The markets, which turned 180 degrees from the excitement of 2021 to the collapse of 2022, drove most investors away from cryptocurrencies. The falling volumes clearly demonstrated this, and we saw that major market makers also abandoned their order books by mid-2022. Now, the widespread belief that a bigger surge will begin in 2024 is causing everyone to have sweet dreams instead of nightmares at night.

2023 DeFi Report

In 2023, significant growth was expected in the DeFi sector. This was due to the perception of a “less trustworthy environment against central institutions” following the collapse of FTX. Investors began to understand the importance of self-custody of their assets and started to seriously consider the possibility of trading with synthetic cryptocurrencies.

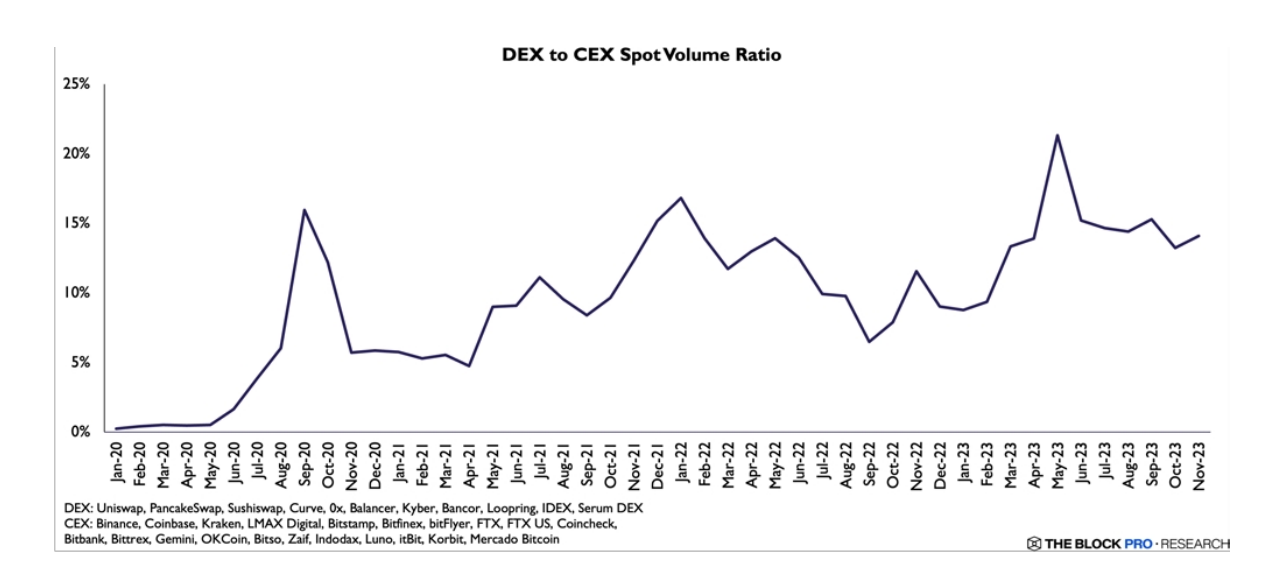

The ratio of DEX volume to CEX volume reached a peak of over 21% in May this year, but the primary reason was the memecoin frenzy seen that month. If you want to achieve hundreds of times in gains, you should know that altcoins with the potential to increase in price by thousands of times usually start trading on DeFi platforms first. After remaining below 10% for months at the beginning of the year, this ratio continued to stay high after the frenzy, exceeding 13% from June to November.

March was the month with the highest volume for DEXs, just like in CEXs, due to the panic caused by the USDC drama. The volumes increased because a large number of USDC was held locally on networks, and investors could also use USDC to mint DAI. We all remember the extent of the imbalance in the Curve stablecoin swap pool.

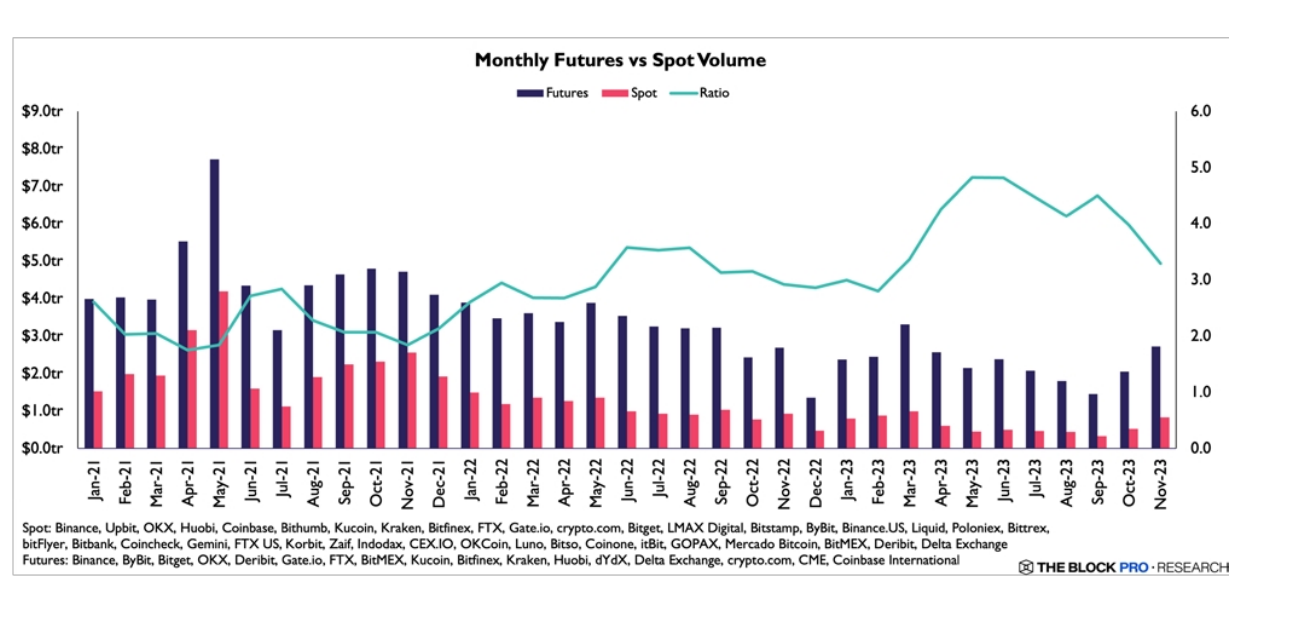

2023 Derivatives Markets

The trend in derivative markets was largely similar to spot markets. This year, the total volumes in futures contracts peaked in March and hit the lowest level in September, but the volumes on the futures front consistently stayed above the lowest levels of December 2022.

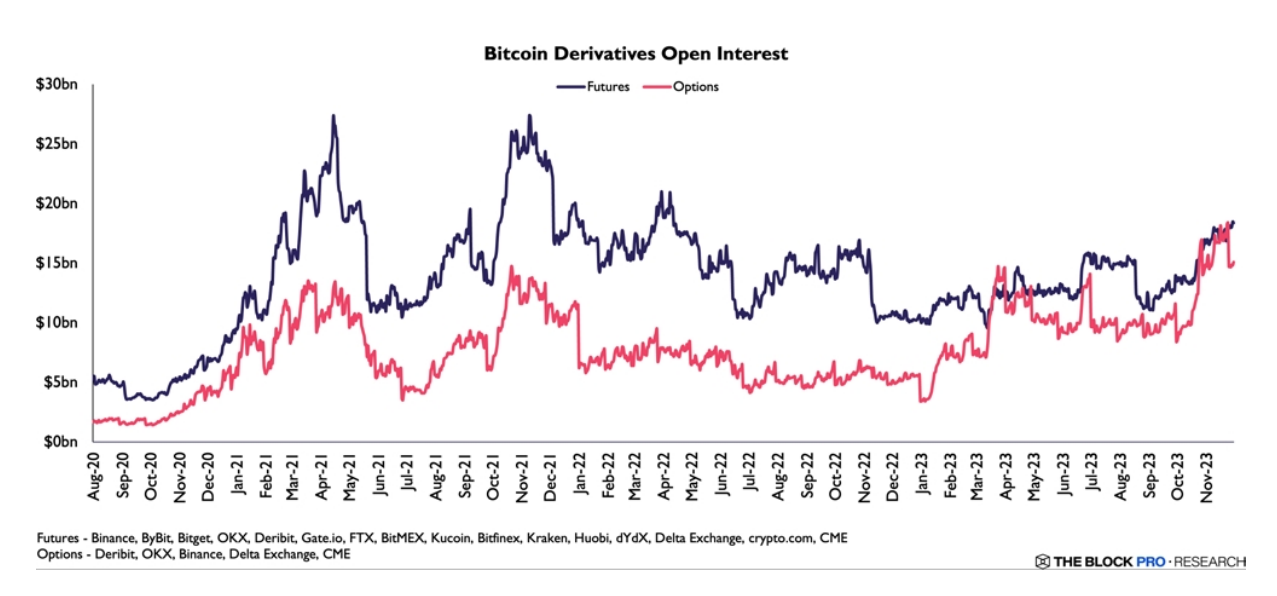

On the open interest front, there were some contrasts between futures and options. Especially looking at Bitcoin contracts, there has been a recent increase in option activities due to the limited number of assets and platforms available for option trading, making a fair comparison between the two difficult.

At the beginning of 2023, the open interest size of BTC options on exchanges was around $3.63 billion. In November, we saw it climb to an all-time high of $17.5 billion, which was largely due to the expectation of ETF approval, as we have mentioned thousands of times over the months.

The open interest in Bitcoin futures also increased throughout the year, but not by such a large margin. On the first day of the year, the open position was $10.15 billion, and it climbed to a peak of about $18.5 billion in November.

Although concerns about inflation resurfacing in August wiped out $3 billion in open positions in one day, we saw this quickly reverse, and since then, the highest levels have been seen since April 2022.