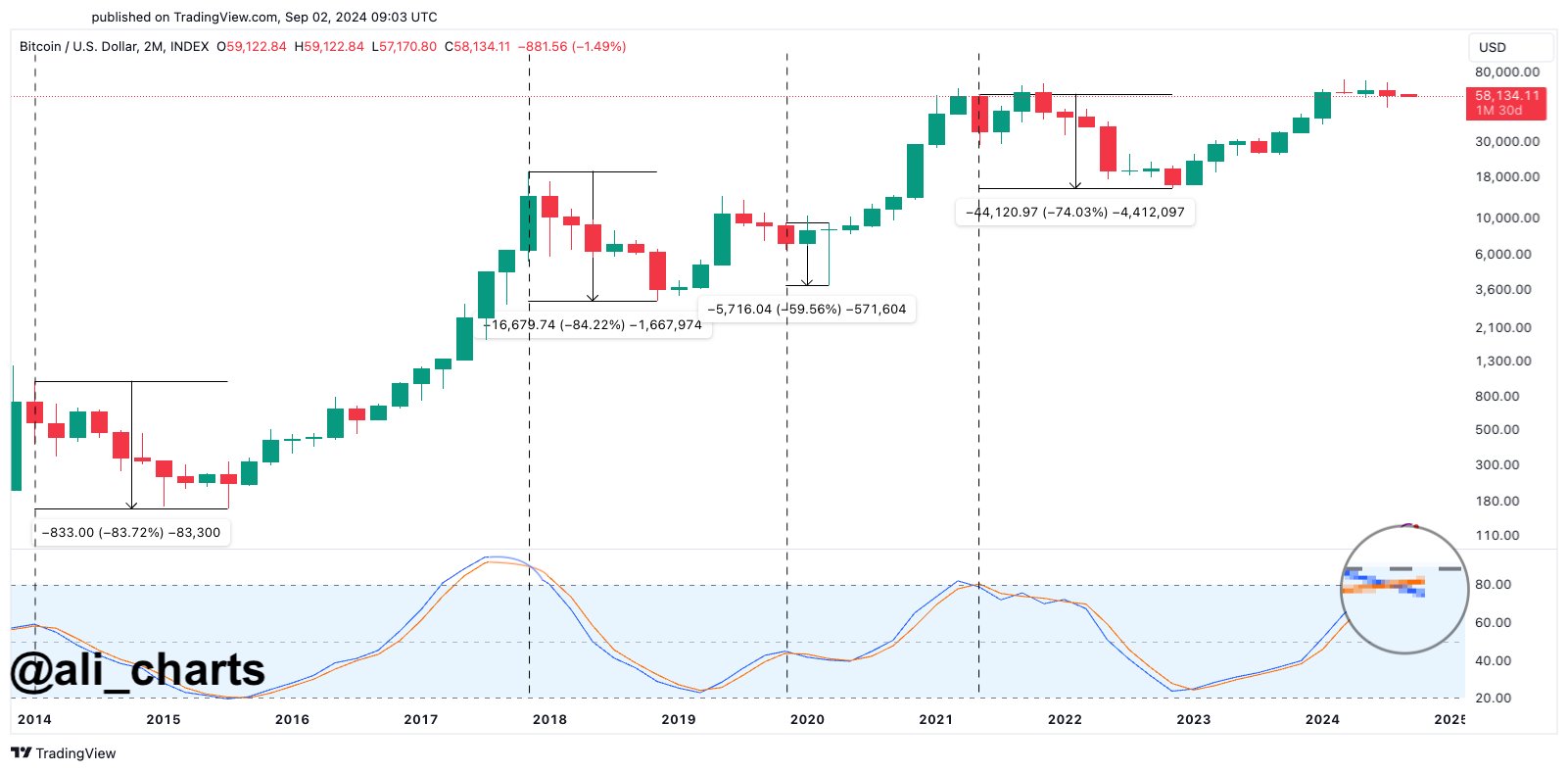

Martinez also pointed to a bearish signal from Bitcoin’s 2-month Stochastic RSI chart, indicating a potential shift from an uptrend to a downtrend. Historically, similar indicators have preceded significant declines, with Bitcoin making corrections of up to 75.50%. Martinez’s analysis suggests that if historical patterns repeat, investors should be prepared for potential severe losses.

Contributing to the bearish trend expectation, experienced analyst Peter Brandt highlighted a troubling market structure for Bitcoin characterized by consecutive lower highs and lower lows. Brandt added that this structure reflects decreased buying interest, which could lead to even sharper declines in Bitcoin’s price.

Meanwhile, outflows from spot Bitcoin ETFs exceeded $287 million on Tuesday. These outflows indicate that institutional sentiment reflects prevailing concerns in the market. Investors are moving away from risky assets amid market volatility, putting pressure on the cryptocurrency sector.

US Department of Justice Hits Nvidia

Troubles on Wall Street worsened as the US Department of Justice issued a subpoena to chipmaker Nvidia. Nvidia’s shares fell by 10%, causing ripple effects across the technology sector and significantly contributing to the S&P 500’s 2.12% decline.

As markets await the Federal Reserve’s decision on a possible 50 basis point rate cut on September 18, it remains to be seen whether Bitcoin can recover from these levels or if bearish forces will deepen market woes and tighten their grip. Investors continue to act cautiously in this uncertain environment, awaiting further signals from economic policymakers.

Türkçe

Türkçe Español

Español