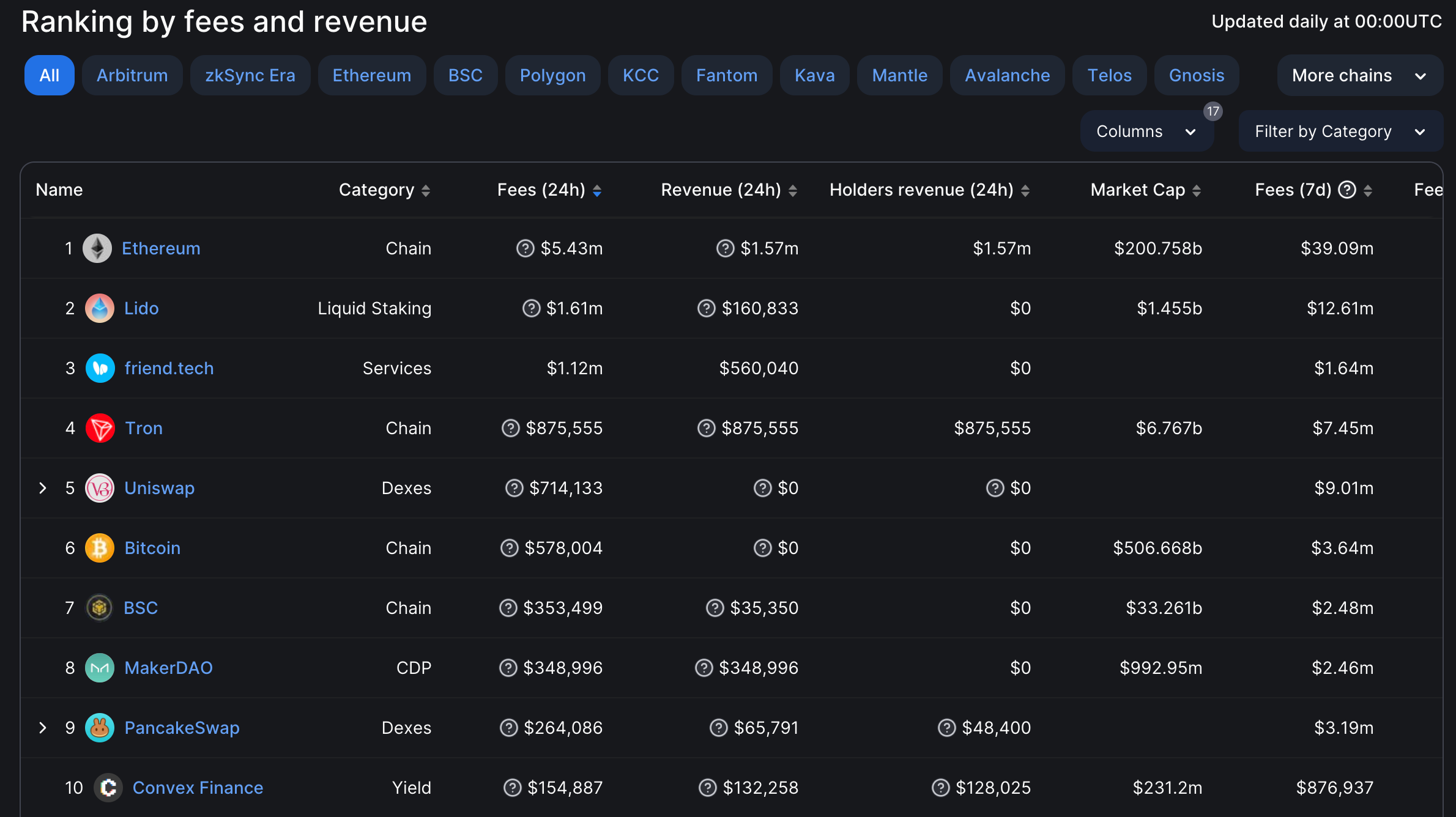

Friend.tech, a recently launched decentralized social (DeSo) network, surpassed established players in the crypto ecosystem, including Uniswap and Bitcoin network, by generating over $1 million in commission revenue within 24 hours on August 19.

Surpassing Giants

The platform was launched in beta on August 11, allowing users to tokenize their social networks by buying and selling “shares” of their connections, as well as enabling users who own each other’s shares to send private messages. The protocol charges a 5% commission fee on transactions, and the account holder also receives a share of the commission generated from the transactions.

Significant activity was observed on the platform built on Coinbase’s Layer-2 scaling solution, Base network, within 24 hours. According to DefiLlama data, Friend.tech generated $1.12 million in commission revenue within 24 hours and $2.8 million since its launch. At the time of writing, the social platform had over 724,000 transactions and more than 64,500 users, resulting in a total project revenue of $1.88 million.

Subject of Controversy: FUD is Being Created!

It is believed that the project is backed by the developer known as Racer. According to a senior software engineer at Coinbase, Racer previously created TweetDAO and Stealcam social media platforms, both based on NFTs. With Friend.tech, Racer aims to strengthen relationships with crypto influencers, venture capitalists, and key players in the crypto industry, as well as earn royalties from transaction fees, targeting Web3 projects.

This excitement has also fueled discussions about the revenue model, risks, and future of the social platform. Ignas, a decentralized finance researcher, pointed out that in Friend.tech’s current business model, “revenue only comes from trading fees and not from having more shareholders,” and added on Twitter that “controversial personalities can earn more and even create FUD as a strategy to earn fees.”

Lux Moreau, the founder of Talk.Markets, also highlighted that as shares are sold, their prices significantly increase, potentially incentivizing smaller groups or sub-group formations on the platform.